The Polybutylene Adipate Terephthalate (PBAT) Resin market registered a demand of 1187 thousand tonnes in 2024 and is anticipated to achieve an impressive CAGR of 11.92% in the forecast period until 2035. Polybutylene Adipate Terephthalate (PBAT) is a semi-aromatic, biodegradable thermoplastic copolymer that is usually known for its flexibility and toughness. PBAT possesses versatile properties such as high mechanical strength, almost the same as PP and ABS, high heat resistance, and outstanding processability. Moreover, PBAT is considered the best biodegradable plastic in terms of process ability in the market and can be easily blended with calcium carbonate, starch, etc. to produce cost-effective products.

The excellent properties of PBAT resin make it an ideal material for manufacturers due to the significantly growing interest for designing new biodegradable polymers to solve the environmental problems associated with conventional plastics. PBAT Resins are produced by the polycondensation reaction of 1-4 butanediol (BDO), Adipic Acid (AA), and Terephthalic Acid (PTA) along with special catalyst using general polyester manufacturing technology. PBAT resin is widely utilized in numerous applications such as packaging, mulching films, shopping bags, paper coating labels, cutlery, bin bags, and others. Depending upon the grade, the PBAT market is divided into Pure PBAT and Blended PBAT. The addition of low-cost and reinforcing materials like starch and Polylactic Acid (PLA) in PBAT resins is an effective way to improve the properties, while maintaining the biodegradability of the composites. PLA-based PBAT blends are widely preferred over starch-based PBAT blends as they are highly biodegradable, commercially available and has a reasonably similar price in comparison to commodity polymers.

On the basis of the end-use industry, the PBAT Resin market is segmented into packaging, agriculture & Horticulture, consumer goods, Textiles, and others. The growing demand for packaged food & beverages is continuously driving the PBAT resins market across the globe. Expansion of the packaged food industry is likely to bolster the demand for PBAT resins over the next few years. PBAT is largely used in the packaging of consumer goods which is expected to flourish the PBAT resins market in the forecast period. Surging demand for soil-biodegradable mulch films for agriculture purposes will further propel the demand for PBAT resins around the globe in the near future.

Due to the unprecedented fall of COVID-19 in 2020, the PBAT Resin market was negatively affected around the globe. Leading authorities in several countries imposed nationwide lockdowns and strict social distancing norms which caused a severe decline in the demand for PBAT Resins along with the disruption in the global supply chain. Manufacturing units temporarily halted their operational activities in order to curb the spread of the deadly virus. However, the demand for single-use plastics and packaging solutions surged during the coronavirus pandemic which further propelled the PBAT Resin market across the various emerging economies.

Among different regions, the Asia Pacific region is leading the PBAT Resin market across the globe, driven by increasing production capacities and the rising exports of 100% biodegradable plastic bags, particularly by Chinese manufacturers. The region benefits from cost-effective manufacturing, supportive government initiatives, and growing awareness regarding sustainable materials. Moreover, the rapid expansion of major end-use industries such as packaging, agriculture, and consumer goods in countries like China, India, and South Korea is further propelling demand. While the European Union follows closely due to its stringent environmental regulations and strong consumer preference for eco-friendly products, the Asia Pacific region is expected to maintain its dominant position in the PBAT resin market in the coming years.

Major players operating in the PBAT Resin market include BASF SE, Kingfa Sci & Tech, Jinfa Technology, Wanhua Chemical, Jinhui Zhaolong Advanced Technology, Guangan Hongyuan Technology, Hubei Yihua, Hunan Yussen Energy Technology Co., Ltd., CNCEC Donghua Tianye New Materials Co., Ltd, Shandong Ruifeng Chemical Co., Ltd, Jinhui Zhaolong Advanced Technology., and Others.

Years considered for this report:

Historical Period: 2015-2013

Base Year: 2024

Estimated Year: 2025

Forecast Period: 2026–2035

This report will be delivered on an online digital platform with one-year subscription and quarterly update.

Objective of the Study:

• To assess the demand-supply scenario of PBAT Resin which covers production, demand, and supply of PBAT Resin market globally.

• To analyse and forecast the market size of PBAT Resin.

• To classify and forecast PBAT Resin market based on Grade, technology, end-use and regional distribution.

• To identify drivers and challenges for PBAT Resin market.

