[Online Quarterly Update] The Indian N-Nonylphenol market has shown significant growth as it reached 95 thousand tonnes in 2020 is expected to grow at an impressive CAGR of 6.50% in the forecast period until 2030. Nonylphenols belong to the family of organic compounds that bears a 9-carbon chain of alkylphenols. There are different isomers of Nonylphenol, among which 4-Nonylphenol is the most widely produced and marketed Nonylphenol. N-Nonylphenols are produced naturally by the environmental degradation of Alkylphenol ethoxylates. Industrial production of N-Nonylphenols is done by the acid-catalyzed alkylation of phenol with a mixture of nonenes. N-Nonylphenols are extensively used in numerous applications including a surfactant in detergents, antioxidants, lubricating oil additives, laundry - Dish detergents, emulsifiers, solubilizers, textiles, and also for the Production of Nonylphenol Ethoxylates. They are the precursors to the commercially important non-ionic surfactants, Nonylphenol ethoxylates, and Alkylphenol ethoxylates, which are widely used in detergents, paints, pesticides, personal care products, cosmetics plastics, polymers, etc.

The growing demand for N-Nonylphenols by key end-user industries including chemical, textile, cosmetics & personal care, automotive, paper & pulp, and others is likely to augment the market growth of N-Nonylphenols in India. In India, according to the Bureau of Indian standards, there are no specific standards mentioned for Nonylphenol or Nonylphenol ethoxylates for water and wastewater. However, it is prohibited to use Nonylphenol in cosmetics, which can hinder the growth of the N-Nonylphenol market in India. The surging demand of Nonylphenols for the production of chemicals and chemical intermediates by the flourishing chemical industry is expected to boost the Indian market of N-Nonylphenol in upcoming years. Increasing domestic production of plastics in India due to the investments by the Indian government up to USD 6.3 million in order to expand the packaging industries to manufacture plastics and polymer, will drive the Indian market of N-Nonylphenol over the next ten years.

In 2020, due to the outbreak of COVID-19, the Indian N-Nonylphenol market witnessed a drastic slowdown. Several end-user industries temporarily halted their operations and production units in order to curb the spread of coronavirus. One of the major end-user industries of N-Nonylphenol i.e., the chemical industry witnessed a major economic downturn during the first half of 2020, as Nonylphenols are highly used in the production of chemical intermediates, which negatively affected the Indian N-Nonylphenol market. However, with the uplifting of lockdowns, the markets are slowing resuming, which is likely to bolster the demand for N-Nonylphenol by the end of the year.

In India, consumption of N-Nonylphenol varies in different regions. North and South regions in India account for major consumption and production of N-Nonylphenols due to the presence of a large number of end-user industries and vivid distribution channels.

Major players for N-Nonylphenol Market include India Glycols, Huntsman International LLC, Dover Chemical Corporation, SI Group, Inc., PCC Group, China Man-Made Fiber Corporation, AkzoNobel N.V., Clariant AG, The DOW Chemical Company, Hunstman, Stepan Company, SABIC, Solvay, PCC Exol SA, The DOW Chemical Company, Huntsman, Stepan Company and Others.

Years considered for this report:

