H1 2023: Dimethyl Sulphate’s largest consumer was Asia Pacific region in H1 2023. Although, Dimethyl Sulphate (DMS) prices in the Asia-Pacific area showed a general declining trend in the first half of 2023. Due to a drop in purchases from downstream businesses like the surfactant, dye, and pesticide industries, the DMS market had a rough start in January. The level of purchases from Asian nations decreased as demand declined in the region. Manufacturers of DMS lowered their rates of operation as well as their pricing. As a result, market activity stayed hazy.. The dynamics of imports and demand from downstream sectors were the main drivers of the bearish trend observed in the Indian Dimethyl Sulphate (DMS) market during H1 2023. Due to constant demand pressure from downstream sectors and stable import prices, DMS prices fell in India. In May 2023, DMS prices had a decline in India which was ascribed to the surge in low-cost imports from nearby APAC nations. The softening pricing dynamics are indicative of the general attitude of the Asian market. The consumption of DMS among downstream surfactant and dye sectors was hazy across Asia. A similar market scenario was observed in the North American during H1 2023. Due to weak market fundamentals, Dimethyl Sulphate (DMS) prices in the North American region deescalated during the first quarter of 2023. Market participants claim that the demand pressure on the DMS market has eased as a result of declining consumption of downstream pesticides, dyes, and surfactants, which in turn led to poor demand from both domestic and international markets. But since there were no new orders coming in from buyers, the manufacturing plants' operating rates stayed low.

The global Dimethyl Sulphate (DMS) market stood at approximately 155 thousand tonnes in 2022 and is anticipated to grow at a CAGR of 4.5% during the forecast period until 2032.

Dimethyl sulfate (DMS), commonly referred to as dimethyl ester, is a colorless substance having a subtle onion scent. It dissolves in alcohol, water, and aromatic solvents. It is offered as a liquid and a vapor. It is employed as an alkyl agent in a variety of products, including military gas, dyes, fragrances, and medications. Additionally, fatty ammonium solutions for surfactants and fabric softeners are made using it. DMS is a potent methylating agent that forms substituted oxygen, nitrogen, and sulfur compounds when it combines with active hydrogen and alkali metal ions. DMS is used to make dyes, surfactants, fabric softeners, chemicals for water treatment, chemicals for agriculture, and medications. DMS is a methylating chemical that can methylate carbon, nitrogen, sulfur, phosphorus, oxygen, and some metals. Although DMS is most frequently employed as a methylating agent, it can also be used as a catalyst, solvent, sulfonator, and stabilizer.

Dimethyl sulphate finds several uses in fabric softeners, dyes, fragrances, agrochemicals, water treatment chemicals, surfactants, and personal hygiene products, among other things. Demand growth for dimethyl sulphate is anticipated to be driven during the projected period by application sectors such as personal care, surfactants, and chemicals used in water treatment. Furthermore, the need for dimethyl sulphate is rising due to its use as a solvent, sulphating agent, catalyst, and stabilizer. Over the course of the forecast period, rising demand from industries like agrochemicals and water treatment chemicals is anticipated to propel the dimethyl sulphate market. Due to the fact that dimethyl sulphate is utilized as a chemical intermediate and has a wide range of uses in various chemicals, it is expected that the worldwide dimethyl sulphate market will develop significantly in the near future. The global Dimethyl Sulphate market is anticipated to touch roughly 240 thousand tonnes by 2032.

Geographically, the Asia-Pacific area accounts for the majority of the world's market for dimethyl sulphate because of the rising demand for chemicals used in personal care, surfactants, and water treatment. In addition, rising per capita income and population numbers are contributing to Asia Pacific demand growth. During the course of the forecast period, Asia Pacific is anticipated to have the fastest growth rate of the dimethyl sulphate market. The primary cause of this is the industrialization of Asia Pacific's developing nations, especially China and India. The agriculture industry is expanding rapidly in Asia Pacific, which will help the market for agrochemicals and pesticides. Dimethyl sulphate is used to manufacture intermediate chemicals which are further used in the manufacture of pharmaceutical products. Government laws to reuse waste water disposed of by chemical manufacturing enterprises have resulted in the installation of numerous water treatment plants throughout North America and Europe. It is anticipated that this application will increase in these regions

Based on the end-user industry, the global Dimethyl Sulphate market is divided into Dyes, Perfumes, Agrochemicals, Water Treatment Chemicals, Surfactants, and Others. Among these, Dyes and Perfumes are the major segment and held about 35% of the global Dimethyl Sulphate market in 2022.

Major players in the Global Dimethyl Sulphate market are Dow Chemical Company, Dupont, BASF, Honeywell, Chevron Philips, CABB Chemicals, and Others.

Years considered for this report:

Historical Period: 2015- 2022

Base Year: 2022

Estimated Year: 2023

Forecast Period: 2024-2032

This report will be delivered on an online digital platform with one-year subscription and quarterly update.

Objective of the Study:

• To assess the demand-supply scenario of Dimethyl Sulphate which covers production, demand and supply of Dimethyl Sulphate market in the globe.

• To analyse and forecast the market size of Dimethyl Sulphate

• To classify and forecast Global Dimethyl Sulphate market based on end-use and regional distribution.

• To examine competitive developments such as expansions, mergers & acquisitions, etc., of Dimethyl Sulphate market in the globe.

