H1 2023: The largest players in the Europe Ethanol derivatives market in H1 2023 were Sekab BioFuels and Chemicals AB and Taco Chemical Company. However, Sekab BioFuels held the largest production capacity of Ethanol Derivatives (ethyl acetate & Acetaldehyde) in the European region in H1 2023. The primary ethanol derivatives produced in Europe were acetaldehyde and ethyl acetate. In the first two months of H1 2023, prices for ethyl acetate rose in the German market as inventories fell and purchases rose following the New Year holidays. However, in the second half of H1 2023, the ethyl acetate market displayed a bearish trend in Germany. Prices dropped as a result of a decline in downstream market inquiries and adequate material availability as a result of consistent imports. Europe’s ethyl acetate production rate was healthy and acetic acid feedstock prices fell significantly in the meantime. A similar trend was observed for the acetaldehyde prices in the European market in the first two months of 2023. Acetaldehyde prices rose in the first two months of 2023. The demand for food preservatives and perfumes was moderate in this time frame. Additionally, the price of acetaldehyde in the local market had increased due to the volatility in crude oil prices and inflationary pressure. However, towards the end of February 2023, acetaldehyde prices fell drastically in March 2023. Furthermore, Europe imported Acetaldehyde at cheap prices from Asian countries that supported the low acetaldehyde prices. Europe had enough inventories to meet the regional demand, but the consumption of acetaldehyde from the downstream food preservative and perfume industries stayed sluggish in March 2023.

The Europe Ethanol Derivatives market has projected an expansion to reach approximately 600 thousand tonnes in 2022 and is expected to grow at an impressive CAGR of 4.09% during the forecast period until 2030. In December 2022, CropEnergies AG, one of the leading chemical companies in Europe, announced the construction of a greenfield expansion for the synthesis of renewable ethyl acetate at Zeitz Chemical and Industrial Park, Elsteraue, Germany. The plant lies in the range of EUR 120 and EUR 130 million and is anticipated to be commissioned by the summer of 2025. This plant will have an annual production capacity of 50 thousand tonnes of renewable ethyl acetate using sustainable ethanol.

The two main compounds that fall into the category of ethanol derivatives are ethyl acetate and acetaldehyde. Ethyl acetate is released during the production of synthetic leather and silk, as well as during the making of photographic plates and films. It is also released in the manufacture of artificial fruit flavoring agents and essences, acetic acid, linoleum, dyes, pharmaceuticals, and perfumes & aromas. In substances like base coats, nail polish remover, and nail polish, ethyl acetate serves as a solvent. For nitrocellulose, dry cleaning, stains, lacquers, varnishes, and other materials, ethyl acetate serves as a solvent.

Increasing demand for bio-based raw materials across various end-user industries such as paint & coatings, cosmetics, pharmaceuticals, etc. is anticipated to increase the demand for Ethanol derivatives during the forecast period. Besides, strong government support for cleaner and low-cost alternative chemical commodities and raw materials to reduce environmental impact, and the rising demand for pharmaceuticals and self-care products are boosting the Europe Ethanol derivatives market growth during the forecast period. The Europe Ethanol Derivatives market will most likely reach 850 thousand tonnes by 2030.

Based on demand by region, the Ethanol Derivatives market among the regions Germany, Turkey, Sweden, United Kingdom, Italy, and Belgium. Among these, Belgium and Italy are the key consumers. In 2022, Belgium accounted for consumption of approximately 40% of the net Ethanol Derivatives market. Heavy usage of Ethanol derivatives by various downstream industries such as Pharmaceuticals, cosmetics, etc, is causing this demand.

Based on the end-user industry, the Europe Ethanol Derivatives market is segregated into Paints, Coating & Adhesives, Personal Care and Cosmetics, Pharmaceutical, and Others. Although, the Paints, Coating & Adhesive industry is dominating the Ethanol Derivatives market in Europe. The oxidation of ethanol leads to the production of acetaldehyde. The production of acetic acid, acetic anhydride, ethyl acetate, peracetic acid, glyoxal, maleic acid, pentaerythritol, mono-, di-, and trichloro acetyl chloride, and pyridine bases on a large scale all rely on acetaldehyde. Moreover, it serves as an intermediate in the manufacture of insecticides, fragrances, drugs, and dyes.

Major players in the Europe Ethanol Derivatives market are Taco Chemical Company, Adokim Chemical Company, Sekab BioFuels and Chemicals AB, CropEnergies AG, and Others.

Years considered for this report:

Historical Period: 2015- 2022

Base Year: 2022

Estimated Year: 2023

Forecast Period: 2024-2030

This report will be delivered on an online digital platform with one-year subscription and quarterly update.

Objective of the Study:

• To assess the demand-supply scenario of Ethanol Derivatives which covers production, demand and supply of Ethanol Derivatives market in the globe.

• To analyse and forecast the market size of Ethanol Derivatives

• To classify and forecast Europe Ethanol Derivatives market based on end-use and regional distribution.

• To examine competitive developments such as expansions, mergers & acquisitions, etc., of Ethanol Derivatives market in the globe.

