H1 2023: The leading Tall Oil Rosin producers were Ingevity Corporation, Kraton Corporation, and Sunpine ABC during H1 2023. Regionally, Europe was the leading consumer and producer of TOR in H1 2023. However, Tall Oil Rosin prices declined slightly in the German market owing to low demand and ample supplies. The market expansion of Tall Oil Rosin was hampered by the challenges like persistent inflationary pressure and rising interest rates. The German market's drop in demand for Tall Oil Rosin from the downstream adhesives industry downstream pushed down the price of Tall Oil Rosin in Europe. In the first half of 2023, the price of tall oil rosin in the USA market showed a mixed trend, Due to healthy buying activities during the first three months of 2023, Tall Oil Rosin prices rose in US. Also, purchases from the downstream paper and ink sectors had increased. As production in Brazil was hindered during the funfair holidays, imports from the exporting country have decreased at the same time, which pushed traders to increase their price quotation. As a result, there are less supplies available in the US market. However, at the end of March 2023, Tall Oil Rosin prices slightly decreased due to the downstream industry's lackluster demand in the US. While there are enough supplies to meet the total domestic demand, Tall Oil Rosin demand from the downstream paints & coatings and adhesives sectors has remained depressed till May and then increased in June 2023. Because of labor shortage in the US ports of Long Beach and Los Angeles, there was restriction at the ports and reduced the supply in the US as the imports from Brazil were sluggish in June 2023.

H1 2022: During H1 2022, the total production reached 240 thousand tonnes. However, Europe held a market share of approximately 35% and North America consumed approximately 30% of the market. Asia Pacific acquired the third position in terms of consumption by volume. The leading Tall Oil Rosin producers were Ingevity Corporation, Kraton Corporation, and Metsä Fibre during H1 2022.The companies Ingevity Corporation and Kraton Corporation collectively produced roughly 28% of the tall oil rosin In H1 2022. However, Ingevity Corporation held the position of the leading producer in H1 2022. Three of the production facilities owned by Ingevity are located in North America that produce two different kinds of tall oil rosin products: regular rosin and stabilized rosin. The regular rosin contains abietic acid whereas stabilized rosin primarily contains dehydroabietic acid. However, Europe was the largest producer of tall oil rosin, with Finland being the largest producer, followed by Sweden. It was backed up by the reason of presence of raw material (pine trees) in abundance in these countries. During H1 2022, Tall Oil Rosin was employed by multiple downstream industries including adhesives, paper sizing, printing ink, and rubber emulsifier across the globe.

H2 2022: During H2 2022, production reached around 260 thousand tonnes, slightly higher than H1 2022. The market consuming industries also enhanced their demand in H2 compared to H1 2022. Europe displayed the highest demand for Tall Oil Rosin in terms of volume in H2 2022. However, due to the low prices of feedstock, tall oil rosin prices had declined in the European market in H2 2022. Due to weak consumer demand in Europe, demand from the downstream adhesives, paint, and coating sectors also decreased during H2 2022. Also, Tall Oil Rosin prices fell in North American market during H2 2022, which was supported by the sluggish demand dynamics and a persistent decline in feedstock prices. In response to the high inflation rate, demand from the downstream adhesives, paint, and coating sectors had also decreased in North America. Similar trend was observed in Asia Pacific region. A significant bearish trend was caused by adequate inventory levels and a decline in feedstock prices. Although not a high demand was observed from the downstream paint and coating adhesive industries across the Asia Pacific region.

The global Tall Oil Rosin (TOR) market has reached around 500 thousand tonnes in 2022 and is expected to grow at a CAGR of 4.98% during the forecast period until 2035. Tall Oil Rosin is produced by Crude Tall Oil (CTO) distillation. Finland produces most of the Crude Tall Oil (CTO) at present. One of Finland's top CTO refineries, Fintoil Oy, has announced a 100-million-euro investment to build the newest CTO biorefinery in the HaminaKotka port. Environmental and construction licenses have been given for this refinery. It will have an operating capacity of 200 thousand tonnes per year. This plant is anticipated to be the 3rd biggest CTO biorefinery worldwide by the summertime of 2022.

