Welcome To ChemAnalyst

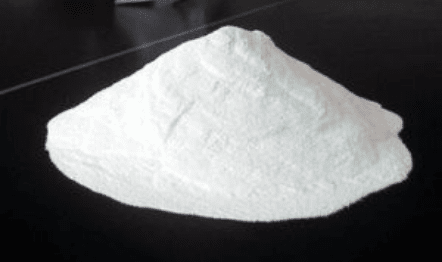

Concerns over the supply of Lithium from China has been pushing up its prices to significant highs in the first half of January. Demand for Lithium has strengthened across the globe due to rising adoption for EV batteries in various countries. Lithium Carbonate prices skyrocketed entering 2022 following strong demand for electric-vehicle manufacturers. The strong wave of demand has shadowed over the availability of Lithium at times of ongoing maintenance turnarounds and curbs due to Winter Olympics in China. As buyers begin to scramble for spot purchases amid the tight material availability, lithium and its derivatives prices have showcased tremendous surge in the past two weeks.

Chile holds largest Lithium reserves in the world. Various countries have been bidding for Lithium mining contracts from Chile amidst the exponential rise in demand. As per the declaration, the successful bidder will receive seven-year development and exploration rights for Lithium in addition to 20 year extended production rights. However, Chile is keen to charge royalties for quota allocation and even variable payments at times of production.

China has already won 80 KT Lithium in a 400 KT tender which was launched by Chile in October. However, the country has received opposition from a centre-left party in Chile to withdraw from the biding process. As per ChemAnalyst, “If the stress over Lithium mining contracts extends, the situation is likely to withhold several mining activities which is expected to exacerbate the supply crises of Lithium ores and its derivatives across the globe. Similarly, Lithium prices are also likely to witness a continuous surge until the dark clouds on Lithium mining activities are resolved.”

We use cookies to deliver the best possible experience on our website. To learn more, visit our Privacy Policy. By continuing to use this site or by closing this box, you consent to our use of cookies. More info.