Welcome To ChemAnalyst

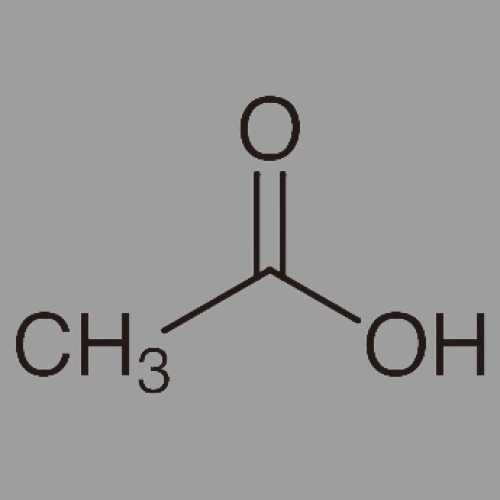

Over the past few months, the supply of Acetic Acid surplused with a weak demand from the downstream derivative market that further reduced the prices in the Asian region. Asia's Acetic acid spot market was weighed down by an influx of products coming from China, where lockdowns and weak market sentiments hampered domestic consumption. To ease the rising inventories among the ports of East China, significant producers of Acetic Acid in China diverted their cargoes to overseas suppliers. As of 22nd April, the price of Acetic Acid in China slipped to USD 770/ton FOB Qingdao with a weekly declination of 4%. The feedstock Methanol market was frail, with deterred demand from gasoline blending. In India, the cost of Acetic acid is reduced due to weak market sentiments and insufficient product availability. On 25th April, Acetic acid's price in India was observed to be USD 758/ton Ex-Kandla. Gujarat Narmada Valley Fertilizer and Chemical Limited, an Indian manufacturer of fertilizers and chemicals, decreased Acetic Acid prices for the domestic market on 26th April.

In the US and European markets, the price of Acetic Acid surged due to rising feedstock Methanol and Natural gas prices. Force majeure among major Acetic acid producers in the European region resulted in a price hike. On 15th April, LyondellBasell issued force majeure on supplies of Acetic acid in La Porte owing to some technical issues. The plant has a production capacity of 544KTPA. In the US, Acetic Acid's price surged to USD 1515/ton FOB Louisiana with a weekly inclination of 1.0%. The market soared with limited supply and accelerating exports to Mexico and other European countries in the US. Narrowing profit and constraints on supply forced the suppliers to revise Acetic Acid prices for the domestic and international markets.

According to ChemAnalyst, the price of Acetic Acid in the Asian region is expected to remain stable with tepid market sentiments. Despite the rising Natural Gas and crude oil market, the acetic acid market will face downward pressure from sufficient supply and accelerating imports of feedstock Methanol from Iran and Russia. Local producers in India will be more likely to drop the prices to reduce their inventories. However, the cost support will be driven by the rising Russia-Ukraine conflict amid supply shortages in the US and European markets. Acetic Acid plant turnaround will also impact the production rate resulting in a price hike.

We use cookies to deliver the best possible experience on our website. To learn more, visit our Privacy Policy. By continuing to use this site or by closing this box, you consent to our use of cookies. More info.