The global Nitro Toluene market stood at approximately 390 thousand tonnes in 2024 and is anticipated to grow at a CAGR of 3.88% during the forecast period until 2035.

Direct nitration of toluene with a concentrated solution of nitric acid and sulfuric acid yields nitrotoluenes. There are three structural isomers of nitrotoluene: ortho, meta, and para. While p-nitrotoluene takes the form of yellow crystals, O- and m-nitrotoluene are yellow liquids. The three structural isomers have a wide range of end uses; for o-nitrotoluene, these include agricultural chemical intermediates, dyestuffs, paints, pharmaceuticals, and plastic foams; for m-nitrotoluene, these include dyestuff intermediates, photographic developer intermediates, and intermediates for paints, dyestuffs, and pharmaceuticals. The majority of the world's demand for nitrotoluenes is held by the p-nitrotoluene structural isomer among the three. The global market for nitrotoluenes is divided into three types- O-Nitrotoluene, P-Nitrotoluene, and M-Nitrotoluene

The growing demand of o-Nitrotoluene to produce agricultural chemicals coupled with the growing consumption of agrochemicals in response to rapidly growing population across the globe is primary factor driving the global Nitrotoluene market. The demand for nitrotoluenes is anticipated to be driven in the upcoming years by an increase in their use in the production of dyestuffs, which are used in the expanding paint and coatings industry. Furthermore, it is anticipated that emerging new technologies would enable future increases in demand, such as selective nitration to produce the desired isomer. The global Nitro Toluene market is anticipated to reach nearly 594 thousand tonnes by 2035.

Asia Pacific is the major consumer of the Nitro Toluene on a global scale. Due to the expansion of the pharmaceutical industry, expanding commercial and residential building, and growing population, the Asia Pacific region accounts for most the world's demand for nitrotoluene. Furthermore, China, India, Thailand, and Taiwan have all seen increases in the dyes and pigments industry, which has expanded the market for nitrotoluene. The region's production and consumption of nitrotoluene have been significantly influenced in recent years by the expansion of manufacturing facilities by major nitrotoluene enterprises.

Based on the end-user industry, the global Nitro Toluene market is divided into Agricultural, Chemicals Dyes, Pharmaceutical, Rubber Industry, and Others. However, Agricultural chemicals is the major segment and held about 34% of the global Nitro Toluene market in 2024. Furthermore, Dyes sector also holds significant market share.

Major players in the Global Nitro Toluene market are Arti Industries Limited, LANXESS, Panoli Intermediates India Private Limited, EMCO Dyestuff, R K Synthesis Limited, Shree Chemopharma Ankleshwar Pvt Ltd., Huaian Jiacheng Hi-tech Chemical Industry Co., Ltd., Jiangsu First Chemical Manufacture Co., Ltd., Jiangsu Huaihe Chemicals Co., Ltd. (ChemChina), Deepak Nitrite Limited, and others.

Years considered for this report:

Historical Period: 2015- 2023

Base Year: 2024

Estimated Year: 2025

Forecast Period: 2026-2035

This report will be delivered on an online digital platform with one-year subscription and quarterly update.

Objective of the Study:

• To assess the demand-supply scenario of Nitro Toluene which covers production, demand and supply of Nitro Toluene market in the globe.

• To analyse and forecast the market size of Nitro Toluene

• To classify and forecast Global Nitro Toluene market based on end-use and regional distribution.

• To examine competitive developments such as expansions, mergers & acquisitions, etc., of Nitro Toluene market in the globe.

