Welcome To ChemAnalyst

Moscow’s invasion of Ukraine in February is the largest conventional military attack after World War II, due to which the global economic conditions have been blighted. On which India had taken a neutral stance owing to the historic partnership with Russia. As the country was already on the road to recovery due to the covid-19, the growing inflation is continuously exacerbating the economy, which is further driven by the accelerated tensions between Russia and Ukraine. In a statement, the ITC Chairman said, “As the pandemic was ebbing, we are faced with another situation of unprecedented inflation. Both food and energy inflation are key, and the recent conflict in Ukraine has only accentuated the situation”.

According to an industry expert, “the Russia-Ukraine crisis has stoked uncertainty in global trade and will impact oil and several other commodities.” However, India does not have a particular merchandise trade with Russia, but it still stands to lose economically due to supply disruptions caused by heavy sanctions by the Western countries and their allies.

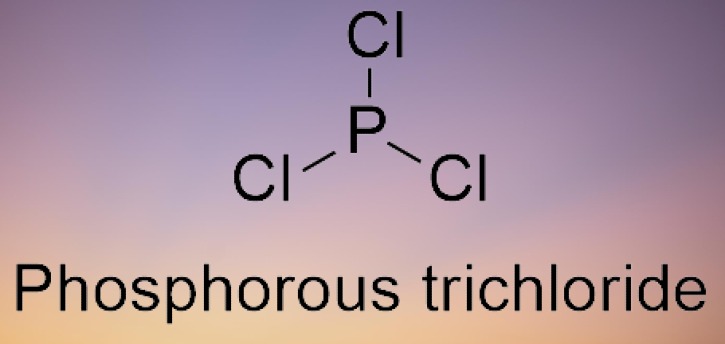

Considering the ongoing situations, the demand for various commodities has declined in India, due to which a number of end-user industries, including agrochemicals, chemical intermediates, plasticizer, pharmaceuticals, and others, has been negatively affected. As per ChemAnalyst, the pricing trend of Phosphorus Trichloride has been following the downward trajectory since mid Q1 on the back of the declining demand in the domestic market. Due to the availability of enough inventories, the market competitiveness has increased among the traders and manufacturers, which is another reason for the PCl3 price dwindling in the Indian market. It has been observed that more risks could come to light if growth conditions weaken further, which would worsen the trade expenditure of India.

Another Industry expert mentioned in a statement, “Despite India’s limited direct exposure, the combination of supply disruptions and the ongoing terms of trade shock will likely weigh on growth, result in a sharper rise in inflation, and (lead to) a wider current account deficit.”

We use cookies to deliver the best possible experience on our website. To learn more, visit our Privacy Policy. By continuing to use this site or by closing this box, you consent to our use of cookies. More info.