[Online Quarterly Update] India Linear Low-Density Polyethylene (LLDPE) demand stood at 2.0 Million Tonnes in FY2022 and is forecast to reach 3.70 Million Tonnes by FY2030, growing at a healthy CAGR of 8.20% until FY2030. High demand for LLDPE in the solar power and packaging industries and the expansion of the plastics industry are the major drivers over the forecast period.

LLDPE is a substantially linear polymer manufactured by copolymerization of ethylene with small-chain alpha-olefins (such as 1-butene, 1-hexene, 1-octene, etc.). LLDPE is said to possess better characteristics than LDPE such as higher tensile strength, superior toughness, and improved impact resistance. Among all the categories of polyethylene, LLDPE is projected to achieve the sharpest growth in the forecast period.

Due to its remarkable properties, consumption of LLDPE is growing in various end-use industries such as packaging, agriculture, construction, and automotive. LLDPE films are known for their reduced thickness and flexibility and hence find huge demand for the manufacturing of carrier bags, pouches, and agricultural covering films, and others. Among all the end-users, the packaging sector accounts for the largest market share with about 65% share in India’s LLDPE demand. Apart from that, demand from other applications like extrusion of pipes, profiles, and cables is expected to show a gradual improvement with increasing investment of the Indian government in the country’s agricultural sector. Rotational molding is one of the fastest-growing plastics processing methods today because products of versatile shapes and sizes can be generated. This has enabled rotational molders to enter markets where vinyl processes could not stand. Demand for the versatile class of LLDPE roto-molding grades serving extensive applications in automotive components, insulated containers, tanks, etc. is expected to drive the overall LLDPE market in the forecast period.

However, the sudden outbreak of novel coronavirus weighed over the demand for polymer products in Q4FY20, causing players to deal with huge inventory pileups and slumps in total annual sales. The decline remained closely impacted due to India’s economic and infrastructural slowdown caused due to nationwide lockdown. As a result of a halt in industrial activities further pressured by muted demand, several state-controlled LLDPE refiners such as OPAL and RIL curtailed their operating rates at their high-density polyethylene (HDPE) and linear low-density polyethylene (LLDPE) production lines. However, with ease in lockdown restrictions by May, the companies scaled up their production activities to recover potential losses. The outlook for LLDPE is likely to remain positive in the current fiscal and the forecasted period in India strongly heading towards recovery and players scaling up their operating rates after a prolonged disruption in activities.

Some of the major players operating in the India LLDPE market are Reliance Industries Limited, GAIL India Limited, Indian Oil Corporation Limited, Haldia Petrochemicals Limited, ONGC Petro additions Limited, Brahmaputra Cracker and Polymer Limited, etc. The Dow Chemical Company, ExxonMobil, SABIC, SINOPEC group, etc. are some of the leading international players operating in the India LLDPE market.

Large-scale capacity additions and lucrative investment opportunities in India will surely drive the LLDPE market growth in the years to come. In FY19, India’s HPCL-Mittal Energy Ltd (HMEL) received clearance from the ministry of environment for adding a polymer unit at its Guru Gobind Singh refinery and Petrochemical complex. The proposed unit would house two LLDPE/HDPE swing plants of capacity 400 KTPA each, a 500 KTPA PP plant, a 450 KTPA HDPE unit, and a 55 KTPA butane-1 line. The project is expected to complete by April 2021.

LLDPE film CFR prices in India lowered down by $10 to around $790-830/tonne in Q4FY20 due to COVID-19 related uncertainties. However, with downstream sectors restarting their production activities, prices are likely to show an uptrend by Q2FY21.

Years Considered for this Report:

Historical Years: FY2015 – FY2021

Base Year: FY2022

Estimated Year: FY2023

Forecast Period: FY2024 – FY2030

This report will be delivered on an online digital platform with one-year subscription and quarterly update.

Objective of the Study:

• The primary objective of the study was to evaluate and forecast LLDPE capacity, production, demand, inventory, and the demand-supply gap in India.

• To categorize LLDPE demand based on application, end use, type, grade, region, and sales channel.

• To study trade dynamics and company share in the India LLDPE market.

• To identify major customers of LLDPE in India.

• To evaluate and forecast LLDPE pricing by grade in the India LLDPE market.

• To identify and profile major companies operating in the India LLDPE market.

• To identify major news, deals, and expansion plans in the India LLDPE market.

