H1 2023: The leading global players in the Vinyl Ester Resin (VER) market in H1 2023 were INEOS Composites, AOC, and Swancor Holding Co., Ltd. Based on consumption, Asia Pacific region was the biggest consumer of VER in H1 2023. However, Asia Pacific experienced an overall stable demand and steady prices in H1 2023. Although in March 2023, Vinyl Ester Resin prices slightly decreased along with a slowdown in downstream industries like pipes & fittings. Competitive offers due to the presence of large stock levels of Vinyl Ester Resin also impacted the VER prices. Additionally, feedstock Epoxy Resin's prices altered the pricing of VER in H1 2023. Due to the weak demand from the downstream construction and automotive industries, Vinyl Ester Resin (VER) prices declined continuously from March 2023 onwards in the Asian market. The decreased demand of VER from the downstream industries in the Chinese market led to the poor prices of VER in China. Epoxy resin, the feedstock, witnessed a drop in prices in China, which supported the downward trend in VER prices in the second half of H1 2023. The VER prices in Europe depicted mixed pattern. VER prices decreased in April, increased in May by showing a recovery, but dropped in June 2023 precipitously. The decline in the product's price was primarily caused by adverse market dynamics during recession and decline in the cost of feedstock epoxy resin in Europe.

H1 2022: The prominent players of Vinyl Ester Resin (VER) in H1 2022 were INEOS Composites, AOCSwancor Holding Co., Ltd., and Jinling AOC Resins Co., Ltd. Among these, INEOS Composites gained the position of the largest producer in H1 2022. Furthermore, regionally, Asia Pacific consumed the majority of the Vinyl Ester Resin market in H1 2022. However, the prices of vinyl ester resins in the Asia Pacific region were mixed due to the high volatility of raw material prices in the region. Port congestion also disturbed the VER market in January 2022, leading to supply shortages across the region. In India, despite strong demand from the downstream market, the limited availability of VER had reduced profit margins for distributors in the nation. However, prices remained still through the middle of H1 2022 as production rates was sluggish in key countries such as China and Taiwan. Although, VER prices changed in June 2022 as natural disasters in China affected vinyl ester resin production rates. Production costs for vinyl ester resin increased due to soaring raw material prices in the market and surges in electricity charges in China. Thus, it was a mixed situation VER market across Asia during H1 2022.

H2 2022: During H2 2022, production reached around 385 thousand tonnes, which was slightly higher than H1 2022. Vinyl ester resin market in the Asia Pacific region had a sluggish behavior. The market for VER faced a decline during H2 2022 across China due to weak demand for this product from the downstream industries of paints & coatings, adhesives and electronics. Furthermore, inadequate power supplies across China had forced the manufacturing facilities to halt or drastically cut production during the first three months of H2 2022. The cost of the underlying materials, such as the epoxy resin, required to manufacture this product was reduced, also contributed to the lower price of VER. In China’s neighboring nation, India, the prices of vinyl ester resins fell significantly during the first half of H2 2022 mainly due to decrease in demand from the downstream end-users of the product. In the Taiwan market, VER prices were falling due to weak demand from the various sectors such as pipe & construction. Meanwhile in China, product prices rose from mid-November 2022. However, by the end of December 2022, VER prices became stable in China. In North America, Vinyl Ester Resin prices rose till mid of H2 2022 then fell off during H2 2022. Product’s price was lowered due to impact by the lower raw material costs (epoxy resin), low level of interest from downstream companies, and high level of inventories in North America.

The global Vinyl Ester Resin (VER) market has expanded remarkably to reach approximately 750 thousand tonnes in 2022 and is expected to grow at a CAGR of 3.74% during the forecast period until 2030. A couple of years ago, Showa Denko (SDK) built production lines to produce vinyl ester resin (VE) and synthetic resin emulsion (EM) (SSHP) on the grounds of Shanghai Showa Highpolymer Co. Ltd.

Vinyl Ester Resin is a thermosetting resin with a polymeric backbone with a chain ending with an acrylate or methacrylate group. It is synthesized by a chemical reaction between an epoxy resin with methacrylic acid. It offers chemical resistance, water resistance, corrosion resistance, and mechanical properties due to better cross-bonding in the structure. Vinyl Ester Resin is frequently used for tanks for underground storage, tanks for corrosive chemicals, professional scrubbers, pipes, and effluent control.

The primary driver of the Vinyl Ester Resin global market is accounted by the Pipes & Tanks sector, which is anticipated to rise in response to rising demand from the building and transportation sectors in the coming years. In 2022, approximately 60% of global Vinyl Ester Resin was utilized by Pipes & Tanks industry. Due to its water-resistant properties, consumption by the marine components industry is also expected to rise in the forecast period. The pipes and tanks segment holds the major share in the VER market as it is widely used in chemical storage vessels, chemical reactors, electro-refining tanks, and others. Rapidly increasing demand for FGD installations across the world due to several environmental concerns and stringent regulations on harmful gas emissions is expected to boost the demand for Vinyl Ester Resin, thereby propelling its market growth in the next few years. Owing to these factors, the VER market is expected to reach 1000 thousand tonnes in 2030.