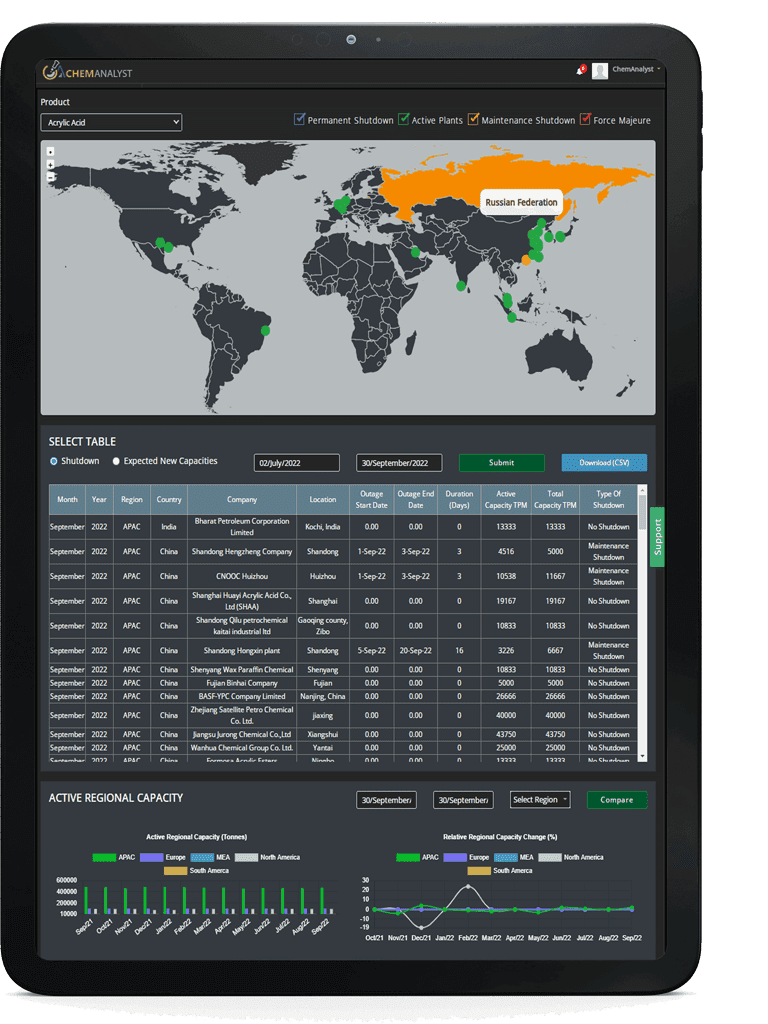

To extract data for Global Dimethyl Sulphate market, primary research surveys were conducted with Dimethyl Sulphate manufacturers, suppliers, distributors, wholesalers and Traders. While interviewing, the respondents were also inquired about their competitors. Through this technique, ChemAnalyst was able to include manufacturers that could not be identified due to the limitations of secondary research. Moreover, ChemAnalyst analyzed various segments and projected a positive outlook for Global Dimethyl Sulphate market over the coming years.

ChemAnalyst calculated Dimethyl Sulphate demand in the globe by analyzing the historical data and demand forecast which was carried out considering the production of raw material to produce Dimethyl Sulphate. ChemAnalyst sourced these values from industry experts and company representatives and externally validated through analyzing historical sales data of respective manufacturers to arrive at the overall market size. Various secondary sources such as company websites, association reports, annual reports, etc., were also studied by ChemAnalyst.

Key Target Audience:

• Dimethyl Sulphate manufacturers and other stakeholders

• Organizations, forums and alliances related to Dimethyl Sulphate distribution

• Government bodies such as regulating authorities and policy makers

• Market research organizations and consulting companies

The study is useful in providing answers to several critical questions that are important for industry stakeholders such as Dimethyl Sulphate manufacturers, customers and policy makers. The study would also help them to target the growing segments over the coming years (next two to five years), thereby aiding the stakeholders in taking investment decisions and facilitating their expansion.

Report Scope:

In this report, Global Dimethyl Sulphate market has been segmented into following categories, in addition to the industry trends which have also been detailed below:

|

Attribute

|

Details

|

|

Market size Volume in 2022

|

154 thousand tonnes

|

|

Market size Volume in 2032

|

240 thousand tonnes

|

|

Growth Rate

|

CAGR of 4.5% from 2023 to 2032

|

|

Base year for estimation

|

2023

|

|

Historic Data

|

2015 – 2022

|

|

Forecast period

|

2024 – 2032

|

|

Quantitative units

|

Demand in thousand tonnes and CAGR from 2023 to 2032

|

|

Report coverage

|

Industry Market Size, Capacity by Company, Capacity by Location, Operating Efficiency, Production by Company, Demand by End- Use, Demand by Region, Demand by Sales Channel, Demand-Supply Gap, Company Share, Manufacturing Process.

|

|

Segments covered

|

By End-Use: (Dyes, Perfumes, Agrochemicals, Water Treatment Chemicals, Surfactants, and Others)

By Sales Channel: (Direct Sale and Indirect Sale)

|

|

Regional scope

|

North America, Europe, Asia Pacific, Middle East and Africa, and South America.

|

|

Pricing and purchase options

|

|

Available Customizations:

With the given market data, ChemAnalyst offers customizations according to a company’s specific needs.

In case you do not find what, you are looking for, please get in touch with our custom research team at sales@chemanalyst.com