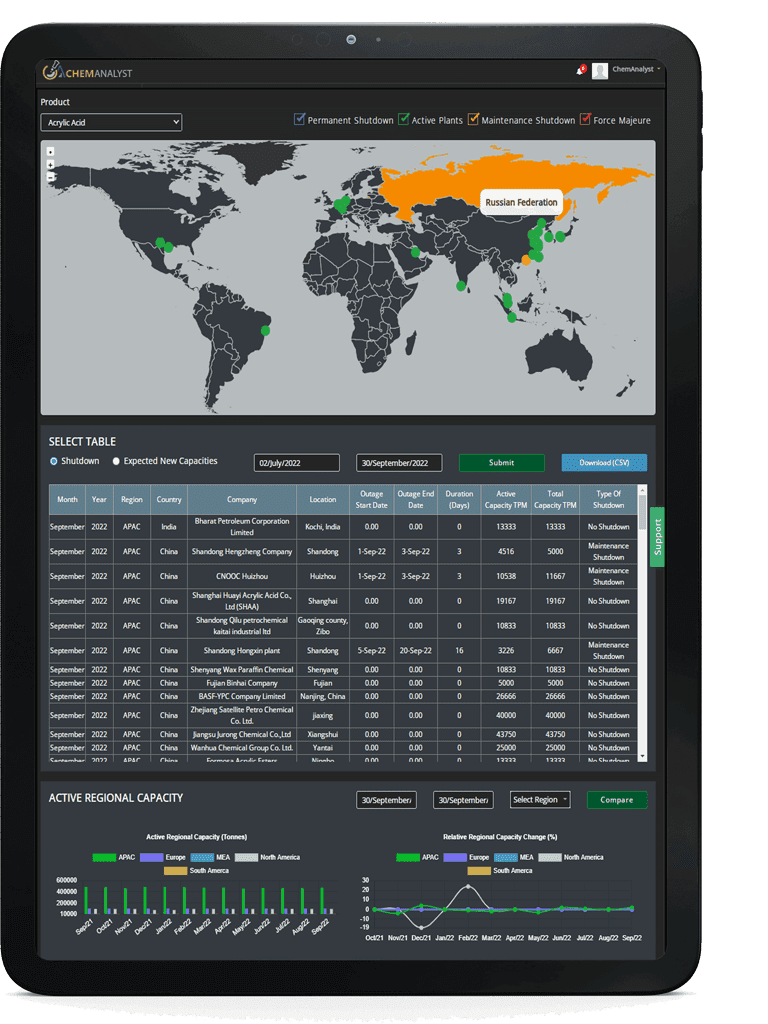

To extract data for the India LLDPE market, primary research surveys were conducted with LLDPE manufacturers, suppliers, distributors, wholesalers, and end-users. While interviewing, the respondents were also inquired about their competitors. Through this technique, ChemAnalyst was able to include manufacturers that could not be identified due to the limitations of secondary research. Moreover, ChemAnalyst analyzed various end user segments and projected a positive outlook for the India LLDPE market over the coming years.

ChemAnalyst calculated LLDPE demand in India by analyzing the historical data and demand forecast was carried out considering the end-use industries growth. ChemAnalyst sourced these values from industry experts and company representatives and externally validated them through analyzing historical sales data of respective manufacturers to arrive at the overall market size. Various secondary sources such as company websites, association reports, annual reports, etc., were also studied by ChemAnalyst.

Key Target Audience:

• LLDPE manufacturers and other stakeholders

• Organizations, forums, and alliances related to LLDPE distribution

• Government bodies such as regulating authorities and policymakers

• Market research organizations and consulting companies

The study is useful in providing answers to several critical questions that are important for industry stakeholders, such as LLDPE manufacturers, distributors, and policymakers. The report also provides useful insights about which market segments should be targeted over the coming years to strategize investments and capitalize on growth opportunities.

Report Scope:

In this report, the India LLDPE market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:

|

Attribute

|

Details

|

|

Market size volume in FY2022

|

2.0 million Tonnes

|

|

Market size volume in FY2030

|

3.70 million Tonnes

|

|

Growth Rate

|

CAGR of 8.20% from FY 2023 to FY 2030

|

|

Base year for estimation

|

FY2022

|

|

Historic Data

|

FY2015 – FY2021

|

|

Forecast period

|

FY2024 – FY2030

|

|

Quantitative units

|

Demand in tons and CAGR from FY 2023 to FY 2030

|

|

Report coverage

|

Revenue forecast, demand & supply, competitive analysis, competitive landscape, growth factors, and trends

|

|

Segments covered

|

1.Type: (Mono layer & Multilayer Films, Extrusion Coating, Rotational Molding, Others)

2.End Use:(Flexible Packaging, Extrusion Coated Lamination, Rotational Molding, and Others)

3.Sales Channel: (Direct/Indirect Sales)

|

|

Regional scope

|

North, West, East and South

|

|

Key companies profiled

|

Reliance Industries Limited, GAIL India Limited, Indian Oil Corporation Limited, Haldia Petrochemicals Limited, ONGC Petro additions Limited, Brahmaputra Cracker and Polymer Limited, etc. The Dow Chemical Company, ExxonMobil, SABIC, SINOPEC group, etc.

|

|

Customization scope

|

Free report customization with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

|

Available Customizations:

With the given market data, ChemAnalyst offers customizations according to a company’s specific needs.

In case you can’t find what, you are looking for then please get in touch with our custom research team at

sales@chemanalyst.com