[Online Quarterly Update]Singapore Ethanol Derivative demand stood at 12.24 Thousand Tonnes in 2020 and is forecast to reach17.71 Thousand Tonnes by 2030, growing at a healthy CAGR of 3.80% until 2030. Ethanol derivatives cater to high demand as eco-friendly and cost-effective solvents in the paint and coating industry. Continuous advancement for adopting a cost-effective approach is set to grow the demand for ethanol derivatives for the forecasted period. Also growing the export market of ethyl acetate in the country will propel the market for forecasted years. The outbreak of COVID-19 in 2020 disrupted the world economy. The market growth was affected drastically, and production units shut down. Furthermore, the major market players intentionally halted the production keeping their employees’ health and wellness in mind. With imposed new regulations of the COVID-19 and proper precautions, the market is anticipated to regain its growth in the years to come. Once the market regains the full function of its production unit, the market is bound to show robust growth in the forecast period. Potential investment in the market is expecting steady growth in the market in the forecast period, until 2030.

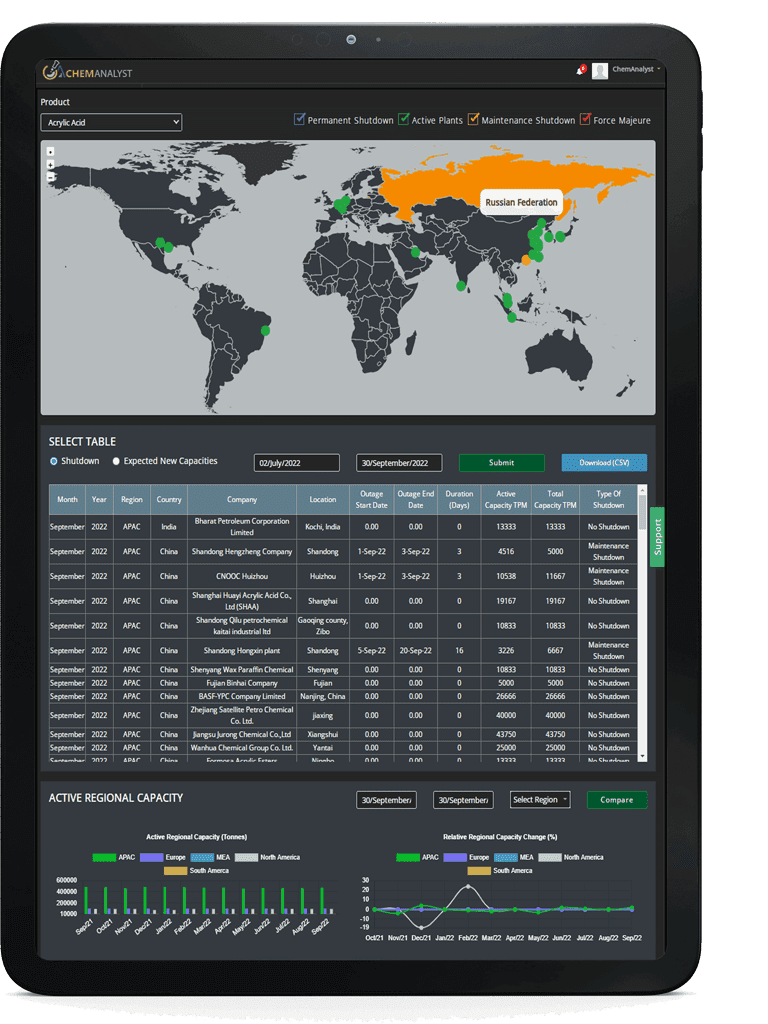

Under this subscription, you would be able to access Singapore Ethanol Derivatives market demand and supply analysis on a cloud-based platform for one year. The data is updated on a near real-time basis to add any new movement in the industry including but not limited to new plant announcements, plant shutdowns, temporary disruptions in demand or supply, news and deals, and much more specific to Ethanol Derivatives.

Years Considered for Analysis:

Historical Years: 2015 – 2019

Base Year: 2020

Estimated Year: 2021

Forecast Period: 2022 – 2030

This report will be delivered on an online digital platform with a one-year subscription and quarterly update.

Deliverables

|

Installed Capacity By Company

|

Installed capacity within the country along with individual capacity of leading players

|

|

Installed Capacity By Location

|

Installed capacity at several locations across the country

|

|

Installed Capacity By Process

|

Installed capacity by different processes

|

|

Installed Capacity By Technology

|

Installed capacity by different technologies being used to produce Ethanol Derivatives

|

|

Production By Company

|

Actual production done by different companies

|

|

Operating Efficiency By Company

|

Operating efficiency at which different companies are operating their plants

|

|

Demand By End Use

|

Demand/Sale of Ethanol Derivatives in different end user industries across the country

|

|

Demand By Sales Channel

|

Demand/Sale of Ethanol Derivatives by different sales channels across the country

|

|

Demand By Region

|

Demand/Sale of Ethanol Derivatives in different regions of the country

|

|

Country Wise Exports

|

Exports of Ethanol Derivatives by Different Countries

|

|

Country Wise Imports

|

Imports of Ethanol Derivatives by Different Countries

|

|

Demand & Supply Gap

|

Demand & Supply Gap at country level

|

|

Market Share of Leading Players

|

Revenue shares of leading players in the country

|

|

News & Deals

|

Historical & Current News & Deals in Ethanol Derivatives market

|

To extract data for the Singapore Ethanol Derivatives market, the ChemAnalyst team conducts primary research surveys with Ethanol Derivatives manufacturers, suppliers, distributors, wholesalers, and customers followed by exhaustive secondary research to cross-validate the information being collected through primary research surveys.

Available Customizations:

With the given market data, ChemAnalyst offers customizations according to a company’s specific needs.

In case you do not find what, you are looking for, please get in touch with our custom research team at sales@chemanalyst.com