The global Fluorspar market stood at approximately 8608 thousand tonnes in 2024 and is anticipated to grow at a CAGR of 3.07% during the forecast period until 2035.

The crystalline form of calcium fluoride, known as fluorspar, is a member of the halide group and crystallizes in an isometric cubic habit. Other small-scale uses of fluorspar in goods generated from fluorocarbons include the production of steel, aluminum, and welding rods. The fluorspar content and the corresponding impurity levels (lead, arsenic, sulfur, and quartz) determine the grades. Based on grade, The Fluorspar market is divided into Metallurgical grade and Acid grade. Approximately 35–40% of fluorspar produced is of the metallurgical grade, mostly used in cement and steel manufacturing. The production of aluminum and hydrofluoric acid (HF) are the two main uses of acid grade fluorspar, which makes up between 60 and 65 percent of all applications.

The uses of fluorspar is determined by its grade. Approximately one third of fluorspar is of metallurgical quality and is mostly used as a flux in the production of aluminium and steel, while the remaining nearly two thirds of fluorspar is of acid grade and is largely utilized in the production of hydrofluoric acid (HF). Fluorspar is suitable for ceramic applications, such as the production of specialty glass, ceramics, and enamelware. Owing to its extreme corrosive nature, it finds application in numerous sectors, including chemical, mining, refining, glass finishing, silicon chip production, and cleaning. A little portion of hydrofluoric acid (HF) is used in petroleum alkylation and as a pickling agent for metal etching in the electronics industry, but the majority of the hydrofluoric acid production is used in fluorochemical applications such as refrigerants, non-stick coatings, medical propellants, and aesthetics. Moreover, HF is employed in the etching of glass, the cleaning of silicon wafers, and the creation of polished and frosted glass.

Hydrofluoric acid, an essential component in the production of aluminum, is made from fluorspar. The significant usage of aluminum in the automotive sector is expected to remain a major driver of market expansion. Future developments in the automotive sector are anticipated to be influenced by growing production and demand in emerging economies. The market's demand is expected to be enhanced by the metal industries' strong expansion. Fluorspar is a material that is commonly used to manufacture opaque glasses. Opaque glasses are used in housing infrastructure, offices, and hospitals. The growing need for opaque glasses in the infrastructure sector is expected to help the global fluorspar industry. Another usage for fluorspar is in the production of fluorocarbons, which are employed in downstream operations. The global Fluorspar market is anticipated to expand as a result of these reasons and reach 11000 thousand tonnes by 2035.

Geographically, Asia Pacific dominates the worldwide Fluorspar market. The region's need for fluorspar is anticipated to be driven by the chemical industry's growing demand for it as well as its expanding usage in the steel and automotive industries in developing nations like China and India. Growing downstream activity in developing countries like China is expected to hasten the fluorspar market's expansion. Furthermore, the growing demand for steel and aluminium from the building and construction industry will likely have an effect on the fluorspar market in North America.

Based on the end-user industry, the global Fluorspar market is segmented into Fluorspar Chemicals (Hydrofluoric acid), Iron & Steel Industry, Aluminum Industry, and Others. However, the Fluorspar Chemicals (Hydrofluoric acid) is the leading segment, accounting for over 48% of the worldwide Fluorspar market in 2022. Demand for fluorspar is correlated with infrastructure growth, and it is anticipated that demand will increase in the coming years as infrastructure spending, including the construction of buildings, bridges, roads, and other structures, rises.

Major players in the Global Fluorspar market are Tertiary Minerals Plc, Mexichem S.A.B. de C.V, Masan Group, Centralfluor Industries Group Inc., Kenya Fluorspar Company Ltd., MINERSA GROUP, Seaforth Mineral & Ore Co. Inc., British Fluorspar Ltd, China Kings Resources Group Co. Ltd., and Mongolrostsvetmet LLC.

Years considered for this report:

Historical Period: 2015- 2025

Base Year: 2024

Estimated Year: 2025

Forecast Period: 2026-2035

This report will be delivered on an online digital platform with one-year subscription and quarterly update.

Objective of the Study:

• To assess the demand-supply scenario of Fluorspar which covers production, demand and supply of Fluorspar market in the globe.

