Welcome To ChemAnalyst

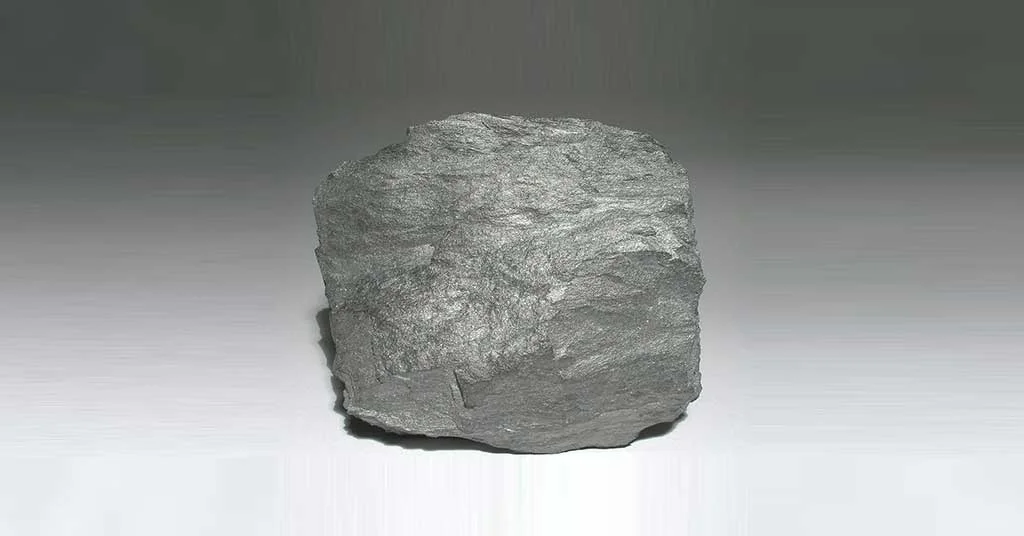

Graphite prices have been declining since the start of August in the global market. The extraction rate across several mining countries increased in the past months. The expansion of the downstream electrical vehicles industry incited the mines to increase their manufacturing activity as the end use of cathode electrodes was expected to rush into the global market. The hike in federal interest rates across the US and European nations kept the market players in a wait-and-watch situation.

The global Graphite mining activity remained on a higher edge as the automotive industry expanded in the international market. The motive of the European Union to reduce their dependency on China has been the cause for a major win for Talga Groups for Graphite mining. Talga Groups, Australia's major battery anode and graphene additives company, has been waiting for several years to finally get the approval to establish a Graphite plant for the supply of enough battery material to power two million electric cars a year. Talga has been adhering to the regulatory procedures to keep precautions over environmental impact that helped them receive approval from the overseas Swedish Government to set up new mines. The company will supply Graphite related products to major automotive industries such as Tesla, Ford, and Toyota and even battery manufacturing industries across the Eurozone. Meanwhile, Northern Graphite has anticipated a boost in production rate as they have completely shifted their Namibian production unit to the Okanjande mine instead of rehabilitating the current mill at Okorusu. The plant is now fully functional on solar energy along with lower operational cost and reduction in emission of Green household gases during operations. Additionally, Syrah Resources, a major global integrated natural Graphite and battery anode company, has declined as the inventory level across Chinese warehouses remains on a higher edge. The new deals and policies, including the upliftment of downstream electric vehicle industries, have kept the demand high, but the market remains stable amid a hike in local supply rate across China.

Furthermore, the expansion of battery industries resulted in the partnership of Global mining giant Rio Tinto with Sovereign Metals, a major Graphite producing company in Australia, for their Kasiya Rutile Project. Rio Tinto invested USD 40.4 million to boost the production rate in Kasiya. The demand from downstream electric vehicle and battery industries remained on a lower edge as the increase in interest rate panicked the global Graphite market to lower their consumption rate. The upcoming months are expected to boost the demand for Graphite as technology advances across various mills and end-use consumption sectors.

According to ChemAnalyst, the prices of Graphite will show an upsurge in the global market as the demand for batteries and electric vehicles increases. The major market players across the globe are anticipating that mills will increase their prices as the Chinese inventory level slumps in the forthcoming weeks.

We use cookies to deliver the best possible experience on our website. To learn more, visit our Privacy Policy. By continuing to use this site or by closing this box, you consent to our use of cookies. More info.