Historical Period: 2015-2019

Base Year: 2020

Estimated Year: 2021

Forecast Period: 2022–2030

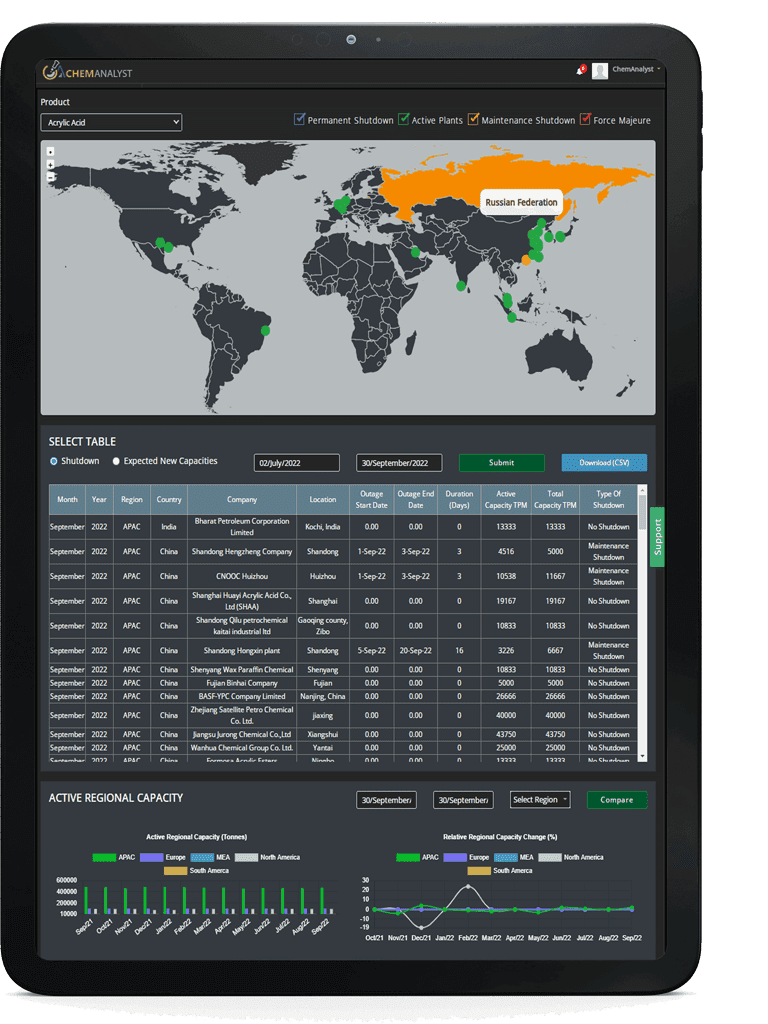

This report will be delivered on an online digital platform with one-year subscription and quarterly update.

Objective of the Study:

• To assess the demand-supply scenario of N-Nonylphenol which covers production, demand and supply of N-Nonylphenol market in India.

• To analyse and forecast the market size of N-Nonylphenol.

• To classify and forecast Indian N-Nonylphenol market based on application, end-use and regional distribution.

• To identify drivers and challenges for Indian N-Nonylphenol market.

• To examine competitive developments such as expansions, new product launches, mergers & acquisitions, etc., of N-Nonylphenol market in India.

• To identify and analyse the profile of leading players involved in the manufacturing of N-Nonylphenol.

To extract data for India N-Nonylphenol market, primary research surveys were conducted with N-Nonylphenol manufacturers, suppliers, distributors, wholesalers and end users. While interviewing, the respondents were also inquired about their competitors. Through this technique, ChemAnalyst was able to include manufacturers that could not be identified due to the limitations of secondary research. Moreover, ChemAnalyst analyzed various end user segments and projected a positive outlook for Indian N-Nonylphenol market over the coming years.

ChemAnalyst calculated N-Nonylphenol demand in India by analyzing the historical data and demand forecast which was carried out considering imported, raw materials used for production of N-Nonylphenol. ChemAnalyst sourced these values from industry experts and company representatives and externally validated through analyzing historical sales data of respective manufacturers to arrive at the overall market size. Various secondary sources such as company websites, association reports, annual reports, etc., were also studied by ChemAnalyst.

Key Target Audience:

• N-Nonylphenol manufacturersand other stakeholders

• Organizations, forums and alliances related to N-Nonylphenol distribution

• Government bodies such as regulating authorities and policy makers

• Market research organizations and consulting companies

The study is useful in providing answers to several critical questions that are important for industry stakeholders such as N-Nonylphenol manufacturers, customers and policy makers. The study would also help them to target the growing segments over the coming years (next two to five years), thereby aiding the stakeholders in taking investment decisions and facilitating their expansion.

Report Scope:

In this report, India N-Nonylphenol market has been segmented into following categories, in addition to the industry trends which have also been detailed below:

|

Attribute

|

Details

|

|

Market size volume in FY2020

|

95 thousand tons

|

|

Growth Rate

|

CAGR of 6.50% from FY2021 to FY2030

|

|

Base year for estimation

|

2020

|

|

Historic Data

|

FY2015 – FY2019

|

|

Forecast period

|

FY2022 – FY2030

|

|

Quantitative units

|

Demand in tons and CAGR from FY2021 to FY2030

|

|

Report coverage

|

Revenue forecast, demand & supply, competitive analysis, competitive landscape, growth factors, and trends

|

|

Segments covered

|

By End Use: (Chemicals, Textiles, Cosmetics & Personal Care, Automotive, Paper & Pulp, and Others)

By Application: (Antioxidant, Cleaning, Surfactants & Detergents, Emulsifiers, and Others)

By Sales Channel: (Direct Company Sale, Direct Import, Distributors & Traders, Retailers)

|

|

Regional scope

|

North India, South India, East India, West India

|

|

Key companies profiled

|

India Glycols, Huntsman International LLC, Dover Chemical Corporation, SI Group, Inc., PCC Group, China Man-Made Fiber Corporation, AkzoNobel N.V., Clariant AG, The DOW Chemical Company, Hunstman, Stepan Company, SABIC, Solvay, PCC Exol SA, The DOW Chemical Company, Huntsman, Stepan Company and Others.

|

|

Customization scope

|

Free report customization with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

|

Available Customizations:

With the given market data, ChemAnalyst offers customizations according to a company’s specific needs.

In case you do not find what, you are looking for, please get in touch with our custom research team at sales@chemanalyst.com