Welcome To ChemAnalyst

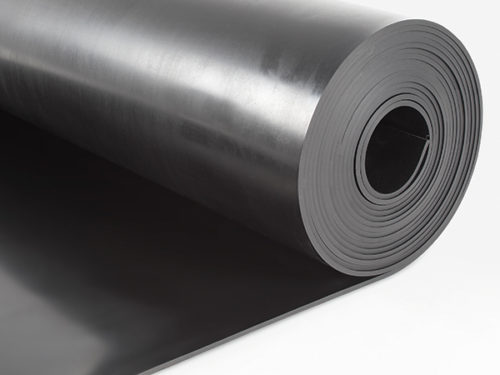

Despite the rising cost of feedstocks, Styrene-Butadiene Rubber prices have remained weak during the mid-April, as per the assessment by ChemAnalyst. Butadiene prices have been consistently increasing in the last few weeks due to limited availability and the robust cost of upstream energy feedstocks. However, the Styrene-Butadiene rubber market has been sluggish on the back of weak demand fundamentals.

As of 19th April 2022, the Ex-Factory price of Styrene Butadiene Rubber 1502 was assessed at USD 1943 per MT in Sinopec North China. Furthermore, SBR prices rose initially in March; however, demand drop culminated in a decline in pricing sentiment; hence prices dropped significantly in the last couple of weeks of March.

Demand from downstream industries has been sluggish as the construction industry's performance has been underwhelming due to the volatility in the building & construction market in recent months in China. The automotive industry has been steady in South Asia and resulted in stable volume intakes. The resurgence of covid cases has further dampened the demand dynamics where consumption levels have plummeted as lockdowns galore in several Chinese cities.

Meanwhile, Styrene prices have increased in the last few weeks owing to a consistent rise in upstream crude oil and several planned maintenances in pure Benzene plants that curtailed feedstock availability.

In terms of production, Li Changrong and Zhejiang Weitai have a combined capacity of 150 KTPA, and recently both plants have faced temporary shutdown. Meanwhile, Jilin Petrochemical operated at a reduced rate. Several sources have confirmed that the Shenhua Chemical plant with SBR production capacity of 170 KTPA will likely go on scheduled maintenance in April. Hence, it has been concluded that supply dynamics have been weak owing to production lags and transportation issues.

As per ChemAnalyst, the “Styrene-Butadiene Rubber market is expected to remain weak in coming weeks due to the sluggish supply fundamentals and stagnancy in demand from the downstream construction industry. However, feedstocks Butadiene and Styrene are likely to remain robust in the short term.”

We use cookies to deliver the best possible experience on our website. To learn more, visit our Privacy Policy. By continuing to use this site or by closing this box, you consent to our use of cookies. More info.