[Online Quarterly Update] India Biodiesel market demand stood at 0.17 Million Tonnes in FY2021 and is forecast to reach 0.26 Million Tonnes by FY2030, growing at a healthy CAGR of 8.60% until 2030. Increasing crude oil import bills has made the Indian government switch to domestic fuel alternatives with Biodiesel, which is serving as the main game-changer. With the initiation of the National Policy on Biofuels in 2019, the demand for Biodiesel is set to witness an upward trend in the coming years. India’s initiative towards promoting cleaner fuels is all set to elevate the country’s overall Biodiesel demand. As India’s primary energy demand is all set to double in the next two decades, the use of cleaner fuel alternatives will continue to spur the sales of Biodiesel as a fuel. The transport sector, railways, and industries are the major Biodiesel end-users in India and offer vast potential to the biofuel market.

Biodiesel is mainly manufactured from the oil-bearing seeds of Jatropha Curcas plants which are cultivated by Indian farmers. However, due to a shortage of Jatropha seeds, other multiple feedstock technologies are being used to produce Biodiesel. For example, used cooking oils, animal fats and imported crude vegetable oils (such as Palm Oil) are also being used by several producers for manufacturing Biodiesel. Blended with conventional diesel and used as fuel in railways and other commercial vehicles, Biodiesel has a vast potential to act as a substitute for conventional fossil fuels to enhance the country’s energy demand. COVID-19 has impacted the biodiesel market adversely as the disruption in the supply chain was observed due to import-export restrictions imposed by the leading authorities to contain the novel coronavirus. However, post COVID-19 lockdown the market is expected to pick up the pace eventually.

The demand for biofuels is shifting towards emerging economies, which are working towards framing policies that favor the domestic biofuels market. India’s biofuel production accounts for only one percent of the global production and hence this market is still a niche in the country. As the Central Government is providing support to the domestic players to tap the potential for India’s Biodiesel market, many players are investing in this sector. The transportation sector is one of the major consumers of Biodiesel, followed by the energy and construction sector where it is used in operations. Strong Indian government support is also attracting international players to enter for biofuel business in India.

Years Considered for this Report:

Historical Years: FY2015 – FY2020

Base Year: FY2021

Estimated Year: FY2022

Forecast Period: FY2023– FY2030

This report will be delivered on an online digital platform with a one-year subscription and quarterly update.

Objective of the Study:

• The primary objective of the study was to evaluate and forecast Biodiesel capacity, production, demand, inventory, and demand–supply gap in India.

• To categorize Biodiesel demand in India based on end use, grade, region, and sales channel.

• To study trade dynamics and company share in the India Biodiesel market.

• To identify major customers of Biodiesel in India.

• To evaluate and forecast Biodiesel pricing by grade in the India Biodiesel market.

• To identify and profile major companies operating in the India Biodiesel market.

• To identify major news, deals, and expansion plans in the India Biodiesel market.

Major players operating in the India Biodiesel market include Biomax Fuels Limited, Universal Biofuels, Kaleesuwari Refinery, and Industry Private Limited, and Emami Agrobiotech Limited.

The domestic manufacturers are currently operating at their maximum production capacity. Universal Biofuels recently established a new production record by delivering more than 20 million liters of Biodiesel to domestic oil marketing companies which continue to satisfy 80 percent of the domestic Biodiesel demand.

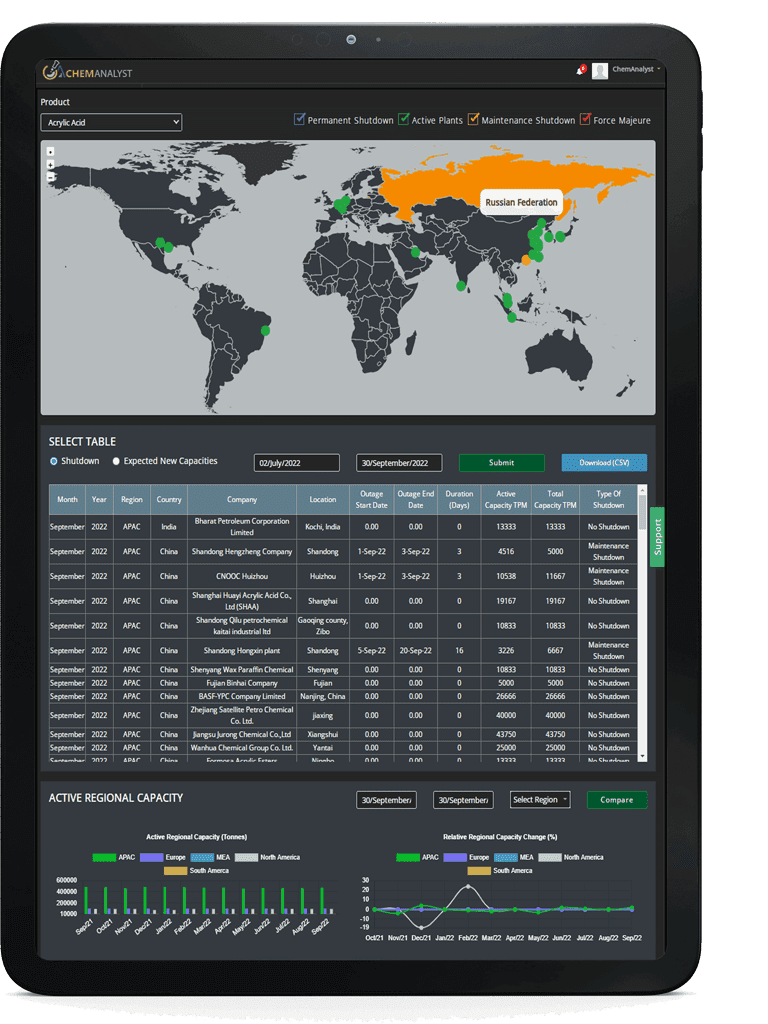

To extract data for the India Biodiesel market, primary research surveys were conducted with Biodiesel manufacturers, suppliers, distributors, wholesalers, and end-users. While interviewing, the respondents were also inquired about their competitors. Through this technique, ChemAnalyst was able to include manufacturers that could not be identified due to the limitations of secondary research. Moreover, ChemAnalyst analyzed various end-user segments and projected a positive outlook for the India Biodiesel market over the coming years.

ChemAnalyst calculated Biodiesel demand in India by analyzing the historical data and demand forecast was carried out considering crude oil prices. ChemAnalyst sourced these values from industry experts and company representatives and externally validated them through analyzing historical sales data of respective manufacturers to arrive at the overall market size. Various secondary sources such as company websites, association reports, annual reports, etc., were also studied by ChemAnalyst.

Key Target Audience:

• Biodiesel manufacturers, suppliers, and other stakeholders

• Organizations, forums, and alliances related to Biodiesel distribution

• Government bodies such as regulating authorities and policymakers

• Market research and consulting firms

The study is useful in providing answers to several critical questions that are important for industry stakeholders, such as Biodiesel manufacturers, distributors, and policymakers. The report also provides useful insights about which market segments should be targeted over the coming years to strategize investments and capitalize on growth opportunities.

Report Scope:

In this report, the India Biodiesel market has been segmented into the following categories, in addition to the industry trends which have also been detailed below: