H1 2023: The leading consumer of Acetylene in H1 2023 was Asia Pacific region. However, the Acetylene prices depicted a fluctuating pricing trend in the period. The prices exhibited a consistent upward trend for the first two months in India, propelled by stable demand fundamentals and heightened manufacturing activities amid favourable economic conditions. The downstream metal fabrication industries maintained sufficient inquiries, contributing to the overall growth of the Acetylene market in the Indian region. However, around March, prices began to decline. The accumulation of Acetylene stocks reached higher levels, exerting pressure on the supply side. The reduction in operational costs, influenced by declining crude oil prices and a decrease in upstream Calcium Carbide costs, played a role in supporting the observed downturn in Acetylene price realizations in March in the Asian market. Prices remained low in the Indian market even in April 2023. However, in May and June, Acetylene prices exhibited positive sentiments in the Indian market. Indian players had low inventories and to meet the growing demand from downstream metal fabrication industries and thus had a positive impact on acetylene prices. The demand from the downstream construction sector was active which thus affected the metal fabrication sector and impacted the acetylene market sentiment in India.

The global Acetylene market displayed a consumption of 2 million tonnes in 2022 and is expected to grow at a steady CAGR of 3.1% during the forecast period until 2032.

Acetylene with the chemical formula C₂H₂ is the simplest alkyne and a hydrocarbon. Acetylene is an odourless and colourless gas that is widely used as a key fuel and a chemical building block. It is usually handled as a solution as it is unstable in its pure form. Historically, Acetylene was generated through the reaction of Calcium Carbide with water. However, contemporary methods often involve its production as a by-product of Ethylene production. The low moisture content in the flame renders Acetylene a favourable option for numerous essential heating applications. Some of the major end uses of the chemical include welding, cutting, heat treating, portable lighting, Plastics, and acrylic acid derivatives, and others.

Acetylene is primarily used for welding, heat treating, and oxyacetylene cutting. This is the leading application of acetylene and is anticipated to stay so in the future Moreover, the chemical processing sector uses bulk acetylene as a raw material to create organic molecules such acetaldehyde, acetic acid, and acetic anhydride. Methane or ethylene are used to produce polyethylene plastics, which are both manufactured from acetylene. Continuously growing demand for Acetylene by the chemical industry is likely to flourish in the market in the next few years. Acetylene is frequently utilized during the carbon coating process in the manufacture of glass which adds on the acetylene demand. Acetylene is employed in a wide range of end-use sectors, including the automotive, aerospace, metalworking, pharmaceutical, glass, and others. The rising demand for Acetylene by the automotive industry coupled with growing transportation activities for metalworking applications in automobiles is anticipated to propel the global Acetylene market in upcoming years. It is anticipated that the global consumption of Acetylene will reach approximately 2.7 million tonnes by 2032.

Regionally, the Asia Pacific region is dominating the Acetylene market. This region held a market share of approximately 37% in 2022. The growing demand for Acetylene due to increased transportation and construction activities in emerging economies like China and Japan is driving the market in the Asia Pacific region. It is forecasted that the Asia Pacific region will maintain its dominance until 2032.

Based on the end-user industry, the global Acetylene market is segmented into Metal Fabrication, Chemical Intermediates, Glass Processing, and Others. Among these, the Metal Fabrication industry is dominating the Acetylene market. In 2022, this sector held about 53% of the market share and will most likely stay so in the forthcoming years. Acetylene cylinders play a crucial role in the gas cutting process utilized for welding and cutting applications. The use of acetylene results in a highly intense cutting flame, making it an essential component in metal manufacturing.

Major players for Acetylene globally include BASF SE, China Petroleum and Chemical Corporation, Airgas, Gulf Cyro, Hebei Xingyu Chemical Co. Ltd., Linde Aktiengesellschaft, Praxair Inc., Ilmo Products Company, Shandong Xinlong Group Co. Ltd., Suzhou Jinhong Gas Co. Ltd., The Dow Chemical Company, Toho Acetylene and Others.

Years considered for this report:

Historical Period: 2015- 2021

Base Year: 2022

Estimated Year: 2023

Forecast Period: 2024-2032

This report will be delivered on an online digital platform with one-year subscription and quarterly update.

Objective of the Study:

• To assess the demand-supply scenario of Acetylene which covers production, demand and supply of Acetylene market in the globe.

• To analyse and forecast the market size of Acetylene

• To classify and forecast Global Acetylene market based on end-use and regional distribution.

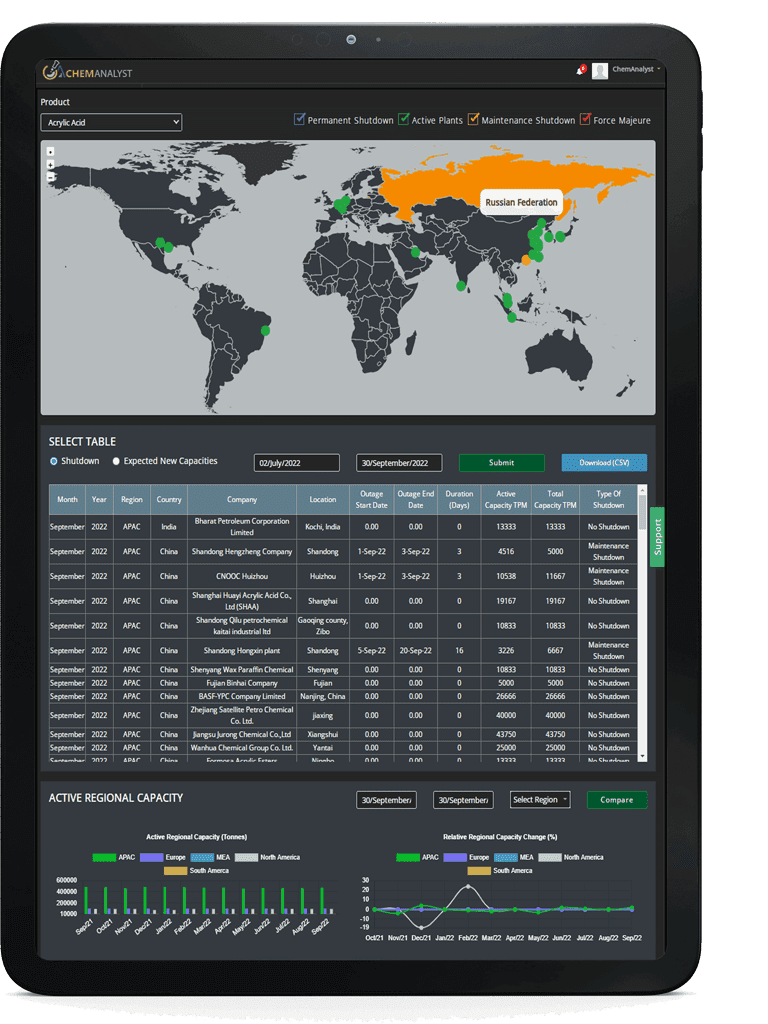

To extract data for Global Acetylene market, primary research surveys were conducted with Acetylene manufacturers, suppliers, distributors, wholesalers and Traders. While interviewing, the respondents were also inquired about their competitors. Through this technique, ChemAnalyst was able to include manufacturers that could not be identified due to the limitations of secondary research. Moreover, ChemAnalyst analyzed various segments and projected a positive outlook for Global Acetylene market over the coming years.

ChemAnalyst calculated Acetylene demand in the globe by analyzing the historical data and demand forecast which was carried out considering the supply and demand of Acetylene across the globe. ChemAnalyst sourced these values from industry experts, and company representatives and externally validated through analyzing historical sales data of respective manufacturers to arrive at the overall market size. Various secondary sources such as company websites, association reports, annual reports, etc., were also studied by ChemAnalyst.

Key Target Audience:

• Acetylene manufacturers and other stakeholders

• Organizations, forums and alliances related to Acetylene distribution

• Government bodies such as regulating authorities and policy makers

• Market research organizations and consulting companies

The study is useful in providing answers to several critical questions that are important for industry stakeholders such as Acetylene manufacturers, customers and policy makers. The study would also help them to target the growing segments over the coming years (next two to five years), thereby aiding the stakeholders in taking investment decisions and facilitating their expansion.

Report Scope:

In this report, Global Acetylene s market has been segmented into following categories, in addition to the industry trends which have also been detailed below:

|

Attribute

|

Details

|

|

Market size Volume in 2022

|

2 million tonnes

|

|

Market size Volume by 2032

|

2.7 million tonnes

|

|

Growth Rate

|

CAGR of 3.1% from 2023 to 2032

|

|

Base year

|

2022

|

|

Estimated Year

|

2023

|

|

Historic Data

|

2015 – 2021

|

|

Forecast period

|

2024 – 2032

|

|

Quantitative units

|

Demand in million tonnes and CAGR from 2023 to 2032

|

|

Report coverage

|

Industry Market Size, Demand by End- Use, Demand by Region, Demand by Sales Channel, Demand-Supply Gap, Company Share, Manufacturing Process.

|

|

Segments covered

|

By End-Use: (Metal Fabrication, Chemical Intermediates, Glass Processing, and Others)

By Sales Channel: (Direct Sale and Indirect Sale)

|

|

Regional scope

|

North America, Europe, Asia Pacific, Middle East and Africa, and South America.

|

|

Pricing and purchase options

|

|

Available Customizations:

With the given market data, ChemAnalyst offers customizations according to a company’s specific needs.

In case you do not find what, you are looking for, please get in touch with our custom research team at sales@chemanalyst.com