• To examine competitive developments such as expansions, new product launches, mergers & acquisitions, etc., in PBAT Resin market.

• To identify and analyse the profile of leading players involved in the manufacturing of PBAT Resin.

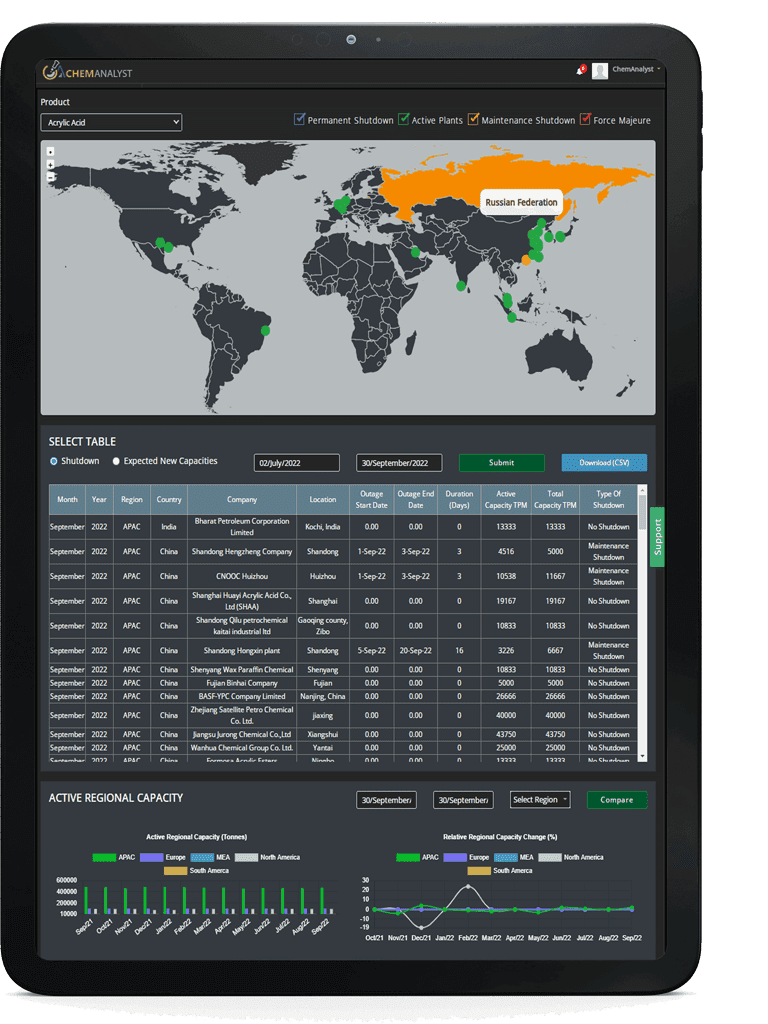

To extract data for PBAT Resin market, primary research surveys were conducted with PBAT Resin manufacturers, suppliers, distributors, wholesalers, and end users. While interviewing, the respondents were also inquired about their competitors. Through this technique, ChemAnalyst was able to include manufacturers that could not be identified due to the limitations of secondary research. Moreover, ChemAnalyst analyzed various end user segments and projected a positive outlook for Global PBAT Resin market over the coming years.

ChemAnalyst calculated PBAT Resin demand globally by analyzing the historical data and demand forecast which was carried out considering imported PBAT Resin, styrene prices, monomers used for production of PBAT Resin. ChemAnalyst sourced these values from industry experts and company representatives and externally validated through analyzing historical sales data of respective manufacturers to arrive at the overall market size. Various secondary sources such as company websites, association reports, annual reports, etc., were also studied by ChemAnalyst.

Key Target Audience:

• PBAT Resin manufacturers and other stakeholders

• Organizations, forums, and alliances related to PBAT Resin distribution

• Government bodies such as regulating authorities and policy makers

• Market research organizations and consulting companies

The study is useful in providing answers to several critical questions that are important for industry stakeholders such as PBAT Resin manufacturers, customers, and policy makers. The study would also help them to target the growing segments over the coming years (next two to five years), thereby aiding the stakeholders in taking investment decisions and facilitating their expansion

In this report, Global Polybutylene Adipate Terephthalate (PBAT) market has been segmented into following categories, in addition to the industry trends which have also been detailed below:

With the given market data, ChemAnalyst offers customizations according to a company’s specific needs.