H1 2023: In H1 2023, prices of o-Nitro Toluene fluctuated in the Asia Pacific region. In January 2023, the market price of o-Nitro Toluene experienced a decline in the Asian market. The substantial inventory levels at retailers were sustained by sluggish demand from downstream sectors such as chemicals, pharmaceuticals, and dyes. The sizeable stockpiles of Toluene raw materials in the region also played a role in supporting the downward trend in prices. The diminished consumption in the area led to a reduction in the demand for o-Nitro Toluene, resulting in increased product stockpiles across Asia. The Japanese o-nitro toluene market witnessed a bearish trend in the first half of 2023, with prices for ortho nitro toluene experiencing a significant drop. The bearish price trends were a consequence of restricted demand from downstream dye industries. Insufficient cost support from Toluene upstream emerged as a major factor influencing product prices in the Asian market. The weakened cost support from the upstream toluene market continued to exert downward pressure on toluene prices until June, impacting the pricing of nitro toluene in the Japanese market of the Asian region.

The global o-Nitro Toluene market stood at approximately 210 thousand tonnes in 2022 and is anticipated to grow at a CAGR of 4.8% during the forecast period until 2032.

o-Nitro Toluene, or o-nitrotoluene, is a chemical compound (C7H7NO2) derived from toluene, finding applications across diverse industries. In synthetic chemistry, it serves as a crucial precursor, participating in reactions to synthesize various chemical compounds essential in pharmaceutical and agrochemical manufacturing. Additionally, o-Nitro Toluene plays a significant role in the production of dye intermediates, acting as a foundational component in the synthesis of dyes and pigments. 2-Nitrotoluene finds its primary application in the manufacturing of derivatives, such as o-toluidine, 2-amino-4-chlorotoluene, 2-amino-6-chlorotoluene, and o-toluidine-4-sulfonic acid. These derivatives serve as key intermediates in the production process of diverse azo dyes. Its involvement in the manufacturing of explosives, particularly as a component in the production of trinitrotoluene (TNT), underscores its significance in military and industrial applications. Moreover, o-Nitro Toluene contributes to the polymer industry by serving as a raw material for specific polymers and resins. Its utility in this context highlights its role in the synthesis and formulation of diverse materials. The compound's versatility makes it a valuable resource in research and development laboratories, where it is employed for various chemical studies and experiments.

The demand for O-Nitro Toluene is expected to be driven by its widespread use in the formulation of dyes. O-Nitro Toluene is also used in the manufacture of rubber chemicals and in various azo and sulphur dyes for dyeing various materials like cotton, wool, silk, leather and paper. The market for o-Nitro Toluene is driven by the robust demand within the chemical industry, where it serves as a crucial intermediate in the production of various chemicals, including dyes, pigments, and pharmaceuticals. Additionally, the expansion of end-user industries such as textiles, plastics, and pharmaceuticals contribute to the growing demand for o-Nitro Toluene. Notably, the pharmaceutical sector's increasing manufacturing and research and development activities further fuel the market, given o-Nitro Toluene's essential role in the synthesis of specific pharmaceutical compounds. These factors collectively propel the market growth for o-Nitro Toluene. Owing to these reasons, the global o-Nitro Toluene market is likely to reach approximately 335 thousand tonnes in 2032.

Asia-Pacific is anticipated to have a dominant position in the o-Nitro Toluene market. The Asia-Pacific region's dominant position in the o-Nitro Toluene market is particularly driven by its pivotal role in the dye industry. Rapid industrial growth, especially in countries like China and India, has spurred increased demand for o-Nitro Toluene as a crucial intermediate in dye production. The concentration of manufacturing hubs in the region, coupled with the expansion of the dye industry itself, establishes Asia-Pacific as a key player in driving the market for o-Nitro Toluene. This dominance is further solidified by the region's significant population, providing a substantial consumer base for dyed products.

Based on the end-user industry, the global o-Nitro Toluene market is divided into Dyes, Rubber chemicals, Agricultural chemicals, and Others. Although, Dyes industry is the major segment and held about 35% of the global o-Nitro Toluene market in 2022 and is anticipated to prevail the similar trend in the upcoming years.

Major players in the global o-Nitro Toluene market are R K Synthesis Limited, LANXESS, Panoli Intermediates India Private Limited, EMCO Dyestuff, Arti Industries Limited, Shree Chemopharma Ankleshwar Pvt Ltd., Jiangsu Huaihe Chemicals Co., Huaian Jiacheng Hi-tech Chemical Industry Co., Ltd., Jiangsu First Chemical Manufacture Co., Ltd., Ltd. (ChemChina), Deepak Nitrite Limited, and others.

Years considered for this report:

Historical Period: 2015- 2022

Base Year: 2022

Estimated Year: 2023

Forecast Period: 2024-2032

This report will be delivered on an online digital platform with one-year subscription and quarterly update.

Objective of the Study:

• To assess the demand-supply scenario of o-Nitro Toluene which covers production, demand and supply of o-Nitro Toluene market in the globe.

• To analyse and forecast the market size of o-Nitro Toluene

• To classify and forecast Global o-Nitro Toluene market based on end-use and regional distribution.

• To examine competitive developments such as expansions, mergers & acquisitions, etc., of o-Nitro Toluene market in the globe.

