Welcome To ChemAnalyst

The prices of lithium and nickel, crucial elements utilized in electric vehicle (EV) batteries, have experienced a significant downturn owing to a notable deceleration in burgeoning demand within China, a dominant market. Nickel reached its lowest point in 32 months in November and has remained at that level since then. This decline is closely tied to the weakening demand observed in China, which stands as the largest manufacturer of EVs worldwide. Notably, China witnessed a surge of approximately 30% in the production of new energy vehicles last year, encompassing EVs.

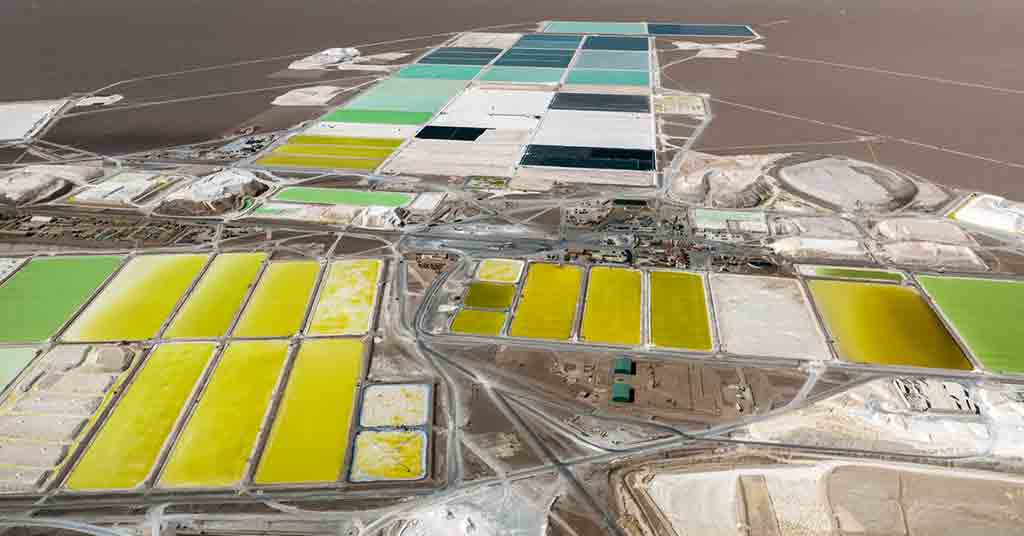

However, this growth rate represents a slowdown compared to the 2.5-fold increase recorded in 2021 and the nearly doubled production witnessed in 2022. The period marked by China's explosive expansion characterized by annual doubling of EV sales and exports has concluded, with growth prospects projected to be more tempered moving forward. Despite the EV market maturing, resulting in subdued demand for lithium and nickel, supply has expanded swiftly in anticipation of future demand. Notably, significant lithium projects have commenced primarily in South American nations like Argentina, while Indonesia is making notable strides in significantly augmenting nickel output.

In the previous year, global lithium production saw a 23% expansion, while nickel output increased by 10%, according to estimates provided by the U.S. Geological Survey. Additionally, since nickel is a component of stainless steel utilized in industrial machinery and construction materials, the sluggishness observed in China's property market has further dampened demand for the metal. In 2022, investment in real estate development in China plummeted by 9.6%. The downturn in nickel and lithium prices has led to the suspension or complete cessation of operations at certain facilities. Australian mining giant BHP announced a temporary halt to segments of its nickel concentrator operation, as reported by media sources. Similarly, Core Lithium, another Australian mining entity, declared the suspension of operations at one lithium project due to depressed prices.

Meanwhile, within the nonferrous-metal sector, three-month futures for zinc plummeted to approximately a two-month low recently. Nyrstar, a prominent European mineral supplier, disclosed the shutdown of a Dutch plant responsible for about 2% of global zinc production capacity for maintenance purposes.

In several instances, mines and refineries that have been shuttered are encountering challenges in resuming operations promptly due to labor shortages or equipment issues. There are apprehensions that such circumstances could trigger a surge in prices.

In 2022, lithium reached historic highs in pricing due to supply shortages. Similarly, zinc prices surged following a series of mine closures undertaken in response to the global financial crisis.

We use cookies to deliver the best possible experience on our website. To learn more, visit our Privacy Policy. By continuing to use this site or by closing this box, you consent to our use of cookies. More info.