Welcome To ChemAnalyst

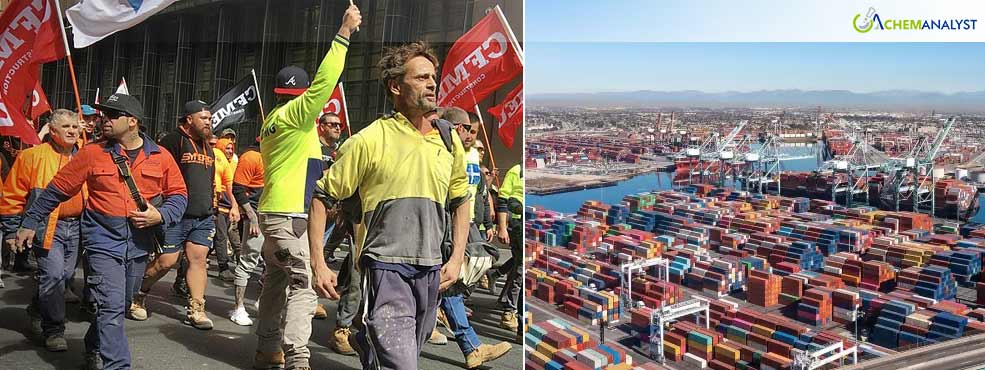

In what looks like a global trend, the shipping and freight industry is going through a tough time. Worker unions across the globe have waged war against corporations and brought businesses to a standstill. Be it the shipping industry or the locomotive industry workers, strikes are being announced almost every day. Worker strikes are causing losses of billions of dollars to economies, underlining that fact that the workers are the backbone of this industry.

In what could be deemed as the first piece of the domino that toppled the worker strikes of 2024, the US’s International Longshoremen’s Association (ILA), went on strike on October 1 demanding increased wages and job security against potential automation threats.

This was major since the ILA represents around 47,000 workers in East Coast and Gulf Coast ports. The union however reached to an agreement to resume port duties on October 3, with the looming threat of potential strikes in January 2025 if their demands went unmet.

The two days US workers were on strike and the 36 ports remained non-functional- it costed the US economy upwards of $5 billion each day. Although this loss dwarfs in comparison to the $29 trillion US economy, the damage borne by the industries piles on. Import goods – especially the ones with an expiration date like pharmaceuticals, on which the US economy relies heavily – need to reach the destination without delay.

Additionally, shipping costs rose as much as 40% across Atlantic during the US port strikes. Shipping companies raised their prices in anticipation of increased port congestion and longer delivery times.

Similarly, the Canadian on-again off-again port strikes began in the first week of November and paralysed both coastlines of the country. The ports, which bear the capacity to process goods valued at nearly C$400 million ($288 million) each day, were causing the businesses of the country a loss of upwards of $800 million a day.

Canada’s GDP relies heavily upon its import-export trade. In 2019, Canada supplied $114 billion worth of crude oil, petroleum gas, and refined petroleum. It also is one of the top exporters of cars and automobile parts. In 2022, Canada exported a total of $587 billion, making it the number nine top exporter in the world. In such a scenario, disruptions in freight services are quite expensive, in terms of both time and money.

Latest to join the list of ongoing strikes was Italy, with its three prominent trade unions- Filt Cgil, Fit Cisl, and Uiltrasporti - announcing a 48-hour general strike on December 9 and 10. The labor unions issued a joint statement on November 12 accusing the employers' groups of adopting stances that derailed negotiations. The unions' demand are the same - better working hours, stricter health and safety regulations, and job security against automation. They feel that the workers should be compensated as such since the one million workers contribute approximately 10% to Italy's GDP.

Such have been the cases in France and Greece, and fresher strikes were announced in South Korea and India in the past week. Given the recent global trend of labor unrest, there's a significant likelihood of more port worker strikes emerging in regions like Europe - particularly the UK, Netherlands, and Germany - and Australia.

These countries are home to crucial ports that handle a substantial portion of global trade, and any disruptions caused by strikes could have far-reaching economic consequences. Additionally, these disruptions create a faux inflationary condition for the economies which is counterproductive for the weaker section – a section most workers belong to.

According to a presser on the Maritime Union of Australia website, there is an underlying unrest amongst the Australian workers because corporates are using “taxpayers money to shed jobs and reduce waterfront productivity”.

If workers in Australia call for a strike – the global iron ore demand will go unfulfilled as it is home to the biggest iron ore reserves in the world. This will further ripple on to industries dependant on iron like steel and construction. This will cause factories to implement temporary shutdowns, further aggravating a different set of daily wage worker strata.

The fragility as well as the strength of supply-demand chain lies in its workforce. But organizing indefinite strikes is a double-edged sword. It might push economies to seek alternatives to vulnerable ports or drive them toward automation sooner – scenarios not too conducive for the workers. The balance between corporate and human hunger needs to be restored.

We use cookies to deliver the best possible experience on our website. To learn more, visit our Privacy Policy. By continuing to use this site or by closing this box, you consent to our use of cookies. More info.