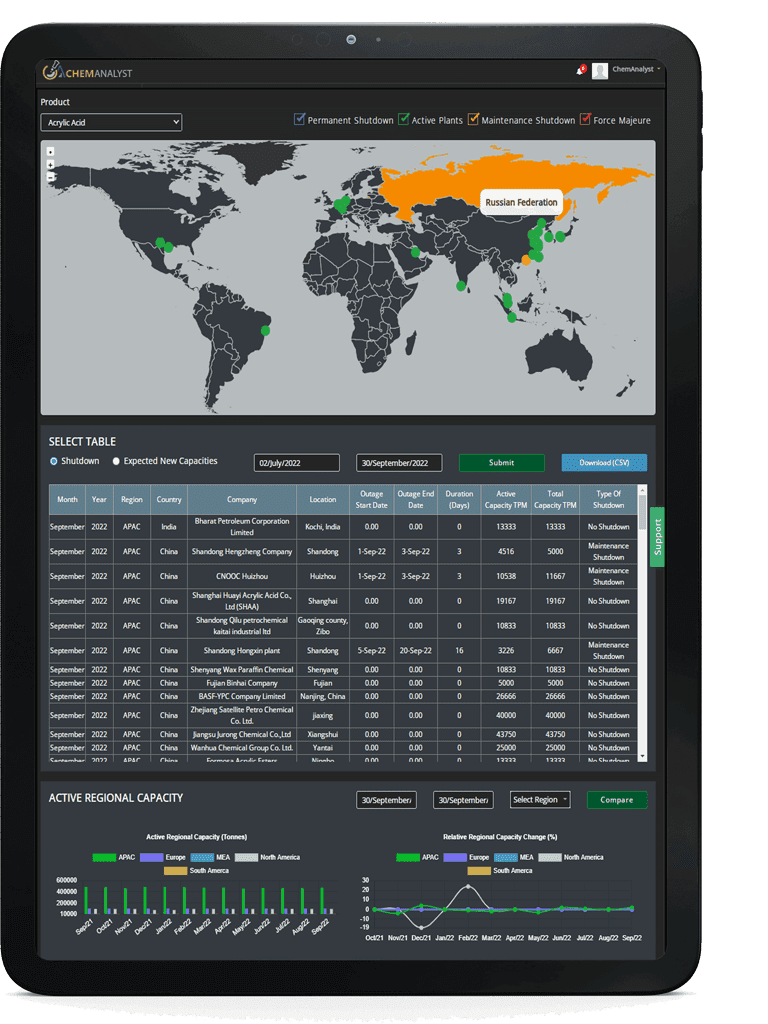

To extract data for Global o-Nitro Toluene market, primary research surveys were conducted with o-Nitro Toluene manufacturers, suppliers, distributors, wholesalers and Traders. While interviewing, the respondents were also inquired about their competitors. Through this technique, ChemAnalyst was able to include manufacturers that could not be identified due to the limitations of secondary research. Moreover, ChemAnalyst analyzed various segments and projected a positive outlook for Global o-Nitro Toluene market over the coming years.

ChemAnalyst calculated o-Nitro Toluene demand in the globe by analyzing the historical data and demand forecast which was carried out considering the production of raw material to produce o-Nitro Toluene. ChemAnalyst sourced these values from industry experts and company representatives and externally validated through analyzing historical sales data of respective manufacturers to arrive at the overall market size. Various secondary sources such as company websites, association reports, annual reports, etc., were also studied by ChemAnalyst.

Key Target Audience:

• o-Nitro Toluene manufacturers and other stakeholders

• Organizations, forums and alliances related to o-Nitro Toluene distribution

• Government bodies such as regulating authorities and policy makers

• Market research organizations and consulting companies

The study is useful in providing answers to several critical questions that are important for industry stakeholders such as o-Nitro Toluene manufacturers, customers and policy makers. The study would also help them to target the growing segments over the coming years (next two to five years), thereby aiding the stakeholders in taking investment decisions and facilitating their expansion.

Report Scope:

In this report, Global o-Nitro Toluene market has been segmented into following categories, in addition to the industry trends which have also been detailed below:

|

Attribute

|

Details

|

|

Market size Volume in 2022

|

210 thousand tonnes

|

|

Market size Volume in 2032

|

335 thousand tonnes

|

|

Growth Rate

|

CAGR of 4.8% from 2023 to 2032

|

|

Base year for estimation

|

2023

|

|

Historic Data

|

2015 – 2022

|

|

Forecast period

|

2024 – 2032

|

|

Quantitative units

|

Demand in thousand tonnes and CAGR from 2023 to 2032

|

|

Report coverage

|

Industry Market Size, Capacity by Company, Capacity by Location, Operating Efficiency, Production by Company, Demand by End- Use, Demand by Region, Demand by Sales Channel, Demand-Supply Gap, Company Share, Manufacturing Process.

|

|

Segments covered

|

By End-Use: (Dyes, Rubber chemicals, Agricultural chemicals, and Others)

By Sales Channel: (Direct Sale and Indirect Sale)

|

|

Regional scope

|

North America, Europe, Asia Pacific, Middle East and Africa, and South America.

|

|

Pricing and purchase options

|

|

Available Customizations:

With the given market data, ChemAnalyst offers customizations according to a company’s specific needs.

In case you do not find what, you are looking for, please get in touch with our custom research team at sales@chemanalyst.com