The Indian Crude Acrylic Acid market has reached around 185 thousand tonnes in FY2022 and is expected to hike at a significant CAGR of 5.71% during the forecast period until FY2035. In India, BPCL is the sole producer of crude acrylic acid as of FY2022 with an annual capacity of 160 thousand tonnes at Kochi and the plant was inaugurated plant on 14 Feb 2021. Further, Indian Oil Corporation Limited (IOCL) Acrylic Acid plant, which is expected to function in FY2024, holds a capacity of 90 thousand tonnes in Gujarat. IOCL placed a contract worth USD 225 million on Tecnimont to implement a new acrylic acid unit.

Acrylic acid is an unsaturated carboxylic acid. Catalytic oxidation of Propylene is one of the primary methods of synthesizing acrylic acid. The raw ingredient for this procedure is a byproduct of naphtha cracking. In the synthesis, two-stage selective oxidation of Propylene occurs to produce acrylic acid. Acrolein works as a fast-acting intermediate in this process. This reaction occurs in a fixed bed reactor along with a catalyst with a reaction temperature range of 310-2500 degrees Celsius. The catalysts used include Tantalum, Arsenic, and Molybdenum. There are various interesting industrial applications of crude acrylic acid and its derivatives, such as paints, adhesives, textiles, special coatings, ink industries, and paper industries. Moreover, it is expected that during the forecast period, there is a potential for acrylic acid for synthesizing the Super Absorbent Polymer (SAP).

One of the primary applications of acrylic acid is the synthesis of acrylic esters. With the scarcity of construction coating and adhesives in the past years, the demand for acrylic esters sharply spiked leading to growth of the Crude Acrylic acid market. Also, by the growing demand for a chemical for water treatment, the acrylic acid consumption will get increase to reach around 381 thousand tonnes by FY2035.

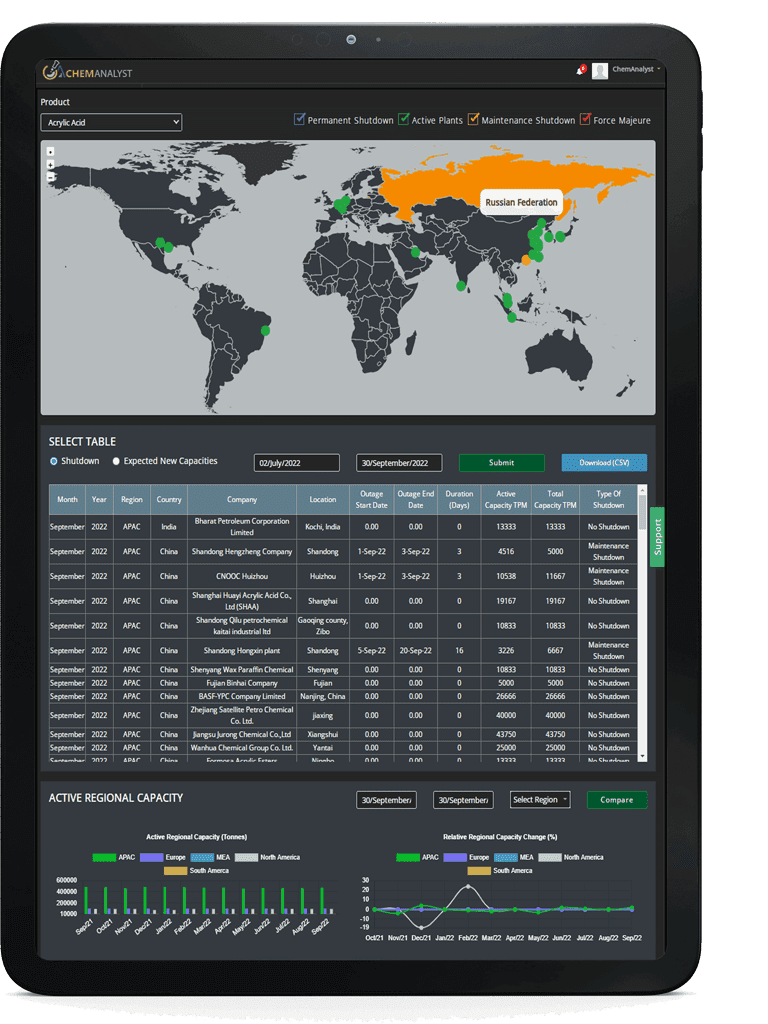

Currently, there is only one producer of acrylic acid in India, Bharat Petroleum Corporation Limited (BPCL), situated in Kochi, India. The Honorable Prime Minister of India inaugurated this plant on 14th February 2021. This plant has an annual capacity of 160 thousand tones per annum. Before this, the demand for acrylic acid in India was solely dependent on export from other nations. Although, in FY2024, the IOCL acrylic acid plant is expected to have an annual capacity of 90 KTPA in Dumad, Gujarat.

