The current installed capacity of Butyl Acrylate is around 4352 thousand tonnes which is sufficient to meet its global demand until 2024 and the market is anticipated to witness a significant growth by reaching 7089 thousand tonnes in 2035, growing at a CAGR of 4.52% in the next ten years.

Butyl Acrylate is a well-known form of acrylic esters, synthesised via esterification reaction between acrylic acid and n-butanol. It is applicable in wide range of end use sectors owing to its hardness, high strength, and high temperature resistance property. The demand for Butyl Acrylate is significantly growing around the globe with rising focus on water-based coatings, increasing construction activities and its wide application in automotive industries.

Owing to its widespread application in paints, surface coatings, adhesives, and sealants in the construction and automotive industries, Butyl Acrylate demand is mostly determined by GDP. As a result, demand for Butyl Acrylate is likely to be high in developing countries, where GDP is expected to grow at a faster rate. There has been an increase in the use of Butyl Acrylate for a range of applications in recent years, and this trend is expected to continue in the coming years as well.

The market's growth is predicted to be aided by the adoption of sustainable and innovative production procedures, as well as increased demand in the downstream sector. Refurbishment and restoration activities, as well as construction plans, have increased as a result of improved infrastructure, greater disposable incomes, and changing lifestyles which in turn is fueling the growth of the market.

Furthermore, increased industrialization in all developing countries, as well as rising demand and significant expansion in the automotive sector, have spurred growth in the paints and coatings business owing to wide application of Butyl Acrylate in coating application and refinish material. This is anticipated to benefit the worldwide Butyl Acrylate industry in the long run.

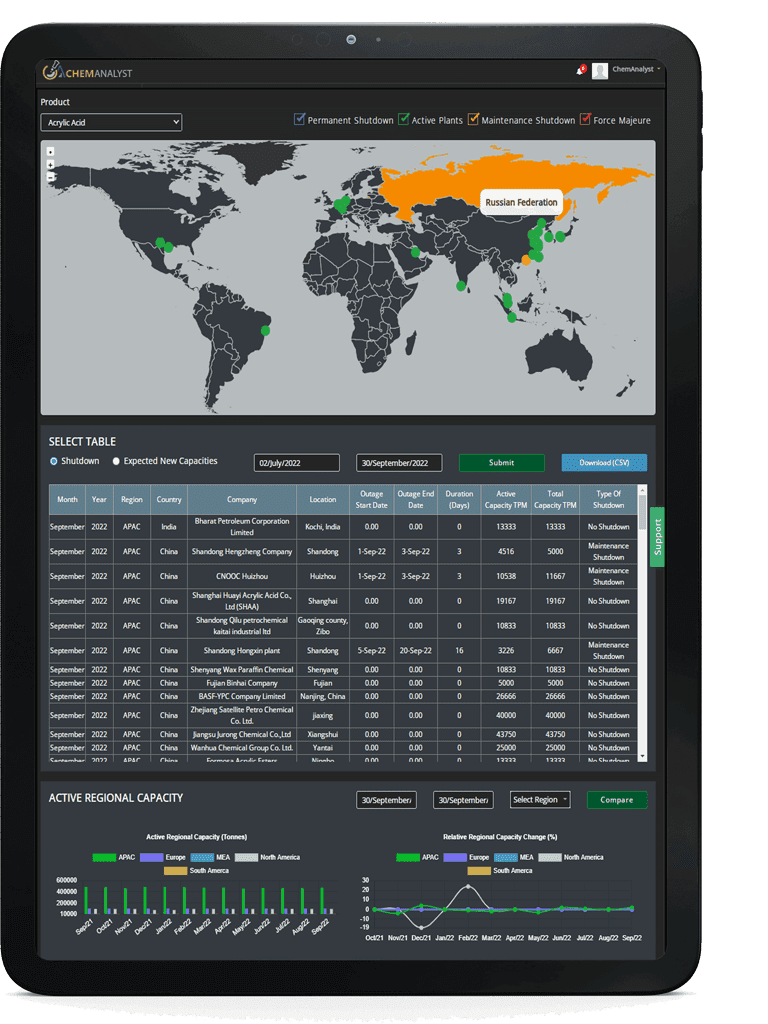

Geographically, the Butyl Acrylate market is segmented into North America, South America, Europe, Asia Pacific, and Middle East & Africa. Asia Pacific is anticipated to account for the majority share in the market due to growing automotive and construction industries. More than 50% of global capacity is in China, the country has become the leading producer of Butyl Acrylate. In China, new Butyl Acrylate manufacturing plants has been established. Manufacturers have planned to expand their capacity due to the sudden increase in demand from end use sectors. For instance, Satellite Chemical Co Ltd, and Jiangsu Sanmu Group expanded their production capacity in 2019, also recently in 2021 Wanhua Chemical in China increased its production capacity.