Based on demand across the globe, the Asia Pacific is reported to be the biggest consumer of the Vinyl Ester Resin market. Huge demand for Vinyl Ester Resin from the building and construction industry due to rising infrastructural activities, especially in the Asia Pacific region, is one of the major factors driving the Vinyl Ester Resin market around the world. It is expected that Asia Pacific will most likely remain the biggest consumer in the forecast period.

Based on type, Vinyl Ester Resin is segregated into Bisphenol-A,F,S vinyl ester resin, Novolac vinyl ester resin, Brominated vinyl ester resin, and others. Bisphenol-A,F,S vinyl ester resin was dominating the market and consumed about 50% of the global Vinyl Ester Resin with in 2022. Bisphenol A based VER is utilized in the marine industry as gel coats and barrier coats. Its growing consumption in the production of ships, boats, yachts, naval ships, etc., is expected to drive the Vinyl Ester Resin market in the upcoming years.

Based on the end-user industry, the global Vinyl Ester Resin market is segmented into different industrial sectors that include Pipes & Tanks, Marine Components, Renewables, and others. The Pipes & Tanks industry is dominating the Vinyl Ester Resin market. In this industry, Vinyl Ester Resin is widely used in chemical storage vessels, chemical reactors, electro-refining tanks, and others. The growing infrastructural investments, along with the rising demand for Vinyl Ester Resin in the pipes and tanks is propelling the global Vinyl Ester Resin market. Moreover, the Marine Components further fuel the global Vinyl Ester Resin demand.

Major players in the production of Global Vinyl Ester Resin are INEOS Composites, AOC, Swancor Holding Co. Ltd., Jinling AOC Resinss Co., Ltd., Showa Denko K.K., Scott Bader Company Ltd., Polynt-Reichhold, Sino Polymer, Eternal Materials Co.,Ltd. Lu-Chu Plant, DIC Corporation, Hexion Inc., Poliya, and others.

Years considered for this report:

Historical Period: 2015- 2022

Base Year: 2022

Estimated Year: 2023

Forecast Period: 2024-2030

This report will be delivered on an online digital platform with one-year subscription and quarterly update.

Objective of the Study:

• To assess the demand-supply scenario of Vinyl Ester Resin which covers production, demand and supply of Vinyl Ester Resin market in the globe.

• To analyse and forecast the market size of Vinyl Ester Resin

• To classify and forecast Global Vinyl Ester Resin market based on end-use and regional distribution.

• To examine competitive developments such as expansions, mergers & acquisitions, etc., of Vinyl Ester Resin market in the globe.