• To analyse and forecast the market size of Fluorspar

• To classify and forecast Global Fluorspar market based on end-use and regional distribution.

• To examine competitive developments such as expansions, mergers & acquisitions, etc., of Fluorspar market in the globe.

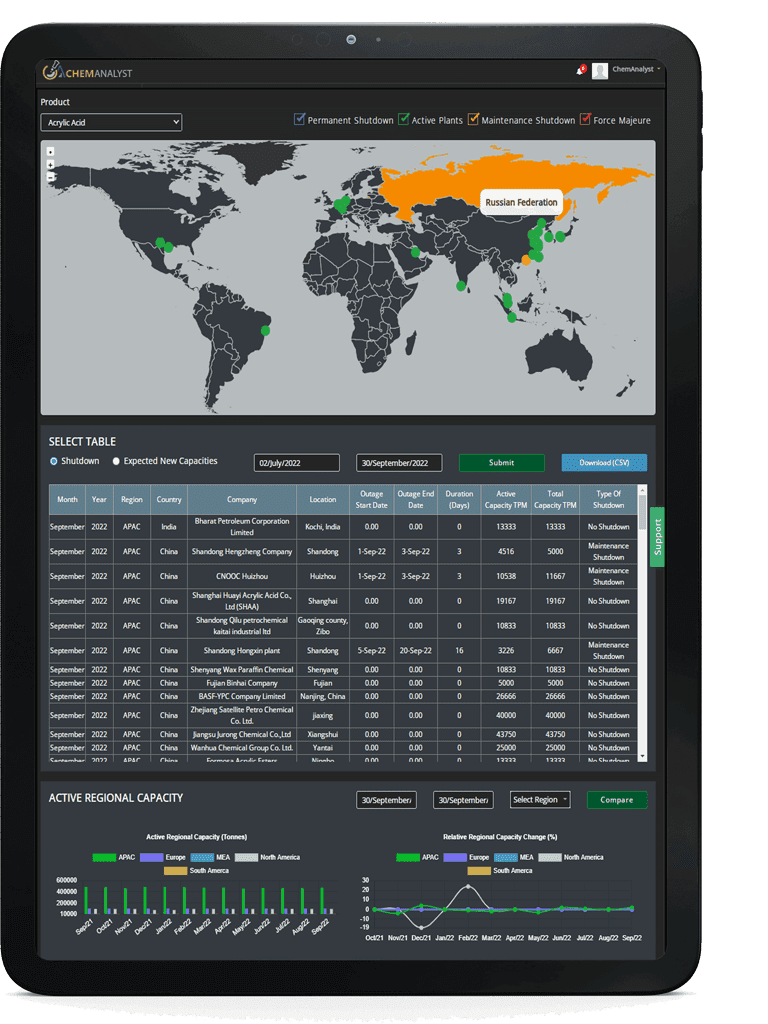

To extract data for Global Fluorspar market, primary research surveys were conducted with Fluorspar suppliers, distributors, wholesalers and Traders. While interviewing, the respondents were also inquired about their competitors. Through this technique, ChemAnalyst was able to include manufacturers that could not be identified due to the limitations of secondary research. Moreover, ChemAnalyst analyzed various segments and projected a positive outlook for Global Fluorspar market over the coming years.

ChemAnalyst calculated Fluorspar demand in the globe by analyzing the historical data and demand forecast which was carried out considering the production of raw material to produce Fluorspar. ChemAnalyst sourced these values from industry experts and company representatives and externally validated through analyzing historical sales data and the overall market size. Various secondary sources such as company websites, association reports, annual reports, etc., were also studied by ChemAnalyst.

Key Target Audience:

• Fluorspar consumers

• Organizations, forums and alliances related to Fluorspar distribution

• Government bodies such as regulating authorities and policy makers

• Market research organizations and consulting companies

The study is useful in providing answers to several critical questions that are important for industry stakeholders such as Fluorspar customers and policy makers. The study would also help them to target the growing segments over the coming years (next two to five years), thereby aiding the stakeholders in taking investment decisions and facilitating their expansion.

In this report, Global Fluorspar market has been segmented into following categories, in addition to the industry trends which have also been detailed below:

With the given market data, ChemAnalyst offers customizations according to a company’s specific needs.