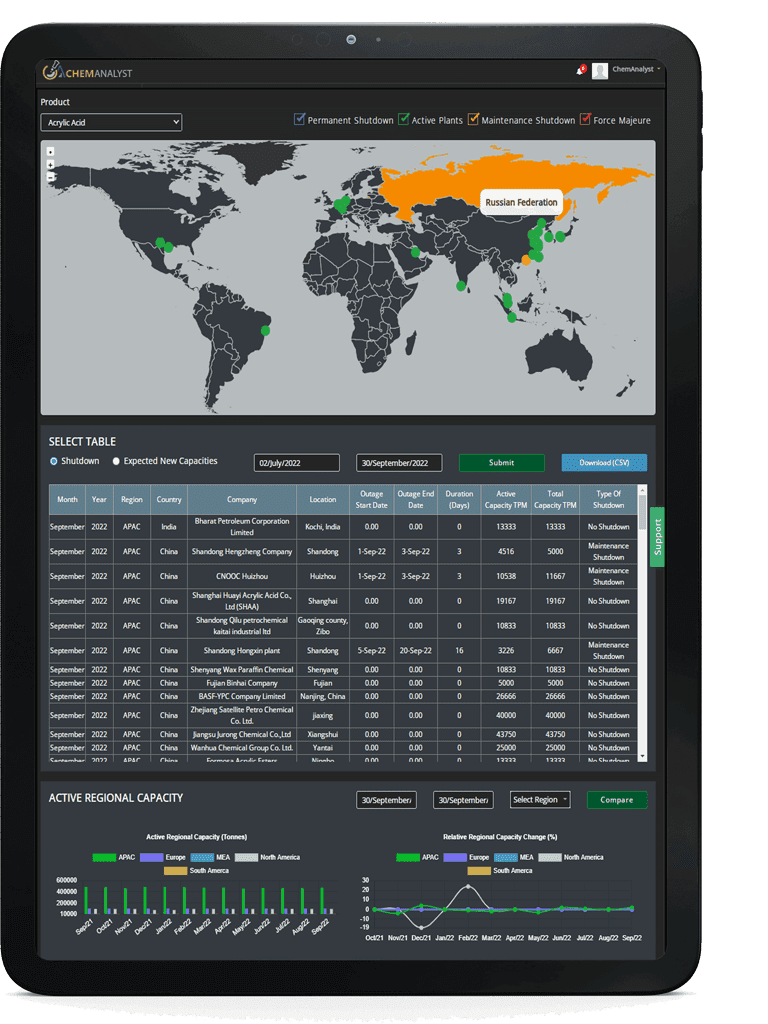

To extract data for Global Nitro Toluene market, primary research surveys were conducted with Nitro Toluene manufacturers, suppliers, distributors, wholesalers and Traders. While interviewing, the respondents were also inquired about their competitors. Through this technique, ChemAnalyst was able to include manufacturers that could not be identified due to the limitations of secondary research. Moreover, ChemAnalyst analyzed various segments and projected a positive outlook for Global Nitro Toluene market over the coming years.

ChemAnalyst calculated Nitro Toluene demand in the globe by analyzing the historical data and demand forecast which was carried out considering the production of raw material to produce Nitro Toluene. ChemAnalyst sourced these values from industry experts and company representatives and externally validated through analyzing historical sales data of respective manufacturers to arrive at the overall market size. Various secondary sources such as company websites, association reports, annual reports, etc., were also studied by ChemAnalyst.

Key Target Audience:

• Nitro Toluene manufacturers and other stakeholders

• Organizations, forums and alliances related to Nitro Toluene distribution

• Government bodies such as regulating authorities and policy makers

• Market research organizations and consulting companies

The study is useful in providing answers to several critical questions that are important for industry stakeholders such as Nitro Toluene manufacturers, customers and policy makers. The study would also help them to target the growing segments over the coming years (next two to five years), thereby aiding the stakeholders in taking investment decisions and facilitating their expansion.

Report Scope:

In this report, Global Nitro Toluene market has been segmented into following categories, in addition to the industry trends which have also been detailed below:

|

Attribute

|

Details

|

|

Market size Volume in 2024

|

390 thousand tonnes

|

|

Market size Volume in 2035

|

594 thousand tonnes

|

|

Growth Rate

|

CAGR of 3.88% from 2025 to 2035

|

|

Base year for estimation

|

2025

|

|

Historic Data

|

2015 – 2024

|

|

Forecast period

|

2026 – 2035

|

|

Quantitative units

|

Demand in thousand tonnes and CAGR from 2025 to 2035

|

|

Report coverage

|

Industry Market Size, Capacity by Company, Capacity by Location, Operating Efficiency, Production by Company, Demand by type, Demand by End- Use, Demand by Region, Demand by Sales Channel, Demand-Supply Gap, Company Share, Manufacturing Process.

|

|

Segments covered

|

By End-Use: (Agricultural chemicals, Dyes and Dyes Intermediate, Pharmaceutical, Rubber Industry, and Others)

By Sales Channel: (Direct Sale and Indirect Sale)

|

|

Regional scope

|

North America, Europe, Asia Pacific, Middle East and Africa, and South America.

|

|

Pricing and purchase options

|

|

Available Customizations:

With the given market data, ChemAnalyst offers customizations according to a company’s specific needs.

In case you do not find what, you are looking for, please get in touch with our custom research team at sales@chemanalyst.com