The Butyl Acrylate market in APAC is anticipated to expand at a considerable pace. Leading Butyl Acrylate manufacturers, BASF SE and Arkema S.A contribute to the major share of production in North America. Further, the surge in the need for water-based coatings, along with restrictions on VOC emission plastics is anticipated to further boost the growth of the butyl acrylate market in the region in the coming years.

Based on end-uses, the market is segmented into Paints & Coatings, Adhesives & Sealants, Printing Inks, Textile and Others. The others segment comprises of paper & pulp, textile, leather processing, etc. In the forecast period it is anticipated that the butyl acrylate market will be driven by the paints and coatings segment. Due to its growing use in the construction and automotive industries, as well as an increase in the replacement of existing coatings with water-based paints and coatings, paints and coatings segment is projected to continue its dominance in the coming years. Butyl Acrylate possesses features like high hardness, endurance, and improved weatherability that make it a popular choice for automotive coating applications. The increased demand for pressure adhesive tapes used in packaging to replace traditional polymers such as PVC is due to the increased use of butyl acrylate in the manufacture of adhesives and sealants. In the near future, this is expected to elevate demand for Butyl Acrylate in adhesives and sealants.

Some of the major players operating in the Butyl Acrylate market are BASF SE, Arkema S.A, Dow Chemical Company, Formosa Plastics Corporation, LG Chem Ltd., and others. Recently, Bharat Petroleum Corporation Limited and Indian Oil Corporation have launched their project of Butyl Acrylate manufacturing facility in order to cater to the rising demand, maintain the demand supply gap of petrochemical products and reduce reliance on import of Butyl Acrylate in India.

Years considered for this report:

Historical Period: 2015-2023

Base Year: 2024

Estimated Year: 2025

Forecast Period: 2026–2035

This report will be delivered on an online digital platform with one-year subscription and quarterly update.

Objective of the Study:

•To assess the demand-supply scenario of Butyl Acrylate which covers production, demand and supply of Butyl Acrylate market globally.

•To analyse and forecast the market size of Butyl Acrylate.

•To classify and forecast Butyl Acrylate market based on end-use and regional distribution.

•To identify drivers and challenges for Butyl Acrylate market.

•To examine competitive developments such as expansions, new product launches, mergers & acquisitions, etc., in Butyl Acrylate market.

•To identify and analyse the profile of leading players involved in the manufacturing of Butyl Acrylate.

To extract data for Butyl Acrylate market, primary research surveys were conducted with Butyl Acrylate manufacturers, suppliers, distributors, wholesalers, and end users. While interviewing, the respondents were also inquired about their competitors. Through this technique, ChemAnalyst was able to include manufacturers that could not be identified due to the limitations of secondary research. Moreover, ChemAnalyst analyzed various end user segments and projected a positive outlook for Global Butyl Acrylate market over the coming years.

ChemAnalyst calculated Butyl Acrylate demand globally by analyzing the historical data and demand forecast which was carried out considering growth of end use industries coupled with raw material prices used for the production of Butyl Acrylate. ChemAnalyst sourced these values from industry experts and company representatives and externally validated through analyzing historical sales data of respective manufacturers to arrive at the overall market size. Various secondary sources such as company websites, association reports, annual reports, etc., were also studied by ChemAnalyst.

Key Target Audience:

• Butyl Acrylate manufacturers and other stakeholders

•Organizations, forums, and alliances related to Butyl Acrylate distribution

•Government bodies such as regulating authorities and policy makers

•Market research organizations and consulting companies

The study is useful in providing answers to several critical questions that are important for industry stakeholders such as Butyl Acrylate manufacturers, customers, and policy makers. The study would also help them to target the growing segments over the coming years (next two to five years), thereby aiding the stakeholders in taking investment decisions and facilitating their expansion.

In this report, Global Butyl Acrylate market has been segmented into following categories, in addition to the industry trends which have also been detailed below:

With the given market data, ChemAnalyst offers customizations according to a company’s specific needs.