Welcome To ChemAnalyst

The automotive industry forms 7% of the total GDP of the European Union and accounts for nearly 7% of the total employment in the European region. There have been speculations around the impact of the ongoing Ukraine-Russia crisis on the European automotive industry and these speculations materialized when multiple sources confirmed a drop in output levels. The decline in automotive production levels will have macroeconomic fallouts but will also affect the demand for several key downstream materials including Polymers and Elastomers.

Ukraine is one of the world’s largest wire-harness producers and the Russian invasion has forced the shutdown of several key factories which is likely to translate into limited wire-harness availability in the European region. The German automaker Volkswagen has already confirmed production cuts in Germany amid ongoing supply tightness while Mercedes Benz has stated a decline in the production rates in Germany and Hungary.

According to many sources, the automotive industry may witness a drop in the availability of 700,000 vehicles in the light of prevalent semiconductor shortages and looming wire-harness shortages. The wire-harness shortage is likely to be eased out towards H2 of 2022 however there is no short-term resolution to the limited availability of wire-harnesses.

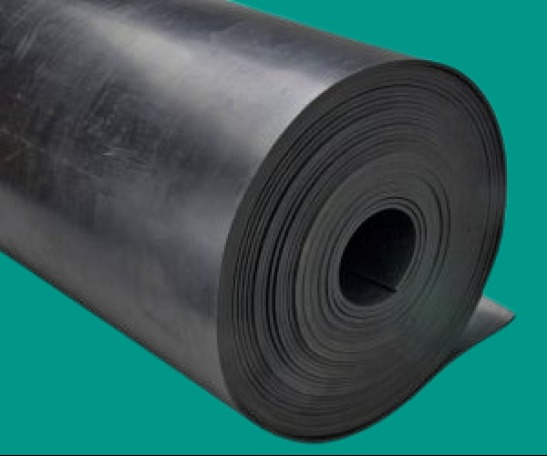

Elastomers including EPDM rubber, Styrene-Butadiene Rubber (SBR), Acrylonitrile Butadiene Rubber (NBR), Polybutadiene Rubber (PBR) and others are highly used in the automotive industry for both tire and non-tire uses, while Polymers like Acrylonitrile Butadiene Styrene (ABS) and Polycarbonate are integral for production of both passenger cars and heavy vehicles.

As per ChemAnalyst, “Any significant drop in the automotive output is likely to severely impact the demand dynamics of EPDM rubber, as EPDM rubber has been heavily employed in the industry, and by volume, the automotive industry uses more than 50% of total EPDM rubber production. Therefore, deterioration of demand dynamics may impact the prices of domestically produced material as well as imported material on European shores.”

We use cookies to deliver the best possible experience on our website. To learn more, visit our Privacy Policy. By continuing to use this site or by closing this box, you consent to our use of cookies. More info.