Tall Oil Rosin is synthesized by distillation of CTO. CTO is a by-product of the kraft pulping process. Fatty acids, a few neutral substances, and rosin constitute CTO. Abietic acid, oleic acid, and linoleic acid are present in CTO. During the extraction process, pine wood chips are boiled to create an alkaline solution, producing a black liquor and the pulp. After this, the black liquor is concentrated, and the black liquor soap layer is skimmed off the top. The residual liquid is then acidified to yield CTO. CTO is further distilled into the components, which are Tall Oil Fatty Acids (TOFA), Tall Oil Rosins (TOR), Distilled Tall Oil (DTO), Tall Oil Head (TOH), and pitch.

Tall Oil Rosin is a mixture of eight rosin acids: abietic, neoabietic, levopimaric, palustric, dehydroabietic, pimaric sandracopimaric, and isopimaric acid. Moreover, up to 6% of rosin's composition is unsaponifiable constituents. Some of TOR's fascinating industrial applications are enhancing the strength and gloss of alkyd resin coatings, electronic welding, synthetic rubber synthesis, and acquiring Pentaerythritol ester and glycerol.

Since TOR is technically a component of CTO, the availability of pine trees is the primary necessity for producing TOR. Europe, Russia, and North America are the three primary continents with the most significant pine trees. Pine trees typically grow in chilly climates. Europe now produces the most pine chemicals. The European nations manufacture almost half of the Tall Oil Rosin. Finland, which has more than ten pine chem biorefineries, is the top producer of CTO in Europe.

Based on consumption, the TOR market is divided into North America, Europe, Asia Pacific, the Middle East and Africa, and South America. In the year 2022, the highest consumption was by Europe. The demand for TOR is expected to rise in the forecast years. The driving factors include the growing demand for tackifier resins throughout the globe. Apart from that, other industrial applications like adhesives and rubber emulsifiers also capture the attention of buyers. During the projected period, it is anticipated that demand from the packaging, construction, and automotive industries would propel the expansion of the global tall oil rosin market. Owing to these reasons, global Tall Oil Rosin (TOR) market is likely to reach around 930 thousand tonnes in 2035.

Based on the end-user industry, the Tall Oil Rosin market is segmented into different sectors, including adhesives, paper sizing, printing ink, rubber emulsifier, and others. However, adhesives are the largest end-user consumer of TOR and held a share of around 25% in 2022. The printing ink market, another prominent end use industry of Tall Oil Rosin. Nonetheless, rubber emulsifier is likely to become the fastest growing industry during the forecast period.

Significant companies for Global TOR are UPM Lappeenranta Biorefinery, Fintoil, Södra, Ingevity Corporation, Kraton Corporation, Forchem Respole Group, Metsä Fibre, ILIM Group, Segezha Group, Mainstream Pine Products, LLC, DRT (Dérivés Résiniques et Terpéniques), Mercer International Inc., and Others.

Years considered for this report:

Historical Period: 2015- 2022

Base Year: 2022

Estimated Year: 2023

Forecast Period: 2024-2035

This report will be delivered on an online digital platform with one-year subscription and quarterly update.

Objective of the Study:

• To assess the demand-supply scenario of Tall Oil Rosin which covers production, demand and supply of Tall Oil Rosin market in the globe.

• To analyse and forecast the market size of Tall Oil Rosin.

• To classify and forecast Global Tall Oil Rosin market based on end-use and regional distribution.

• To examine competitive developments such as expansions, new product launches, mergers & acquisitions, etc., of Tall Oil Rosin market in the globe.

