Welcome To ChemAnalyst

Glycol prices in Asia have been a wavering concern for players since the onset of the winter season. Diethylene Glycol is amongst the major petrochemicals which have showcased a steep decline in the first two weeks of December. Several manufacturers based in India who have been willing to safeguard their margins were witnessed catering to the export demand from Southeast Asian countries at times of mull buying activities in the local market.

Contrary to the Asian market trends, prices of Glycols in the US have been positively revised by Indorama w.e.f. 1st December 2021 due to shift in balance of feedstock Ethylene prices. However, in India and China, slowdown in market activities due to the seasonal slump has led to a drastic decline in overall purchases. Besides, prices of Ethylene Oxide in China have observed a gradual yet continuous fall since October which has eased the cost pressure upon downstream manufacturers. These scenarios allowed them to undertake consistent negative revisions upon downstream prices in order to initiate active offtakes.

In India too, Ethylene Oxide prices after reaching significant highs in early November, have now begun to come down towards December end due to the slowdown in downstream demand. In line with the narrowed demand and supply gap, Diethylene Glycol prices in India were assessed down by nearly 10% in the initial weeks of December. Buyers were heard sidelining their purchases and adopting a wait and see approach amid the present dullness in the market against the ample availability of cargoes. As the liquidity in the market is expected to remain thin, purchasing from various buyers has remained bearish in the near term.

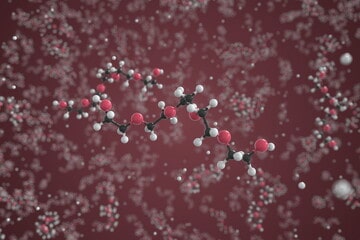

Diethylene Glycol is mainly used as a chemical intermediate, solvent and a dehydrating agent in various industries. As per ChemAnalyst, “Sudden slowdown in market activities post festive season in India has led to a tremendous fall in its prices. On the other hand, as traders usually attempt to deplete their inventories before the year ends, the approach has also weighed down the prices of DEG in India and China. However, prices are expected to marginally revive by mid-January due to expected pick-up in market activities.

We use cookies to deliver the best possible experience on our website. To learn more, visit our Privacy Policy. By continuing to use this site or by closing this box, you consent to our use of cookies. More info.