Welcome To ChemAnalyst

The global Acrylate market has been witnessing frequent ups and downs due to fluctuating market sentiments under the influence of the ongoing war situation in Ukraine. Despite the fact that crude oil value has been on an uptrend for a long time across the global market, Acrylates have fallen in some countries like China due to lacklustre demand from the domestic market because of a sudden resurgence in pandemic cases in the country.

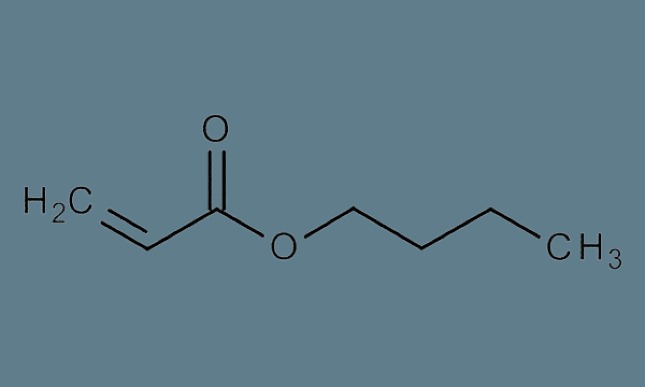

As per the ChemAnalyst data, Butyl Acrylate prices have fallen in China due to a steep decline in its raw material cost, owing to wavering demand from the domestic downstream sector. China has been hit by the worst wave of COVID, which has deepened concerns over demand fundamentals in the country amidst soaring upstream value. As per the market sources, Acrylic Acid has been falling in China since the last week of March, under the pressure of pandemic-related restrictions, which has depressed the local market. Meanwhile, in India, high raw material costs coupled with rising utility cost pressure, compelled manufacturers to keep on revising their offers. Furthermore, demand fundamentals for the product are comparatively better in India than in China, as India currently has no uncertainties related to pandemics. In addition, as per the latest insights, Japanese Butyl Acrylate manufacturer Idemitsu has announced a permanent exit from the Acrylate market by the end of March 2023. This decision has been taken due to the highly competitive market.

Discussing Europe and USA, the Acrylate market has been facing opposite dynamics, primarily driven by rising upstream value coupled with a sudden rise in utility cost. Since the Ukraine-Russia conflict has escalated, the regional consumer price index (CPI) has increased under the threat of rising raw material costs and looming scarcity of products. In addition, manufacturers have been witnessing similar market sentiments in Ukraine, as Germany, Bulgaria, Poland, and France are highly dependent on imports from Russia for Natural gas. Influenced by soaring natural gas prices, producers’ margin has been declining in the regional market as the demand fundamentals are stagnant.

As per the ChemAnalyst data, demand for the product is not expected to rebound in China, as the pandemic in the country will take to vanish. Furthermore, Indian market fundamentals are not expected to change by the end of this month. Meanwhile, ongoing volatility in Natural gas prices in Europe and the USA will take time to get stabilised.

We use cookies to deliver the best possible experience on our website. To learn more, visit our Privacy Policy. By continuing to use this site or by closing this box, you consent to our use of cookies. More info.