Based on the region-wise consumption, the Acrylic Acid market is segmented into West, South, North, and South. Although during the FY2015-FY2020, west India displayed a higher consumption because most of the factories that consume Acrylic Acid are situated in this region. The states with the highest consumption rates are Gujarat and Maharashtra till FY 2021. Post commissioning of BPCL butyl acrylate plant a sudden jump in capacitive consumption was observed in the southern region. The Acrylic Acid market in the South is anticipated to grow in the forecast period.

Acrylic acid is utilized to manufacture various valuable industrial chemicals like Acrylate Esters. The primary end uses of acrylic acid are acrylate ester, water treatment, detergent, paper, and others. However, India's primary use of acrylic acid is synthesizing acrylate ester. The estimate of Acrylic Acid for preparing acrylic ester accounts is the primary application. Additionally, it is anticipated that acrylic acid may be employed to create the Super Absorbent Polymer in the forecasted period. SAP has excellent absorbing properties and a wide range of uses, from non-hygienic uses like agricultural, construction, and civil engineering to hygiene items like disposable diapers and sanitary items.

Years considered for this report:

Historical Period: FY2015-FY2021

Base Year: FY2022

Estimated Year: FY2023

Forecast Period: FY2024- FY2035

This report will be delivered on an online digital platform with one-year subscription and quarterly update.

Objective of the Study:

• To assess the demand-supply scenario of Crude Acrylic Acid which covers production, demand and supply of Crude Acrylic Acid market in India.

• To analyse and forecast the market size of Crude Acrylic Acid in India.

• To classify and forecast India Crude Acrylic Acid market based on end-use and regional distribution.

• To examine competitive developments such as expansions, green field projects/ brown field expansions. mergers & acquisitions, etc., of Crude Acrylic Acid market in India.

To extract data for India Crude Acrylic Acid market, primary research surveys were conducted with Crude Acrylic Acid manufacturers, suppliers, distributors, wholesalers and Traders. While interviewing, the respondents were also inquired about their competitors. Through this technique, ChemAnalyst was able to include manufacturers that could not be identified due to the limitations of secondary research. Moreover, ChemAnalyst analyzed various segments and projected a positive outlook for India Crude Acrylic Acid market over the coming years.

ChemAnalyst calculated Crude Acrylic Acid demand in India by analyzing the historical data and demand forecast which was carried out considering the imports and domestic production coupled with demand from end user industry. ChemAnalyst sourced these values from industry experts and company representatives and externally validated through analyzing historical sales data / import data of crude acrylic acid to arrive at the overall market size. Various secondary sources such as company websites, association reports, annual reports, etc., were also studied by ChemAnalyst.

Key Target Audience:

• Crude Acrylic Acid manufacturers and other stakeholders

• Organizations, forums and alliances related to Crude Acrylic Acid distribution

• Government bodies such as regulating authorities and policy makers

• Market research organizations and consulting companies

The study is useful in providing answers to several critical questions that are important for industry stakeholders such as Crude Acrylic Acid manufacturers, customers and policy makers. The study would also help them to target the growing segments over the coming years, thereby aiding the stakeholders in taking investment decisions and facilitating their expansion.

Report Scope:

In this report, India Crude Acrylic Acid market has been segmented into following categories, in addition to the industry trends which have also been detailed below:

|

Attribute

|

Details

|

|

Market size Volume in 2022

|

185 thousand tonnes

|

|

Market size Volume by 2035

|

381 thousand tonnes

|

|

Growth Rate

|

CAGR of 5.71% from 2022 to 2035

|

|

Base year for estimation

|

2023

|

|

Historic Data

|

2015 – 2021

|

|

Forecast period

|

2024 – 2035

|

|

Quantitative units

|

Demand in thousand tonnes and CAGR from 2022 to 2035

|

|

Report coverage

|

Industry Market Size, Capacity By Company, Capacity by Location, Production by Company, Demand by End- Use, Demand by Region, Demand by Sales Channel, Demand-Supply Gap, Company Share, Country-wise Export, Country-wise Import

|

|

Segments covered

|

By End-Use: (Acrylate Ester, Super Absorbent Polymer (SAP), Water Treatment, Detergent, Paper, and others.)

By Sales Channel: (Direct Sale and Indirect Sale)

|

|

Regional scope

|

Northern India, Southern India, Eastern India, Western India

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

Available Customizations:

With the given market data, ChemAnalyst offers customizations according to a company’s specific needs. In case you do not find what, you are looking for, please get in touch with our custom research team at sales@chemanalyst.com