Sorbitol Market registered demand of 920 thousand tonnes in 2024 and is anticipated to achieve a healthy CAGR of 2.01% in the forecast period until 2035. Sorbitol also known as D-glucitol, or D-Sorbitol is a type of carbohydrate which falls into the category of sugar alcohols called polyols. The chemical is usually synthesized via a glucose reduction reaction in which the aldehyde group is converted into a hydroxyl group in the presence of catalyst aldose reductase. It is extensively used as a sweetener, additive, humectant, texturizer, stabilizer, and as a bulking agent in food, cosmetics, pharmaceutical, paper, leather, and other industries. It is also utilized as a raw material for various chemicals including vitamin C, surfactants, resins, etc. According to the World Health Organization (WHO) and the U.S. Food and Drug Administration (FDA), the consumption of the chemical is reviewed and recognized as safe, as well as potentially support digestive and oral health.

Depending upon the type, there are two forms of Sorbitol including liquid and Powder. The powder/crystal form is primarily used in sweets, specialty foods, frozen fish and meat products, and pharmaceuticals. Whereas the liquid form is widely utilized in Pharmaceuticals and cosmetic emulsions. The liquid segment dominates the Sorbitol market globally owing to its high demand for a plethora of applications. Based on applications, the Sorbitol market is segmented into pharmaceuticals, food & beverages, personal care & cosmetics, and others. Among which, the food and beverages segment dominates the market across the globe

In the pharmaceutical industry, the demand for Sorbitol is continuously rising as it is widely utilized as a laxative and helps in relieving constipation and is likely to accelerate the Sorbitol market in coming years. With the rising number of diabetic patients and health-conscious consumers, the demand for Sorbitol is rapidly increasing as it is utilized in food and confectionary items as a reduced-calorie alternative to sugar and is expected to boost the Sorbitol market across the globe in the next few years.

Continuously growing demand for the chemical due to its numerous applications in major end-use industries is driving the market, globally. Due to the unique properties of Sorbitol as it is a stable chemical that is relatively inert and can be easily incorporated with other food products without hampering the recipe and is expected to accelerate the overall demand of Sorbitol by the pharmaceutical and cosmetic industry around the world. The growing demand for Sorbitol for the manufacturing of several cosmetic and skincare products like lotions, moisturizers, aftershave creams, baby shampoos, etc. as it prevents moisture loss from skin and hair, is likely to bolster the Sorbitol market in upcoming years.

Among different regions, the Asia Pacific region is dominating the Sorbitol market across the globe owing to the continuously increasing demand of Sorbitol by the major end-use industries including cosmetics, food and beverages, and personal care especially in emerging countries such as China and India. Rapidly growing demand for sorbitol for the manufacturing of cosmetics and personal care products is likely to boost the Sorbitol market globally.

Major players for Sorbitol are Gujarat Ambuja Exports Limited ,Kasyap Sweetners Private Limited, Shandong Tianli Pharmaceutical Co ,Shandong Tongchuang Biotechnology Co., Ltd. ,PT Sorini Agro Asia, Archer Daniels Midl andOthers (The Azucarero Sugar Business Group, Anil Products Ltd., etc. )

Years considered for this report:

Historical Period: 2015-2023

Base Year: 2024

Estimated Year: 2025

Forecast Period: 2026–2035

This report will be delivered on an online digital platform with one-year subscription and quarterly update.

Objective of the Study:

• To assess the demand-supply scenario of Sorbitol which covers production, demand and supply of Sorbitol market globally.

• To analyse and forecast the market size of Sorbitol.

• To classify and forecast Sorbitol market based on application, technology, end-use and regional distribution.

• To identify drivers and challenges for Sorbitol market.

• To examine competitive developments such as expansions, new product launches, mergers & acquisitions, etc., in Sorbitol market.

• To identify and analyse the profile of leading players involved in the manufacturing of Sorbitol.

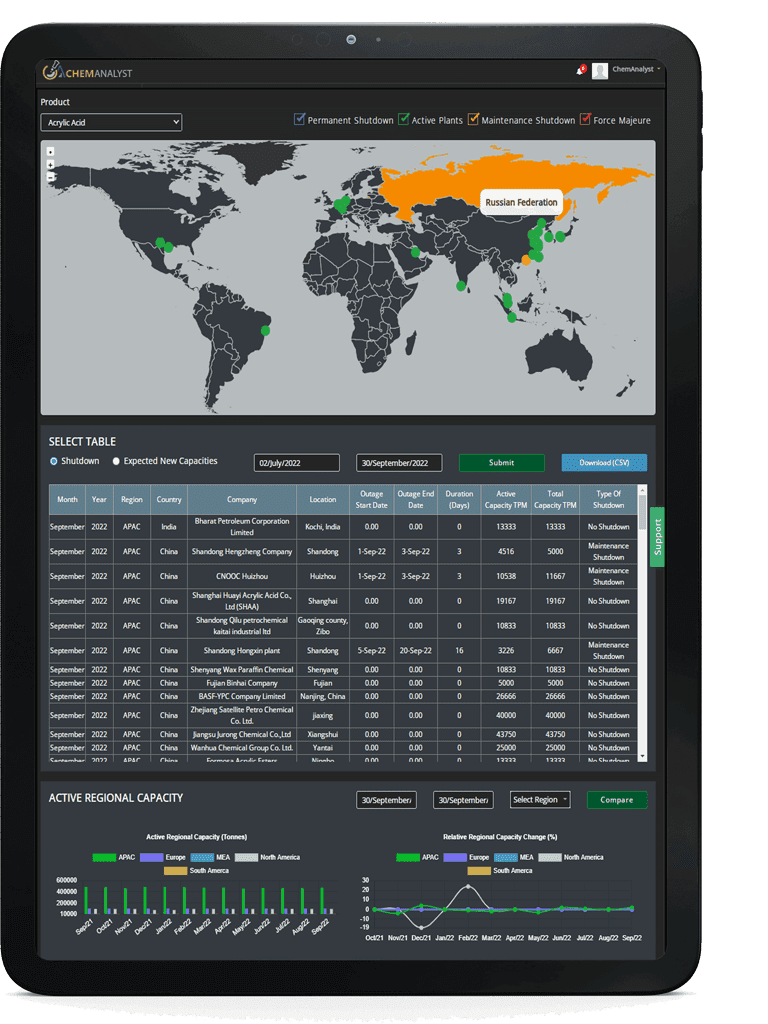

To extract data for Sorbitol market, primary research surveys were conducted with Sorbitol manufacturers, suppliers, distributors, wholesalers and Typers. While interviewing, the respondents were also inquired about their competitors. Through this technique, ChemAnalyst was able to include manufacturers that could not be identified due to the limitations of secondary research. Moreover, ChemAnalyst analyzed various Typer segments and projected a positive outlook for Global Sorbitol market over the coming years.

ChemAnalyst calculated Sorbitol demand globally by analyzing the historical data and demand forecast which was carried out considering imported Sorbitol, styrene prices, monomers used for production of Sorbitol. ChemAnalyst sourced these values from industry experts and company representatives and externally validated through analyzing historical sales data of respective manufacturers to arrive at the overall market size. Various secondary sources such as company websites, association reports, annual reports, etc., were also studied by ChemAnalyst.

The study is useful in providing answers to several critical questions that are important for industry stakeholders such as Sorbitol manufacturers, customers and policy makers. The study would also help them to target the growing segments over the coming years (next two to five years), thereby aiding the stakeholders in taking investment decisions and facilitating their expansion.