The global Sulphuric Acid market has expanded to reach approximately 261 million tonnes in 2024 and is expected to grow at an impressive CAGR of 3.50% during the forecast period until 2035.

Sulphuric Acid is well-known mineral acid and oxidizing agent, commonly produced by contact process method by sulphur dioxide production using sulphur in the presence of air across the globe. Sulphuric Acid is colorless and water-soluble, having various applications across the chemical, fertilizer, and pharmaceutical industry. More than half of sulphuric acid goes into the production of phosphoric Acid, which producers use to make phosphate fertilizers (e.g., DAP, MAP, APP, etc.) used in the agriculture sector owing to its properties which include root & seed development and overall plant maturation. Other industrial uses of sulphuric Acid are for producing dyes, pigments, medicines, explosives, surfactants, inorganic materials, and acids, as well as petroleum refining and metallurgical operations.

The primary driver of the Sulphuric acid market is the Phosphate Fertilizers Sector. Mono ammonium phosphate (MAP) and diammonium phosphate (DAP), blended with phosphate rock to create phosphoric Acid, are made using Sulphuric Acid as a feedstock. Since these minerals may be readily absorbed and utilized by crops, mineral fertilizers supplement the soil's nutritional levels. The increasing demand and consumption of food following the growing population at a high rate across various regions globally would generate the need for fertilizers which is expected to swell the total demand for Sulphuric Acid globally. The global Sulphuric Acid market is anticipated to reach 382 million tonnes by 2035.

The Asia Pacific region dominates the Sulphuric Acid market in terms of consumption. Asia Pacific is expected to dominate the Sulphuric Acid market in the coming years, backed by increasing population, food consumption, and expanding fertilizer and manufacturing industries across these countries. Additionally, some of the leading producers of Sulphuric Acid are in this region. Moreover, China, the fastest-growing economy, has massive potential for the pharma industry, which contributes significantly to the overall growth of Sulphuric Acid in the region through the forecast period.

Based on the end-user industry, the global Sulphuric Acid market is segregated into Phosphate Fertilizers, Metal Processing, Phosphates, Fibres, Paints & Pigments, and Other end-use industries. Phosphate Fertilizers are dominating the Sulphuric Acid market on the global level. In 2024, this industry accounted for approximately 50% of the global market. The Metal Processing industry also relies heavily on sulphuric Acid. It is frequently employed in processing metals, such as in the production of copper and zinc, as well as in the "pickling" process, which cleans the surface of steel sheets. With ongoing construction projects, sulphuric acid demand for metal processing is anticipated to swell up by 2035.

Major players in the production of Global Sulphuric Acid are Yunnan Yun, Guizhau Phosphate Group, Saudi Arabian Mining Company (Ma’aden), OCP Group, Anhui Tomgling (North ferrous metal), Hubei Yihua, Jiangsu copper, Sichuan Dragon Python Group, Hubei Xingfa, Aurubis, and Codelco.

Years considered for this report:

Historical Period: 2015- 2023

Base Year: 2024

Estimated Year: 2025

Forecast Period: 2026-2035

This report will be delivered on an online digital platform with one-year subscription and quarterly update.

Objective of the Study:

• To assess the demand-supply scenario of Sulphuric Acid which covers production, demand and supply of Sulphuric Acid market in the globe.

• To analyse and forecast the market size of Sulphuric Acid

• To classify and forecast Global Sulphuric Acid market based on end-use and regional distribution.

• To examine competitive developments such as expansions, mergers & acquisitions, etc., of Sulphuric Acid market in the globe.

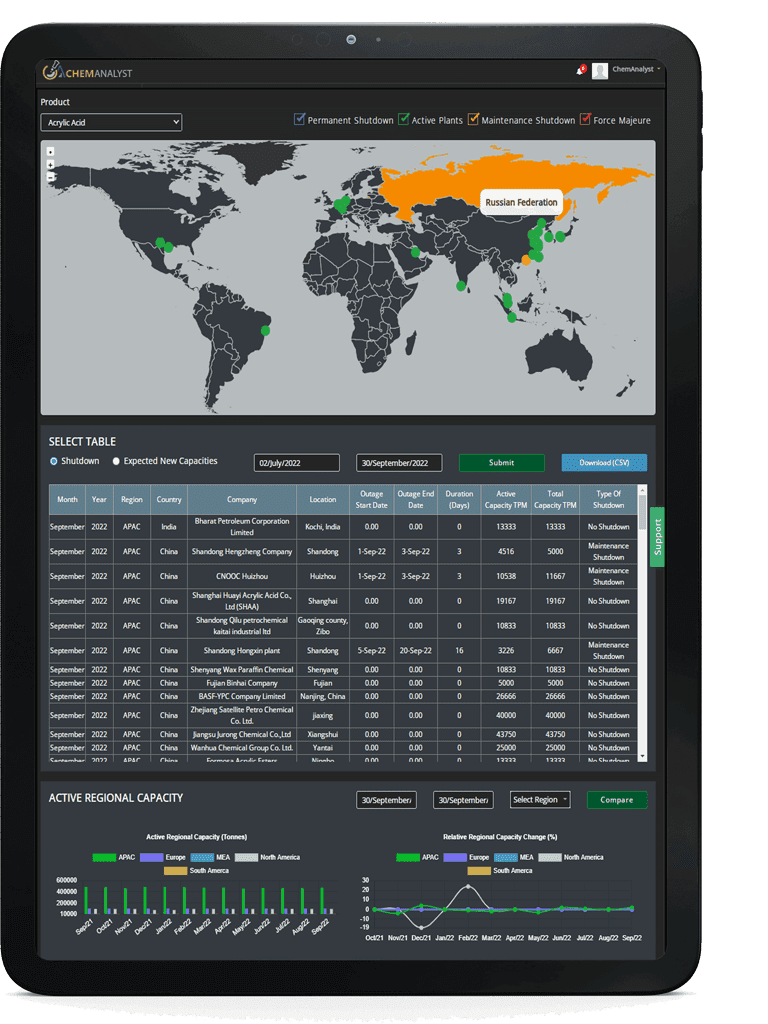

To extract data for Global Sulphuric Acid market, primary research surveys were conducted with Sulphuric Acid manufacturers, suppliers, distributors, wholesalers and Traders. While interviewing, the respondents were also inquired about their competitors. Through this technique, ChemAnalyst was able to include manufacturers that could not be identified due to the limitations of secondary research. Moreover, ChemAnalyst analyzed various segments and projected a positive outlook for Global Sulphuric Acid market over the coming years.

ChemAnalyst calculated Sulphuric Acid demand in the globe by analyzing the historical data and demand forecast which was carried out considering the of Sulphuric Acid by the end-user industries across the globe. ChemAnalyst sourced these values from industry experts, and company representatives and externally validated through analyzing historical sales data of respective manufacturers to arrive at the overall market size. Various secondary sources such as company websites, association reports, annual reports, etc., were also studied by ChemAnalyst.

Key Target Audience:

• Sulphuric Acid manufacturers and other stakeholders

• Organizations, forums and alliances related to Sulphuric Acid distribution

• Government bodies such as regulating authorities and policy makers

• Market research organizations and consulting companies

The study is useful in providing answers to several critical questions that are important for industry stakeholders such as Sulphuric Acid manufacturers, customers and policy makers. The study would also help them to target the growing segments over the coming years (next two to five years), thereby aiding the stakeholders in taking investment decisions and facilitating their expansion.

Report Scope:

In this report, Global Sulphuric Acid market has been segmented into following categories, in addition to the industry trends which have also been detailed below:

|

Attribute

|

Details

|

|

Market size Volume in 2024

|

261 million tonnes

|

|

Market size Volume by 2035

|

382 million tonnes

|

|

Growth Rate

|

CAGR of 3.50% from 2025 to 2035

|

|

Base year for estimation

|

2025

|

|

Historic Data

|

2015 – 2024

|

|

Forecast period

|

2026 – 2035

|

|

Quantitative units

|

Demand in million tonnes and CAGR from 2025 to 2035

|

|

Report coverage

|

Industry Market Size, Capacity by Company, Capacity by Location, Operating Efficiency, Production by Company, Demand by End- Use, Demand by Region, Demand by Sales Channel, Demand-Supply Gap, Foreign Trade, Company Share.

|

|

Segments covered

|

By End-Use: (Phosphate Fertilizers, Metal Processing, Phosphates, Fibres, Paints & Pigments, and Other)

By Sales Channel: (Direct Sale and Indirect Sale)

|

|

Regional scope

|

Asia Pacific, North America, Middle East and Africa, Europe and South America.

|

|

Pricing and purchase options

|

|

Available Customizations:

With the given market data, ChemAnalyst offers customizations according to a company’s specific needs.

In case you do not find what, you are looking for, please get in touch with our custom research team at sales@chemanalyst.com