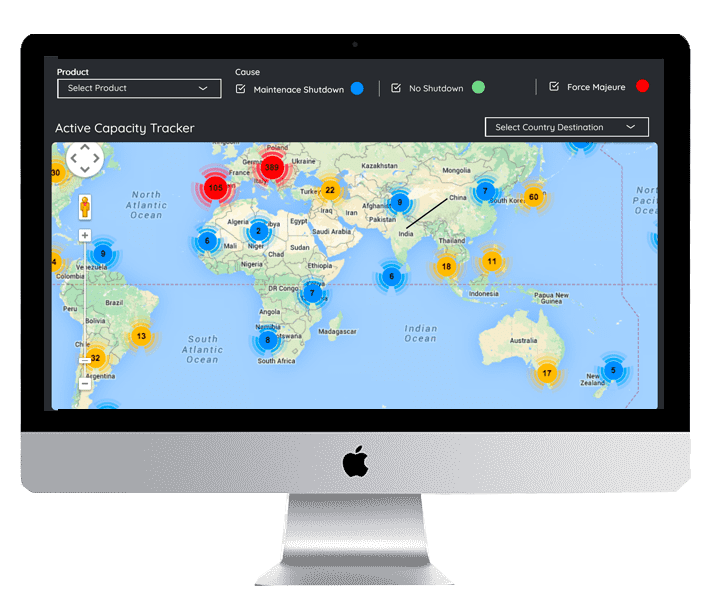

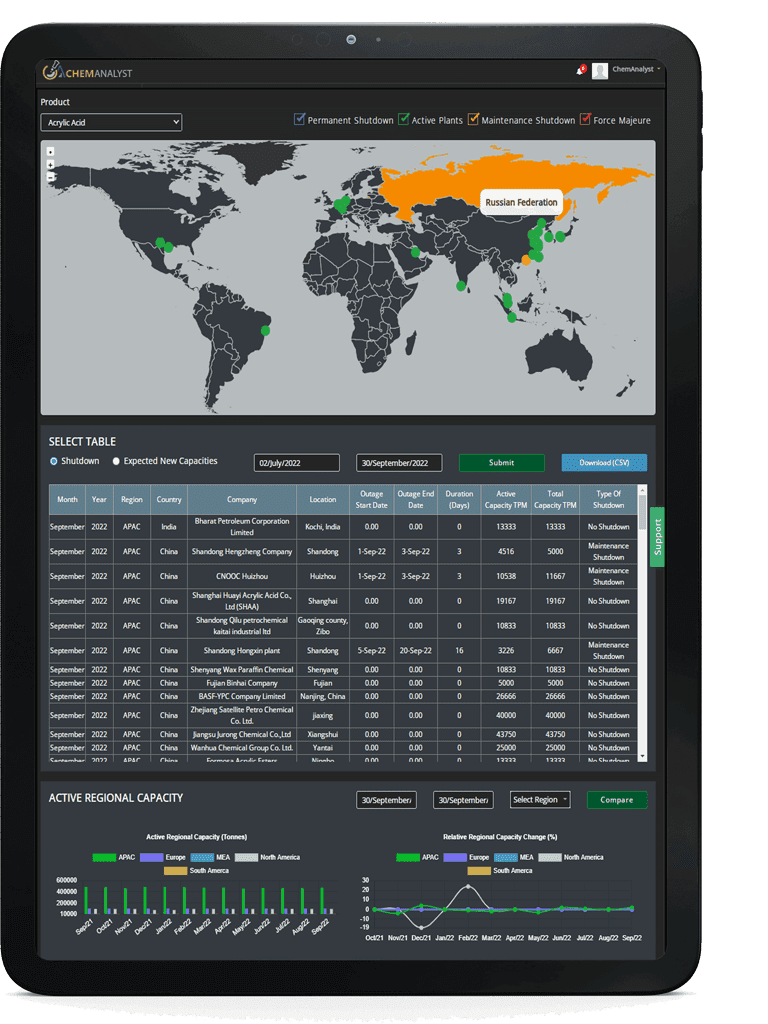

To extract data for Global Vinyl Ester Resin market, primary research surveys were conducted with Vinyl Ester Resin manufacturers, suppliers, distributors, wholesalers and Traders. While interviewing, the respondents were also inquired about their competitors. Through this technique, ChemAnalyst was able to include manufacturers that could not be identified due to the limitations of secondary research. Moreover, ChemAnalyst analyzed various segments and projected a positive outlook for Global Vinyl Ester Resin market over the coming years.

ChemAnalyst calculated Vinyl Ester Resin demand in the globe by analyzing the historical data and demand forecast which was carried out considering the raw materials to produce Vinyl Ester Resin . ChemAnalyst sourced these values from industry experts and company representatives and externally validated through analyzing historical sales data of respective manufacturers to arrive at the overall market size. Various secondary sources such as company websites, association reports, annual reports, etc., were also studied by ChemAnalyst.

Key Target Audience:

• Vinyl Ester Resin s manufacturers and other stakeholders

• Organizations, forums and alliances related to Vinyl Ester Resin s distribution

• Government bodies such as regulating authorities and policy makers

• Market research organizations and consulting companies

The study is useful in providing answers to several critical questions that are important for industry stakeholders such as Vinyl Ester Resin s manufacturers, customers and policy makers. The study would also help them to target the growing segments over the coming years (next two to five years), thereby aiding the stakeholders in taking investment decisions and facilitating their expansion.

Report Scope:

In this report, Global Vinyl Ester Resin s market has been segmented into following categories, in addition to the industry trends which have also been detailed below:

|

Attribute

|

Details

|

|

Market size Volume in 2022

|

750 thousand tonnes

|

|

Market size Volume by 2030

|

1000 thousand tonnes

|

|

Growth Rate

|

CAGR of 3.74% from 2022 to 2030

|

|

Base year for estimation

|

2023

|

|

Historic Data

|

2015 – 2022

|

|

Forecast period

|

2024 – 2030

|

|

Quantitative units

|

Demand in thousand tonnes and CAGR from 2023 to 2030

|

|

Report coverage

|

Industry Market Size, Capacity By Company, Capacity by Location, Operating Efficiency. Production by Company, Demand by End- Use, Demand by Type, Demand by Region, Demand by Sales Channel, Demand-Supply Gap, Company Share, Foreign Trade, Company Share, Manufacturing Process, Policy and Regulatory Landscape

|

|

Segments covered

|

By End-Use: (Pipes & Tanks, Marine Components, Renewables, and others)

By Sales Channel: (Direct Sale and Indirect Sale)

|

|

Regional scope

|

North America, Europe, Asia Pacific, Middle East and Africa, and South America.

|

|

Pricing and purchase options

|

|

With the given market data, ChemAnalyst offers customizations according to a company’s specific needs.