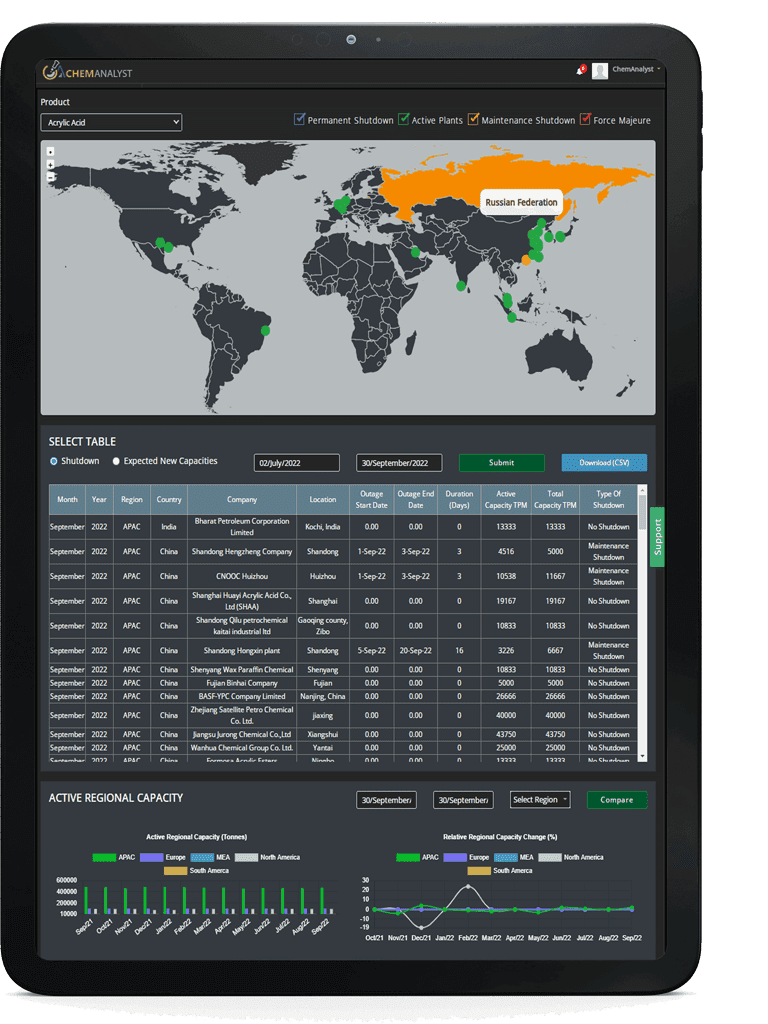

To extract data for Global Tall Oil Rosin (TOR) market, primary research surveys were conducted with CTO manufacturers as Tall Oil Rosin is produced from Crude Tall Oil. Further, manufacturers, suppliers, distributors, wholesalers, and Traders were also interviewed. While interviewing, the respondents were also inquired about their competitors. Through this technique, ChemAnalyst was able to include manufacturers that could not be identified due to the limitations of secondary research. Moreover, ChemAnalyst analyzed various segments and projected a positive outlook for Global Tall Oil Rosin market over the coming years.

ChemAnalyst calculated Tall Oil Rosin demand in the globe by analyzing the historical data and demand forecast which was carried out considering the production of Crude Tall Oil which is further used to produce Tall Oil Rosin. ChemAnalyst sourced these values from industry experts and company representatives and externally validated through analyzing historical sales data of respective manufacturers to arrive at the overall market size. Various secondary sources such as company websites, association reports, annual reports, etc., were also studied by ChemAnalyst.

Key Target Audience:

• CTO & Tall Oil Rosin manufacturers and other stakeholders

• Organizations, forums and alliances related to Tall Oil Rosin distribution

• Government bodies such as regulating authorities and policy makers

• Market research organizations and consulting companies

The study is useful in providing answers to several critical questions that are important for industry stakeholders such as Tall Oil Rosin manufacturers, customers and policy makers. The study would also help them to target the growing segments over the coming years, thereby aiding the stakeholders in taking investment decisions and facilitating their expansion.

Report Scope: