Welcome To ChemAnalyst

The domestic Acetic anhydride prices fell on 15th of December and were observed to be $1657/MT compared with the $1692/MT on 10th of December with the declination of 2.04%. If we compare the price trend from 26TH November to the first week of December, we observe 4.59% price drop from $1880/ton to $1793/ton.

The demand of Acetic Anhydride has eventually subsided which had contributed to the current Chinese market trajectory. The prices of Acetic acid also fell by 9.05% compared with the last week of November. Chinese methanol prices closed the week lower, which were underpinned by tepid demand and lower crude oil prices. Imported spot cargoes of Methanol were also thinned this week. Methanol imports from Iran to China appeared to be sufficient for January 2022 with at least 160,000MT methanol offered in a tender which closes on 6 December. Downstream plastic and dyes industries were also affected with this trend.

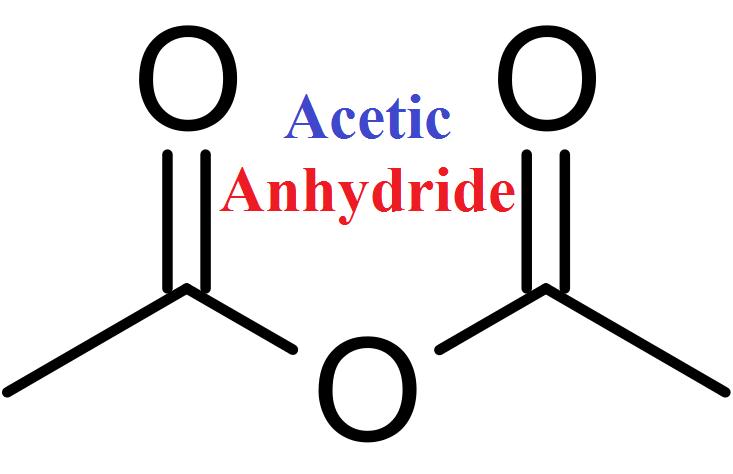

Acetic Anhydride or Ethanoic anhydride is a chemical compound with formula (CH3CO)2O. It is the simplest isolable anhydride of carboxylic acid which is widely used as a reactant in organic synthesis. The raw material for Acetic anhydride is Acetic acid. It is prepared industrially by the acylation of Acetic acid with Ketene. It is widely used as a raw material for cellulose acetate fibres and plastic. It is also used in Aspirin and other pharmaceuticals manufacturing. China is one of the exporters of Acetic Anhydride contributing 3.3% in the global market and mainly exports to South Korea and Japan and Belgium.

According to ChemAnalyst, the market will have sufficient supply of Acetic Anhydride and it is estimated that the demand will be weak. The prices of Raw material Acetic acid and Methanol will fall. Local producers will face pressure in order to clear their inventories and buyers will be more cautious and will purchase for their need-to basis. Plastic and pharmaceutical industries will be down due to ample supply and limited demand in the regional market.

We use cookies to deliver the best possible experience on our website. To learn more, visit our Privacy Policy. By continuing to use this site or by closing this box, you consent to our use of cookies. More info.