Welcome To ChemAnalyst

After staying uptrend under the impact of stronger ethylene and propylene feedstocks throughout the last quarter, the European EPDM Rubber market reversed its track to the downside during January. According to the ChemAnalyst database, the prices for EPDM Rubber assessed on 21st January registered a fall of 5.2% from the prices assessed in the last week of December.

Despite the supply uncertainties in the global upstream market, the fall in the prices has been induced by the bearishness in EPDM Rubber demand which seeped in due to the stagnancy in downstream offtakes during the holiday season. Contrary to expectations, the post-holiday revival of activities could not bring back the firmness in EPDM Rubber market. The major price mitigating factor corresponds to the implementation of severe restrictions on movement and market transactions as Europe moved ahead in combating the alarming Omicron situation. The petrochemical hub, Germany, being one of the hardest-hit nations from the resurgence of Coronavirus cases in Europe, witnessed a substantial decline in spot activity with waning consumption in the downstream sector. As a domino effect, the EPDM rubber imports have also nosedived as traders refrained from raising any further enquiries amid the availability of large quantities of EPDM Rubber supplies beforehand.

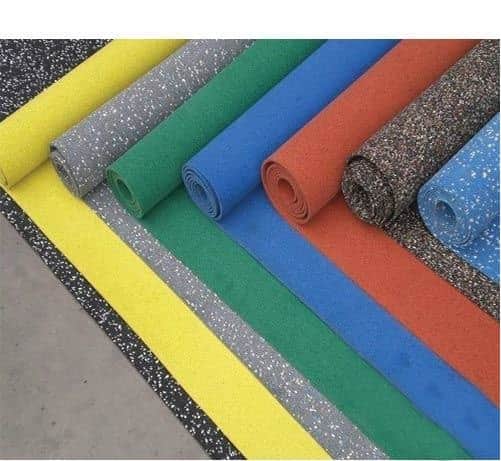

Classified under M-class elastomers, the Ethylene Propylene Diene Monomer (EPDM) Rubber primarily serves the Construction and Automobile end-user industries. Its temperature and water resistance properties along with peroxide and sulphur curability allow it to exhibit applications in automotive weather-stripping, refrigerator door seals, hose pipes and gaskets, electrical insulations, moto oil additives, roofing membrane etc.

As per ChemAnalyst, the growth of the construction and automotive sectors has gone under peril with Covid cases at large again in the European region. The tightening restrictions on border movements have crippled the trading of materials as well as delayed the recovery of the automobile industry from the chip shortage crisis. The continued derailment of the two main pillars of economic growth has resulted in the fall of Europe into an economic recession. Hence, the EPDM rubber market projects a passive outlook amid uncertainties regarding relaxations in the restrictions, causing the traders and downstream industries to refrain from rushing into buying stock inventories, However, overwhelming market performance is expected in the latter half of Q1 2022 with lifting supply chain disruptions from Covid in the near term.

We use cookies to deliver the best possible experience on our website. To learn more, visit our Privacy Policy. By continuing to use this site or by closing this box, you consent to our use of cookies. More info.