Welcome To ChemAnalyst

In a significant development for the global rubber industry, analysts predict a substantial increase in Natural Rubber prices across major importing and exporting regions this August. This anticipated price hike is expected to have far-reaching implications for various sectors, particularly the automotive and manufacturing industries that rely heavily on Natural Rubber.

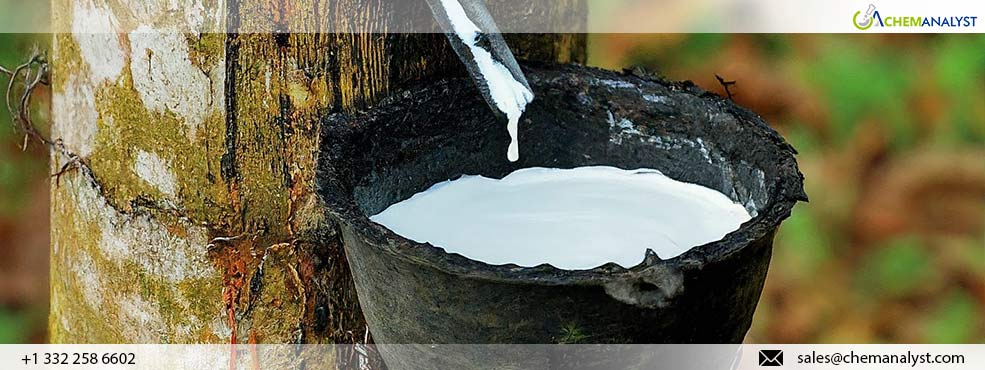

The surge in prices is attributed to a combination of factors, including adverse weather conditions in key production areas, supply chain disruptions, and increased global demand for Natural Rubber. Thailand and Vietnam, two of the world's largest Natural Rubber producers, have reportedly experienced unfavorable weather patterns that have negatively impacted rubber tree yields. Concurrently, there are reports of major tire manufacturers accelerating their purchases of Natural Rubber raw materials, further straining the already tight supply.

India, the world's third-largest producer and fourth-largest consumer of Natural Rubber, is likely to feel the effects of this price increase acutely. The country's Natural Rubber industry, which comprises approximately 6,000 units and employs around 400,000 people, plays a crucial role in the national economy. With an annual turnover of Rs. 200 billion and a significant contribution to the national exchequer, any fluctuation in prices can have substantial economic repercussions.

The Automotive Tyre Manufacturers Association (ATMA) in India has already raised concerns about the shortage, warning of potential production disruptions and plant shutdowns. The association has called upon the Rubber Board to take immediate action to improve domestic availability and ensure a steady supply of Natural Rubber to the industry.

In response to these developments, market analysts expect Natural Rubber futures to trade higher on international commodity exchanges. The Tokyo Commodity Exchange (TOCOM) and the Singapore Exchange (SGX) are likely to see increased activity as traders and investors position themselves in anticipation of the price surge.

For major importing countries like China, the United States, and Japan, this increase in Natural Rubber prices could lead to higher production costs for rubber-based goods, potentially affecting consumer prices across various sectors. Manufacturers may need to reassess their procurement strategies and consider diversifying their Natural Rubber supply sources to mitigate the impact of price volatility.

On the other hand, major exporting countries such as Thailand, Indonesia, and Malaysia may benefit from the higher prices, providing a boost to their agricultural sectors and export revenues. However, these countries will need to balance the short-term gains against the long-term sustainability of their Natural Rubber industries.

As the global economy continues to recover from the impacts of the COVID-19 pandemic, the demand for Natural Rubber in various industries, including automotive, healthcare, and construction, is expected to remain strong. This sustained demand, coupled with supply constraints, is likely to keep the prices elevated in the foreseeable future. As August approaches, all eyes will be on the Natural Rubber market, with producers, consumers, and traders alike bracing for what could be a significant shift in the global landscape.

We use cookies to deliver the best possible experience on our website. To learn more, visit our Privacy Policy. By continuing to use this site or by closing this box, you consent to our use of cookies. More info.