H1 2023: During H1 2023, the top three players in the Asia Pacific Hydrogen Peroxide market were Solvay Chemicals, Evonik, National Peroxide Limited (NPL), and Chang Chun Group. However, Solvay Chemicals held the largest production capacity of Hydrogen Peroxide across APAC. In May 2023, Luxi Chemical Group, a subset of Sinochem Holdings, faced an unfortunate accident at its Hydrogen Peroxide plant. The plant reported to face a fire incident and affected lives of 9 people out of which 1 was missing and the rest 8 were injured. The hydrogen peroxide plant was located at the city of Liaocheng in Shandong province of China. In January 2023, weak demand of hydrogen peroxide from downstream end-user industries like paper sectors led to low hydrogen peroxide prices across the Asian nations. However, market activity soon improved as manufacturing activity improved across Asia. Hydrogen peroxide prices in China gained momentum and rose in March 2023. China saw an increase in inquiries from the downstream end user industries such as paper industries which led to consequent rise in the hydrogen peroxide prices. The market for hydrogen peroxide saw a spike in price trend in April 2023. This turnaround was brought about by an increase in the rate of consumption from the pulp and paper sectors of China. However, the hydrogen peroxide market maintained a downward price trajectory in May and June 2023. Reductions in these key industries' material consumption rates resulted in ample of inventories in the Asia Pacific region, which supported the fall of Hydrogen Peroxide prices in the region.

The Asia Pacific Hydrogen Peroxide market stood nearby 1500 thousand tonnes in 2022 and is expected to grow at a healthy CAGR of 6.06% during the forecast period until 2032.

Hydrogen Peroxide is prominently known across the chemical industries for its application of bleaching of recycled, chemical, and mechanical pulp (de-inking also). Hydrogen peroxide improves the brightness stability of pulp, raises brightness levels, and lowers manufacturing costs, all of which improve the quality of the finished product. Hydrogen peroxide is used extensively for bleaching, sterilizing, cleaning, extraction, and other processes in a variety of industries, including textile, water treatment, energy and chemicals, semiconductors, and others. Hydrogen peroxide functions as an oxidizing agent, providing a lightening and whitening effect in personal care and hygiene items like toothpaste, mouthwash, bathroom cleaners, and laundry stain removers. The manufacturing of printed circuit boards uses hydrogen peroxide as a mordant, while the production of semiconductors uses it as an oxidizing and cleaning agent. It is used to bleach natural cellulose-based fibres, including cotton, linen, and other bast fibres.

The major driver of the Asia Pacific hydrogen peroxide market is the pulp and paper industry due to the chemical's widespread application in enhancing the brightness of the paper. It is mainly due to its eco-friendliness and affordable manufacturing costs. However, with the growing demand for disinfecting products in hospitals and healthcare centers across developing nations demand hydrogen peroxide. Furthermore, countries like India and Bangladesh are the manufacturing hubs for apparel and also import to other Western countries, backed up by the heavy usage of the chemical for bleaching cotton and other fibres is likely to affect the hydrogen peroxide market in the upcoming years. Furthermore, increasing demand for wastewater treatment chemicals like hydrogen peroxide for removing Biochemical oxygen demand (BOD) and chemical oxygen demand (COD)of industrial waste water further leads to the market expansion. The Asia Pacific Hydrogen Peroxide market is projected to grow as a result of these factors and reach 2800 thousand tonnes in the year 2032.

Based on the end-user industry, the Asia Pacific Hydrogen Peroxide market is divided into Paper & Pulp, Textiles, Water & Waste Water Treatment, Food Processing, Electronics & Semiconductors, Pharmaceuticals, and Others. Among these, the Paper & Pulp industry is dominating the Hydrogen Peroxide market. This industry consumed approximately 29% of the market in 2022 and is anticipated to dominate the market in the forecast period as well. In the Food Processing sector, hydrogen peroxide is employed as a biocide and bleaching agent. It is utilized as a bleaching agent in wheat flour, edible oil, and egg white, as well as an antibacterial agent in milk.

Major players in the Asia Pacific Hydrogen Peroxide market are Solvay Chemicals, Evonik, National Peroxide Limited (NPL), Chang Chun Group, Mitsubishi Gas Chemical Company, Sunkyong Chemicals Ltd., Oci Chemicals, Arkema Hydrogen Peroxide Co., Ltd., Mitsubishi Gas Chemical Company (MGC), Meghmani Finechem Limited (MFL), SOLVAY PEROXIDES, Taekwang Industrial Co. ltd., Indian Peroxide Limited (IPL), Chemplast Sanmar Limited (CSL), Suzhou MGC Suhua Peroxide Co., Ltd., and Others.

Years considered for this report:

Historical Period: 2015- 2022

Base Year: 2022

Estimated Year: 2023

Forecast Period: 2024-2032

This report will be delivered on an online digital platform with one-year subscription and quarterly update.

Objective of the Study:

• To assess the demand-supply scenario of Hydrogen Peroxide which covers production, demand and supply of Hydrogen Peroxide market in the Asia Pacific.

• To analyse and forecast the market size of Hydrogen Peroxide

• To classify and forecast Asia Pacific Hydrogen Peroxide market based on end-use and regional distribution.

• To examine competitive developments such as expansions, mergers & acquisitions, etc., of Hydrogen Peroxide market in the Asia Pacific.

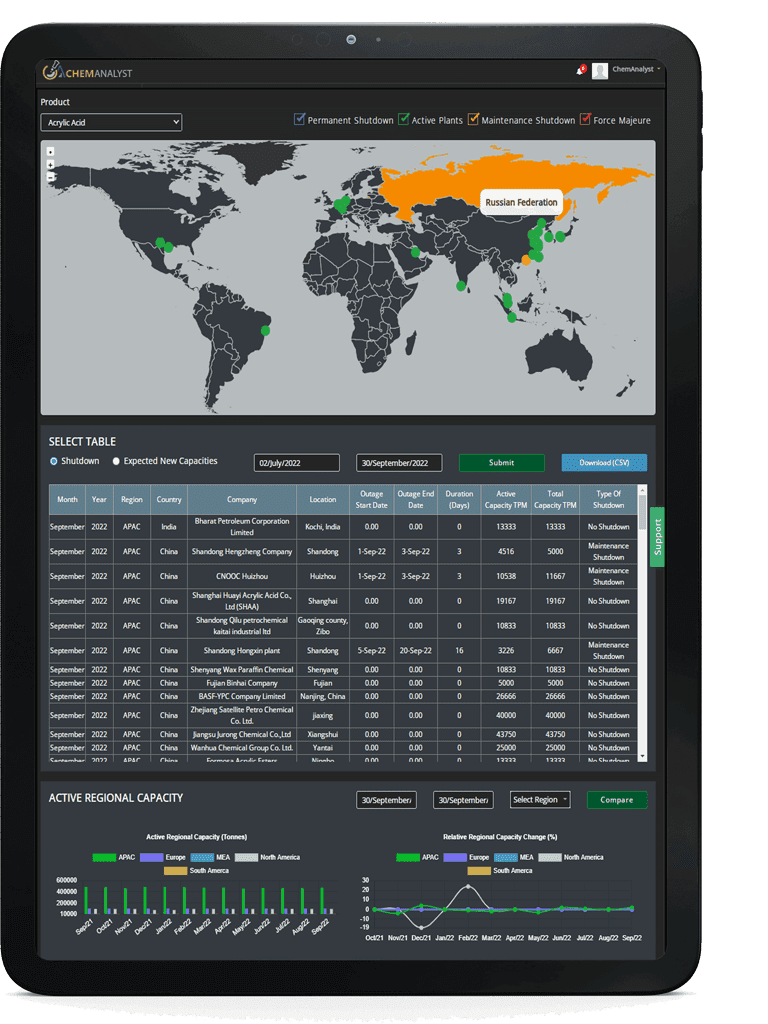

To extract data for Asia Pacific Hydrogen Peroxide market, primary research surveys were conducted with Hydrogen Peroxide manufacturers, suppliers, distributors, wholesalers and Traders. While interviewing, the respondents were also inquired about their competitors. Through this technique, ChemAnalyst was able to include manufacturers that could not be identified due to the limitations of secondary research. Moreover, ChemAnalyst analyzed various segments and projected a positive outlook for Asia Pacific Hydrogen Peroxide market over the coming years.

ChemAnalyst calculated Hydrogen Peroxide demand in the Asia Pacific region by analyzing the historical data and demand forecast which was carried out considering the demand for Hydrogen Peroxide by the end-user industries. ChemAnalyst sourced these values from industry experts and company representatives and externally validated through analyzing historical sales data of respective manufacturers to arrive at the overall market size. Various secondary sources such as company websites, association reports, annual reports, etc., were also studied by ChemAnalyst.

Key Target Audience:

• Hydrogen Peroxide manufacturers and other stakeholders

• Organizations, forums and alliances related to Hydrogen Peroxide distribution

• Government bodies such as regulating authorities and policy makers

• Market research organizations and consulting companies

The study is useful in providing answers to several critical questions that are important for industry stakeholders such as Hydrogen Peroxide s manufacturers, customers and policy makers. The study would also help them to target the growing segments over the coming years (next two to five years), thereby aiding the stakeholders in taking investment decisions and facilitating their expansion.

Report Scope:

In this report, Asia Pacific Hydrogen Peroxide market has been segmented into following categories, in addition to the industry trends which have also been detailed below:

|

Attribute

|

Details

|

|

Market size Volume in 2022

|

1500 thousand tonnes

|

|

Market size Volume by 2032

|

1800 thousand tonnes

|

|

Growth Rate

|

CAGR of 6.06% from 2023 to 2032

|

|

Base year for estimation

|

2023

|

|

Historic Data

|

2015 – 2022

|

|

Forecast period

|

2024 – 2032

|

|

Quantitative units

|

Demand in thousand tonnes and CAGR from 2023 to 2032

|

|

Report coverage

|

Industry Market Size, Capacity by Company, Capacity by Location, Operating Efficiency, Production by Company, Demand by End- Use, Demand by Region, Demand by Sales Channel, Demand-Supply Gap, Company Share, Foreign Trade, Manufacturing Process, Policy and Regulatory Landscape.

|

|

Segments covered

|

By End-Use: (Paper & Pulp, Textiles, Water & Waste Water Treatment, Food Processing, Electronics & Semiconductors, Pharmaceuticals, and Others)

By Sales Channel: (Direct Sale and Indirect Sale)

|

|

Regional scope

|

China, India, Japan, South Korea, Malaysia, Indonesia, and Rest of APAC

|

|

Pricing and purchase options

|

|

Available Customizations:

With the given market data, ChemAnalyst offers customizations according to a company’s specific needs.

In case you do not find what, you are looking for, please get in touch with our custom research team at sales@chemanalyst.com