Welcome To ChemAnalyst

Pyridine prices have surged in the global market due to a substantial increase in upstream crude oil value and strong demand as an intermediate product from the downstream pharmaceutical sector. Due to restricted supply, volatile crude oil price, rising market, and high inflation rates, Pyridine prices rose in the second week of April. During the Russia-Ukraine conflict, the quick rise in crude oil prices had put inflationary pressure on consumers, leading to repeated price revisions by a key player. Pyridine prices have risen because of numerous factors, including a global supply constraint and trade disruptions.

Pyridine prices rose in China due to the reappearance of Covid cases and the region's shutdown, which hampered production and trading activity, hence exacerbating the product supply, causing Pyridine prices to plummet. In India, however, Pyridine prices increased due to logistical challenges mixed with a spike in upstream pricing, affecting the supply chain across the region and resulting in a supply shortage. Pyridine FOB Qingdao (China) prices were estimated at roughly USD 5010/MT, with a week-on-week inclination of 1%, according to the ChemAnalyst database. On the other hand, Pyridine Ex- Mumbai (Bulk) India settled around USD 3236/MT on April 8th.

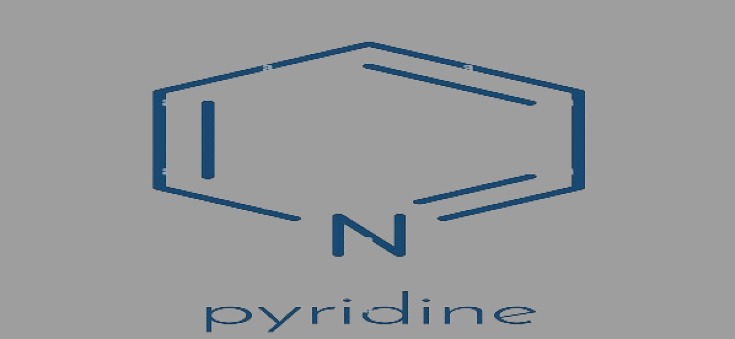

Pyridine with a chemical configuration C5H5N, also known as Azine, is used in the pharmaceutical sector as an intermediate for many drugs manufacturing, dyes, paints, and coating sectors.

As Per ChemAnalyst, "The price of Pyridine is likely to remain firm in the upcoming weeks across the global market on the back of strong demand from the downstream industries while rising upstream Crude value is not going to decline anytime soon. Thus, it is anticipated that the prices of most Speciality Chemical commodities, including Pyridine, will surge further".

We use cookies to deliver the best possible experience on our website. To learn more, visit our Privacy Policy. By continuing to use this site or by closing this box, you consent to our use of cookies. More info.