Welcome To ChemAnalyst

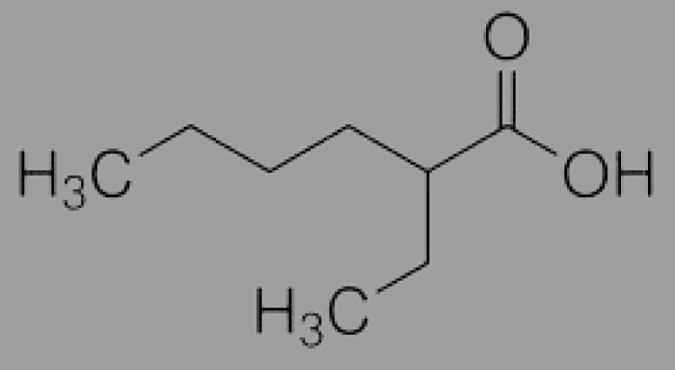

Since a long time, the 2-Ethylhexanoic Acid market has been difficult for the United States, as market participants are concerned about growing input costs despite no major increase in demand from the domestic market. According to ChemAnalyst data, 2-Ethylhexanoic Acid prices in the United States increased by more than 3% in February, putting additional heat on inflationary pressures caused by rising global crude oil costs. Meanwhile, demand fundamentals in the domestic paints and coatings sector have begun to improve, aided by significant seasonal offtakes from the construction sector. Construction activity in the United States usually picks up following the winter season, which has resulted in an increase in product inquiries from the domestic paints, coatings, and plasticizer industries.

Since the crisis between Russia and Ukraine has worsened, the price of crude oil has risen on a contract basis, injecting uncertainty into the global market. Contractors in the United States have reported that they are experiencing significant cost pressure on raw materials, prompting them to be anxious about profitability. Furthermore, not only the United States, but also Canada is bearing the brunt of rising raw material costs. In addition, US sanctions against Russia including the crude oil import ban, have exacerbated overall market sentiments for the country, with traders using the spectre of scarcity to raise their offers on existing cargoes.

As per ChemAnalyst, demand for 2-Ethylhexanoic Acid from the downstream paints and plasticizers industry is predicted to flourish in the second half of Q1 2022, keeping the product buoyant for another period in the United States. Furthermore, the United States has put sanctions on Russia, which has an impact on the European market, as the European market's empty space must be supplied by Asia or the United States. As a result, in order to capture the total market, demand fundamentals in the United States are expected to improve significantly, and pricing dynamics are unlikely to change rapidly in the future.

We use cookies to deliver the best possible experience on our website. To learn more, visit our Privacy Policy. By continuing to use this site or by closing this box, you consent to our use of cookies. More info.