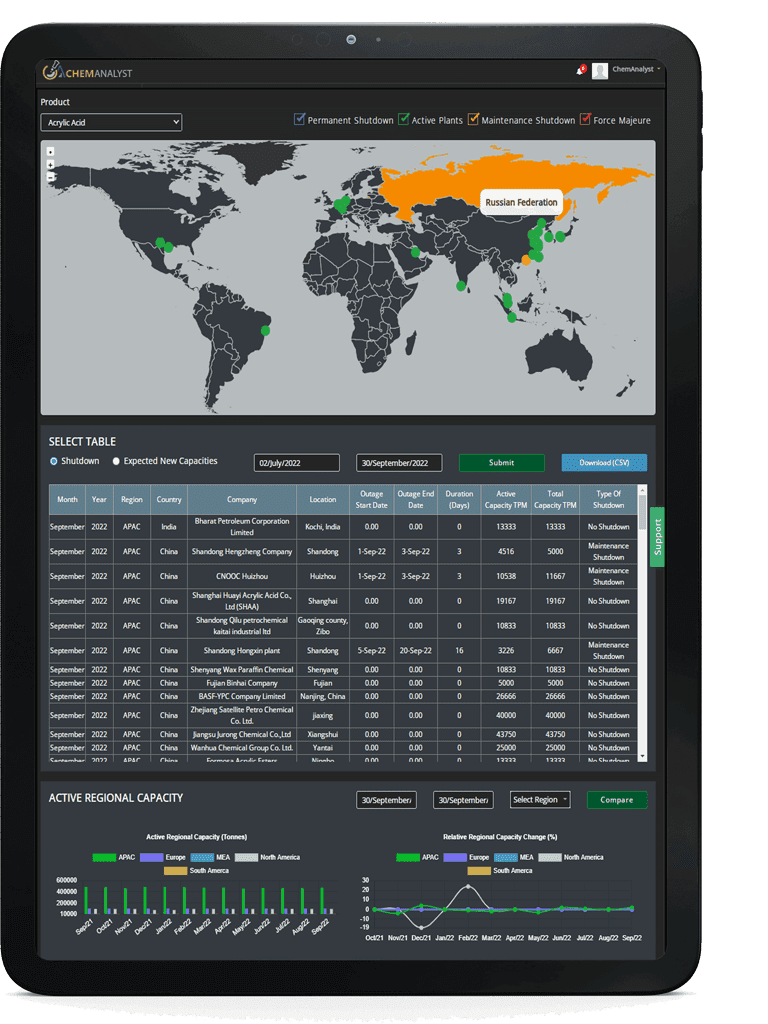

To extract data for Europe Ethanol Derivatives market, primary research surveys were conducted with Ethanol Derivatives manufacturers, suppliers, distributors, wholesalers and Traders. While interviewing, the respondents were also inquired about their competitors. Through this technique, ChemAnalyst was able to include manufacturers that could not be identified due to the limitations of secondary research. Moreover, ChemAnalyst analyzed various segments and projected a positive outlook for Europe Ethanol Derivatives market over the coming years.

ChemAnalyst calculated Ethanol Derivatives demand in the globe by analyzing the historical data and demand forecast which was carried out considering the historical extraction and supply and demand of Ethanol Derivatives across the globe. ChemAnalyst sourced these values from industry experts, and company representatives and externally validated through analyzing historical sales data of respective manufacturers to arrive at the overall market size. Various secondary sources such as company websites, association reports, annual reports, etc., were also studied by ChemAnalyst.

Key Target Audience:

• Ethanol Derivatives manufacturers and other stakeholders

• Organizations, forums and alliances related to Ethanol Derivatives distribution

• Government bodies such as regulating authorities and policy makers

• Market research organizations and consulting companies

The study is useful in providing answers to several critical questions that are important for industry stakeholders such as Ethanol Derivatives manufacturers, customers and policy makers. The study would also help them to target the growing segments over the coming years (next two to five years), thereby aiding the stakeholders in taking investment decisions and facilitating their expansion.

Report Scope:

In this report, Europe Ethanol Derivatives market has been segmented into following categories, in addition to the industry trends which have also been detailed below:

|

Attribute

|

Details

|

|

Market size Volume in 2022

|

600 thousand tonnes

|

|

Market size Volume by 2030

|

850 thousand tonnes

|

|

Growth Rate

|

CAGR of 4.09% from 2023 to 2030

|

|

Base year for estimation

|

2023

|

|

Historic Data

|

2015 – 2022

|

|

Forecast period

|

2024 – 2030

|

|

Quantitative units

|

Demand in thousand tonnes and CAGR from 2023 to 2030

|

|

Report coverage

|

Industry Market Size, Capacity By Company, Capacity by Location, Operating Efficiency, Production by Company, Demand by End- Use, Demand by Region, Demand by Sales Channel, Demand-Supply Gap, Manufacturing Process, Policy and Regulatory Landscape

|

|

Segments covered

|

By End-Use: (Paints, Coating & Adhesives, Personal Care and Cosmetics, Pharmaceutical, and Others)

By Sales Channel: (Direct Sale and Indirect Sale)

|

|

Regional scope

|

Germany, Turkey, Sweden, United Kingdom, Italy, and Belgium

|

|

Pricing and purchase options

|

|

Available Customizations:

With the given market data, ChemAnalyst offers customizations according to a company’s specific needs.

In case you do not find what, you are looking for, please get in touch with our custom research team at sales@chemanalyst.com