Welcome To ChemAnalyst

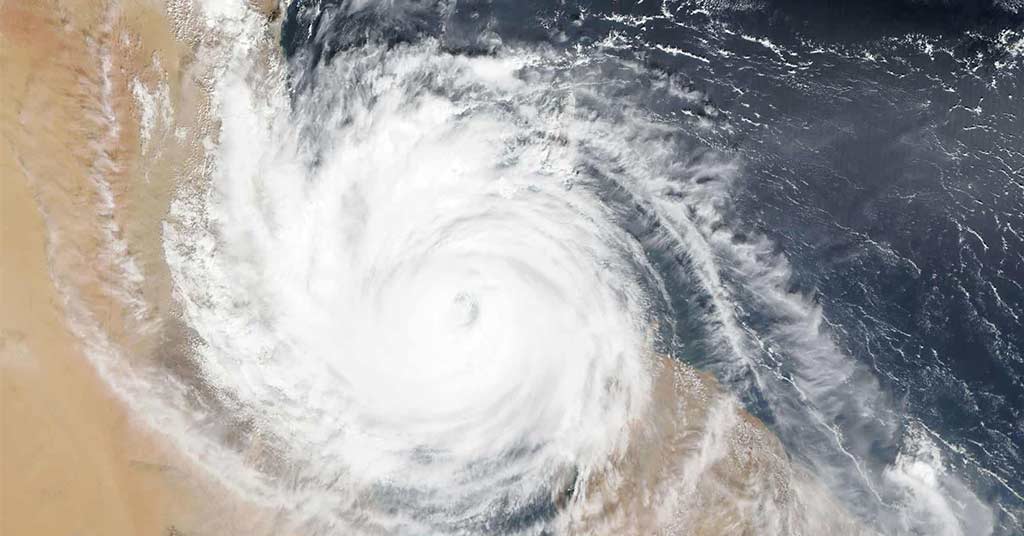

Guangdong (China): After several close shaves by a few earlier typhoons, China finds itself again amidst the eye of the storm. This time Typhoon Doksuri prowls in the Pacific Ocean and is likely to hit the Chinese Southern Coast. Typhoon and closely followed severe conditions may impact several cities; among these cities, Kaohsiung, a major port and petrochemical hub for China, lies most vulnerable to the typhoon menace.

Super Typhoon Doksuri is heading to south-eastern China, with landfall expected on 28 July along the coast of Fujian and Guangdong. According to the sources, Doksuri is likely to be the most powerful Typhoon to land in China in the storm season this year. China intently escaped from Typhoon Mawar, one of the strongest tropical cyclones on record for May 2023, which was headed for China but turned north towards Japan before scattering.

China Metrological Administration (CMA) reported heavy rainfalls are anticipated in the Chinese mainland somewhere between Guangdong and Fujian, which might force several independent refineries in Guangdong and Fujian provinces to suspend their plant operation and land transportation. After the ease of Covid restriction, Asia's biggest economy, China, has battled with weak economic recovery and tepid downstream demand, and now the adverse weather condition might again impact the domestic market. According to ChemAnalyst, due to this Doksuri Typhoon, several petrochemical plants like Acetic acid, Phenol as well as Ethylene, and other plants are projected to face unforeseen disruptions, which might lead to a reduction in crude throughputs and oil product sales cut at the plants for up to seven days.

Furthermore, the adverse weather conditions are anticipated to bring turmoil among the Chinese ports on a broader level. The Chinese ports have already been battered with the aftereffects of Typhoon Talin, which hit the Chinese shores on July 16. Container terminals in Hong Kong and Guangdong Province, and Hainan Island in China have suspended operations as Typhoon Talim made landfall last week. According to recent forecasts from China's meteorological center, gale-force winds are expected in the seas near the southern provinces and regions. Additionally, there will be heavy rainfall of 250-280 mm (9.8-11 inches) on the southwestern coast of Guangxi and the northern part of Hainan Island. As per the market participants, these unexpected weather events are likely to hamper the movements of cargo destined from China to Europe and Africa. The on-loading and offloading activities of various petrochemicals are likely to be affected, impacting their prices for domestic and overseas manufacturing firms.

As per the pricing intelligence of ChemAnalyst, the prices of major Bulk and Petrochemicals manufactured in China might decrease for domestic manufacturing firms amidst the expected congestion at the Chinese ports in the forthcoming weeks. Meanwhile, foreseeing the supply disruption, the Chinese manufacturers are also likely to ramp up their quotations for importing countries to gain high-profit margins, as the rains and thunderstorms are forecast to endure from the weekend in most countries and cities.

We use cookies to deliver the best possible experience on our website. To learn more, visit our Privacy Policy. By continuing to use this site or by closing this box, you consent to our use of cookies. More info.